Some said incoming was abundant rain,

Ol’ John bought a farm & sowed to gain.Some said they knew it would snow,

Ol’ John bought firewood that’d glow.Some said the horizon seemed sunny,

Ol’ John bought hats to make some money.Alas! The visitor was spring and breeze so cool,

Markets rejoiced, while Ol’ John remained the ‘bazaar fool’

Ol’ John was simply trying to play every story that the market fed him but unfortunately landed up being the ‘bazaar fool’ as he lost everything to the chaos. This is something similar that has been happening with many investors, especially with the novices.

If you’ve been reading too many pink newspapers lately, you would have probably convinced yourself to believe that it’s almost game over for global and Indian equities.

But, is it so? Or are you simply being played & made the ‘bazaar fool’?

Here’s the truth. Trade war tensions have escalated, global economies are bracing for a synchronized slowdown in economic activities and the proposed surcharge on the super-rich & foreign investors have dented the sentiments.

However, take a step back and think – is it wise to react to the fear-mongers and exit Indian equities or is it a stronger reason to continue playing the India story more aggressively?

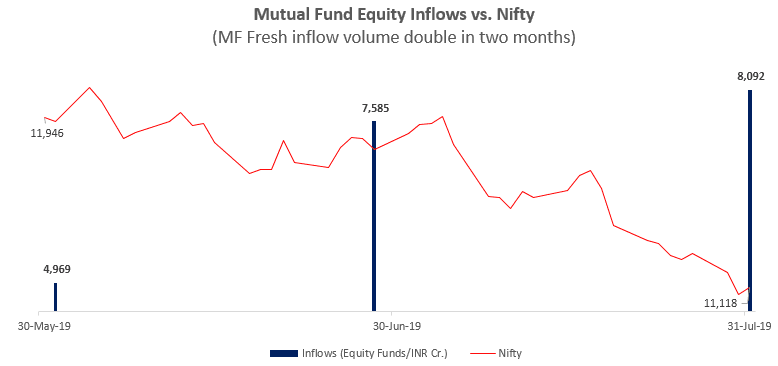

Here’s how the collective wisdom and action of mutual fund investors looked like while the only words exchanged on the street were filled with anxiety & doubt.

The above illustration clearly reflects the way domestic, especially retail, investors are reinstating faith in the India growth story and concurrently the appreciation potential offered by Indian equities even as the period saw the largest outflow of foreign investor money in the past couple of quarters.

Sure, there are a few global headwinds that have blown a full-fledged economic recovery off-track but there’s no reason to not believe that Indian capital market is set to offer the biggest bang for the buck – globally.

Rest assured, we are continuously monitoring the economy, markets, and your portfolio. While the market may seem jittery at the moment, we are certain that your portfolio is continuing to perform in the most optimal fashion possible.

In case you feel otherwise, feel free to write back and we will get in touch with you and discuss how your portfolio can be fine-tuned further.

“What do you do if the market drops from here? Warren Buffett famously says

‘If I see a sale in my favorite store, I go and buy some more of the stuff I like’,”

As long as your asset allocation and portfolio are in line with your objectives, sit back and enjoy your favorite drink – there’s nothing more you need to do here.