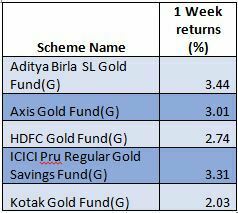

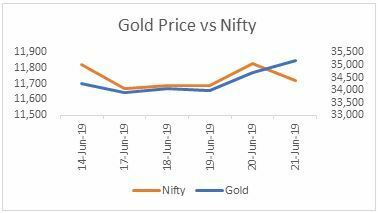

Indian Indices ended the week in red, but gold has lived up to its reputation of being a safe haven asset class and appreciated by 3.10% for the same period.

#Top2: Reasons for gold regaining sheen

-

The dovish stance from major central banks:

The Federal Open Market Committee (FOMC), the policy-making arm of the U.S. Fed kept rates unchanged in a range of 2.25% to 2.5% on Wednesday even as it signaled that it is ready to cut if data so warrants. Along with the US, the other central banks like Australia, Europe signaled to ease their monetary policies to support economic growth.

-

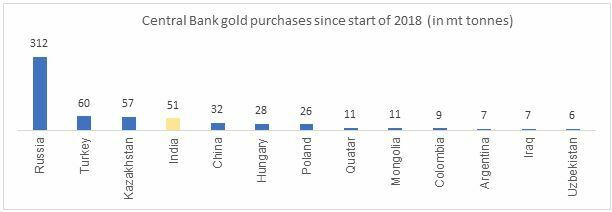

Gold buying by major central banks:

Global Central Banks, especially of countries having exposure to America’s unexpected policies, seem to be loading up on their gold reserves as a hedge against any major economic headwinds they may face.

Bottom line:

Gold as an asset class is known to be a natural hedge to economic risks your portfolio may be exposed to. While this short-term gleam in gold prices does not warrant an out and out investment into gold, it sure strengthens the case for a diversified asset allocation into equity, debt, and gold.

It makes sense for investors to hold an indicative ~5%-10% of the total portfolio in gold mutual funds or digital gold to maintain a well-diversified portfolio that will help build a consistent, sustainable and risk-optimal portfolio for the longer term.