“To fight is a sign of courage, but to live to fight another day is wisdom.”

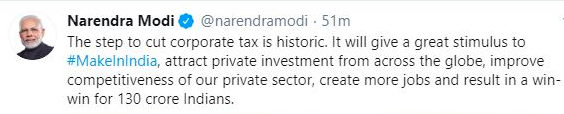

The first full-time lady finance minister of independent India has turned Santa Claus with the biggest gift in the form of a corporate tax rate cut.

The basic tax rate for corporates has been trimmed down from an effective 34.94% to a much lower 25.17% (only if for companies who agree to forego all other concessions & exemptions).

For some companies who choose to remain under the old rate, the MAT reduction from 18.5% to 15% could benefit.

Minimum Alternate Tax ensures that companies with profits under a threshold are covered under the tax rate though the tax liability may be minimal or even zero.

Our Economy

This improved liquidity with a competitive landscape will enable companies to spend more towards driving sales in a more aggressive fashion.

Once consumerism is spiked, and the supply-side starts reacting, we will have the economic engine push with higher horsepower.

The Highlight

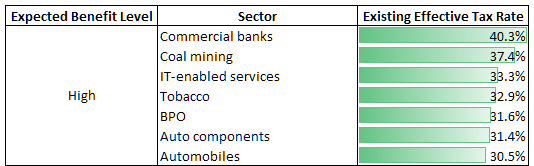

Commercial banks and IT are expected to benefit the most from the move. Given that these sectors have a significantly high-weighted representation on the indices, we could expect to see index valuations getting enriched as well.

Investor Gain

Investors must capitalize on this opportunity while bearing in mind the government and central bank’s collaborative alignment towards reviving the Indian economy by buying equities in the form of Direct Mutual Funds while averaging their cost at all junctures.