“As we look ahead into the next century, leaders will be those who empower others.”

-Bill Gates

Investments are essential in today’s world because earning is not enough. You would be working hard for the money, but that may not be adequate for you to lead a comfortable lifestyle or fulfill your dreams and goals. And due to this reason you need your money work hard for you as well. And this is the reason you should invest. If your money is lying in a bank account, then you are losing the opportunity of earning returns on it. You should spend your money smartly by investing so that you can get profits from it.

Here are the rules of investment one must follow:

-

Have a plan

Before you invest your money, you must be aware of what you are investment purpose. You should set parameters like target return, time horizon, and risk appetite for the asset class, which suits your aims. You are unique, and so are your financial needs, so choose an investment plan based on your specific financial plan.

-

Know the risk tolerance

It is essential for you to know your risk limits when it comes to investment. For example, say you have invested Rs. 30000 and which dropped to Rs. 26000 due to market fluctuations. And due to this reason, if you are upset and always brooding, it clearly shows you are not risk seeker. In such a case, something like debt fund, FD fixed deposit, and PPF (Public Provident Fund) would be more suitable for you.

-

Be disciplined

Continuous investment is important. Investing a fixed sum regularly via SIP (systematic investment plan) makes investments affordable and safe market volatility. Focus on long term investment, which gives you the benefit of earning higher returns.

-

You should not invest in something you don’t understand

Before investment, one should research thoroughly and then invest. You should never invest your money in such an instrument that you are not able to understand. Because you would be angry with yourself when you would be losing your money. Stick to what you know and always do your research.

-

Focus more on value than the price

Experts always say to buy when the market is down and sell when the market is up. An investor who puts money aside over the long term is likely to achieve his or her goal than someone looking to play the market in search of quick profit. The longer the investment, the better the potential effect of compound performance on the original value of your investment.

-

Do not put all your eggs in one basket

Your investment portfolio should be diversified. Investing in one particular fund is risky, and at times, you won’t get returns as per your expectations. So it’s always better to invest in 2 or more funds so that you are on the safer side; in case of one of the funds underperform, but you would still have other funds performing well.

-

Remember the term inflation

Your investment portfolio should be consistent and predictable earnings growth that has the potential of generating returns beating inflation; because a real rate of return is the annual percentage return realized on an investment, which is adjusted for changes in prices due to inflation (and other external factors).

-

Go against the herd

To get the best long term returns you will eventually need to sell what everyone is talking about and buy what is being ignored providing the valuation is right and the growth, risk and quality check are met.

Advantages of investing

- Investing will help you build wealth because there are hundreds of ways to invest and let your money grow with Mutual Funds.

- Investing will get you to your retirement kitty. With the right investments, you would have enough money to retire and also make your money work for you. Furthermore, compound interest is what happens when your interests start earning interest.

- Investment can help you to save on taxes under section 80C.

- You stay ahead of inflation because if you don’t invest, you may end up losing money over time.

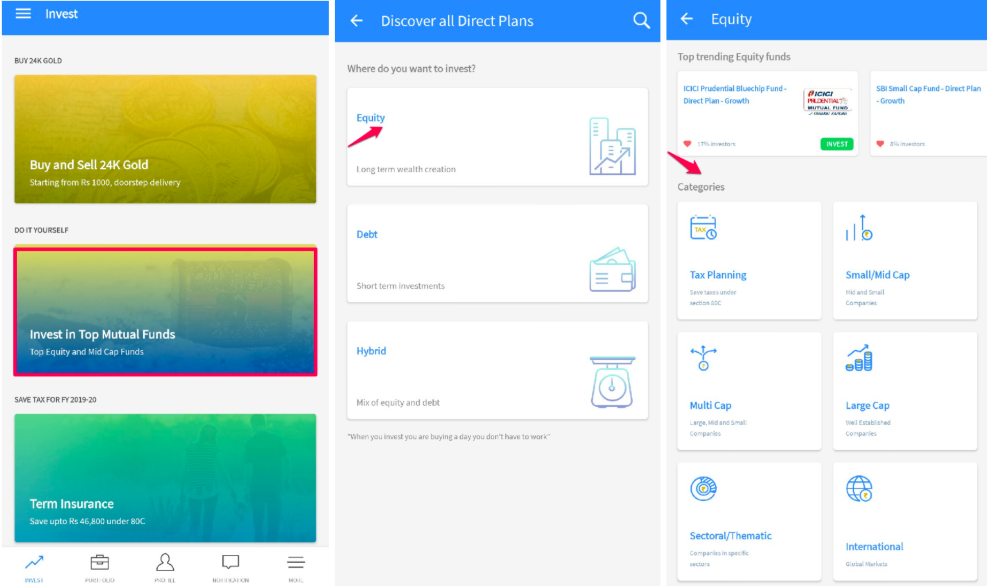

Now that you know an investment is a vital role. With Fisdom , India’s most trusted app for Direct Plan Mutual Funds offers you a wide range of investment options that help you to fulfill your investment goals. All you need to do is:

- Download the Fisdom app

- Sign up

- Complete your KYC – Know Your Customer (the paperless process takes less than 5 mins)

- Upload your PAN and other personal, bank and address details

- Follow the screen flow below

And your all set to choose from the best of Mutual Funds.

[investbtn name=”Don’t Hesitate, Invest Now”]