People normally don’t find it safe to invest in Equity. They consider it a gamble. Why? Because your shares are traded in the stock market which is subjected to market fluctuations. Then why does Monika Halan, consulting Editor for Mint, state “I Love equity funds” in her book “Let’s Talk Money”.

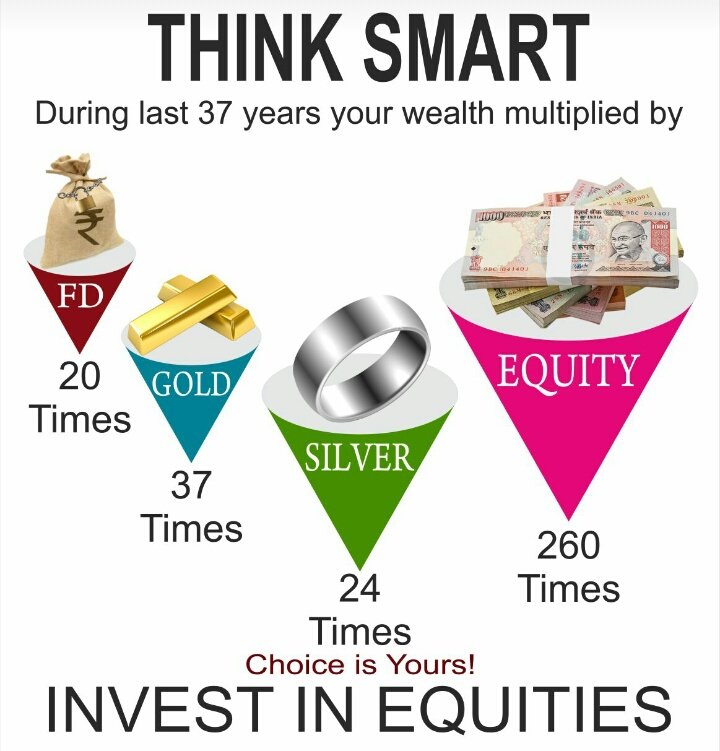

Let’s look at this picture:

Surprising! The most trusted instruments such as Fixed Deposit multiplies wealth only by 20 times whereas investments in Equity multiplies it by 260 times.

Equities are stocks, meaning shares of a company. When you invest in equities it means you own the shares of a company and are partial owners of the company

But the hitch is how do you know which company’s stock performs well? How are your shares trending in the market? When to sell or buy?

This arises the need to understand the difference between investors and traders. The work of a trader is to track the market minute to minute and closely monitor the fluctuations in the stock. But as an investor, you must ascertain your investment horizon and financial need, invest in Equities and to stay invested until investment purpose is achieved. Remember, “time in the market” is important not timing the market.

The best option to invest in Equities is through Mutual Funds. Even Monika Halan says that she doesn’t buy shares directly but rather invests in Equity through Mutual Funds. Because when you do so, the decision of picking the right stock is vested with Professional Fund Managers who track the movement of shares closely and rebalance the investment portfolio regularly. They have a tab on the performance of companies, markets, political events, interest rates, and past data that help them to forecast the future of a stock. With Mutual Funds, there is a scheme for every person depending on your risk and investment goal. Say if you are a conservative investor but are willing to take a little bit of risk then, with Mutual funds you can always have your investments primarily in Bonds (Debt) with a little exposure to Stock (Equity).

As an investor one should remember that Equity Investing is no gamble. In a growing economy like India, good investments should outperform in the long run, irrespective of the macroeconomic factors. The Table below will give a clear idea:

| Time Period | 1 year | 3 years | 5 years |

| Amount Invested (INR) | 12000 | 36000 | 60000 |

| L&T India Value Fund-Direct Plan Growth Option | 10,948.02 | 37,485.68 | 76,658.66 |

| ICICI Prudential Bluechip Fund-Direct Plan Growth | 11,596.35 | 40,193.66 | 75,470.58 |

| SBI Bluechip Fund Direct Growth | 11,322.36 | 37,843.27 | 72,645.74 |

These are the Top Rated Funds on Fisdom . The Table clearly shows that when Rs 1000 a month invested through SIP in these funds, say L&T India Value Fund-Direct Plan Growth Option for a period of 1 year gives a fund value of Rs. 10,948 which is lesser than the invested amount of Rs. 12000. But when the same process is carried out for a process of 5 years, the fund value is Rs. 76,658.66, which is 27% more than the invested amount Rs. 60000. The same pattern is seen in the other two funds as well.

India is expected to add the fourth-highest number of High Net Worth Individuals in the next five years, only behind the star economies of U.S., China, and Japan yet ahead of the European powerhouse – Germany.

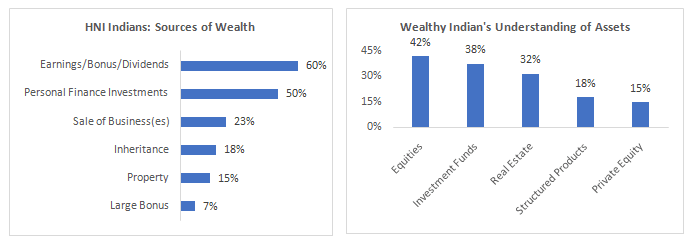

Here’s what the High Net Worth Indians are doing right with their money-

To make life simpler, here’s the inference you should care about – The wealthy have become wealthy through smart investing and by having a very good understanding of equities as an asset class.

Investing & Equity – bring these together and you will discover the secret sauce to wealth creation.

To sum it up, Equities may be volatile in the short run, but over the longer period, volatility will decrease and the returns will increase, thus reducing the risk.

So, Remember!

The thumb rule in Equity is to stay patient and remain invested for a long period to reap its benefits.