Indian equity indices remained marginally higher this week. The S&P BSE Sensex closed at 40,359 up by 0.01% and Nifty 50 closed at 11,914 up by 0.16%.

Weekly Capsule

- Cabinet approves the sale of 5 PSUs including BPCL, Shipping Corp, CONCOR

(Selling these assets will be key to the government meeting its ambitious target of generating INR. 1.05 trillion from asset sales in the current fiscal year. The government’s decision to boost corporate taxes to boost the economy and attract investments has left Finance Minister Sitharaman struggling to meet the year’s fiscal deficit target of 3.3% despite receiving an INR. 1.76 trillion windfalls from the Reserve Bank of India.) - Relief to telecom sector: Cabinet gives nod to a two-year moratorium on spectrum payments

(Telecom companies get a two-year moratorium to pay their spectrum auction dues. Deferment of spectrum auction installments would ease the cash outflow of the stressed telcos and facilitate payment of statutory liabilities and interest on bank loans. Continues operation by telecom providers, would give a fillip to employment and economic growth.)

Fund alerts:

- Aditya Birla Sun Life Mutual Fund has proposed to change the name of Aditya Birla Sun Life Short Term Opportunities Fund to Aditya Birla Sun Life Short Term Fund, with effect from November 21, 2019.

- Franklin Templeton Asset Management has amended its schemes to enable side pocketing. Side Pocketing allows mutual funds to set aside a portion of their units in lieu of bad debt. The move comes close on the heels of Ind-Ra’s downgrade of Vodafone Idea debt on 1st November to BBB.

Key events to watch next week:

The GDP maths: All eyes are on the July-September GDP growth figure as the debate rages on how to shore up the economy. With growth slumping to a multi-year low of 5 percent, efforts are on to spur consumer demand and investment. On top of that, a slowdown in manufacturing and construction is adding to the worry lines. The GDP data is due on November 29.

Along with GDP data, Fiscal deficit data and Eight Infrastructure Industries data will be released for the month of October on 29th November.

Bottom line:

We believe the Markets are likely to remain range-bound in the coming week and look out for positive triggers that will boost investor sentiments. Market participants will continue to track global factors like the US-China trade deal, crude oil price and currency movement.

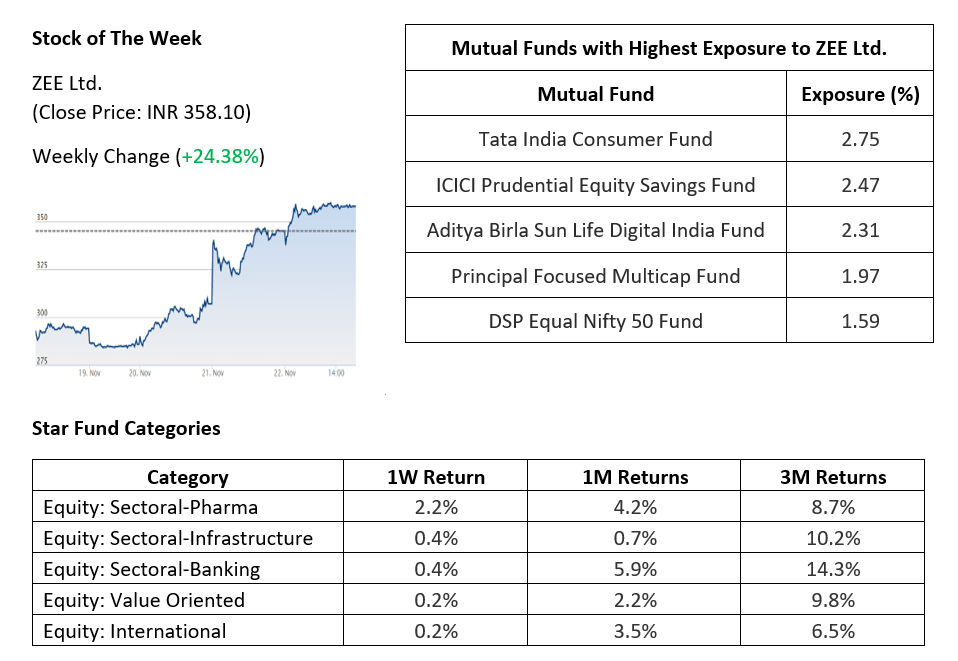

Returns have been concentrated in select index leaders while the broader markets underperformed, this presents an opportunity to benefit from the current market distortions. We believe the Multi-Cap and Mid Cap strategies are ideally positioned to benefit meaningfully from the likely revival while Large Cap funds can be part of any investor’s core portfolio allocation.