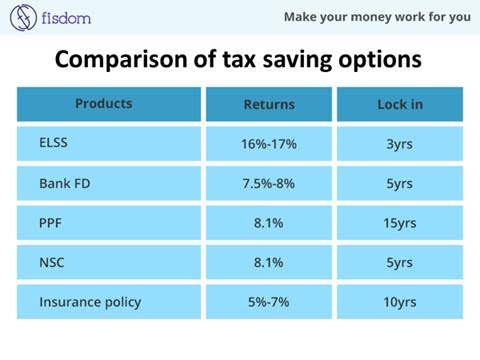

Investing in an Equity Linked Savings Scheme (ELSS) mutual fund is the superior way to save tax. Among the various investment options which allow for a deduction under section 80C, ELSS is the best option with the lowest lock-in period and the best post-tax returns.

If you have not optimized your section 80C deductions, you can do so right now, in less than five minutes. Hurry up, the financial year ends in fifteen days.

Click here to understand more about tax saving instruments through a simple video.

Click here to understand more about tax saving instruments through a simple video.

Axis Long Term Equity fund has been one of the most popular investment options within the ELSS segment. While tax-saving is the prime motive, there are various other factors that make this fund a popular choice.

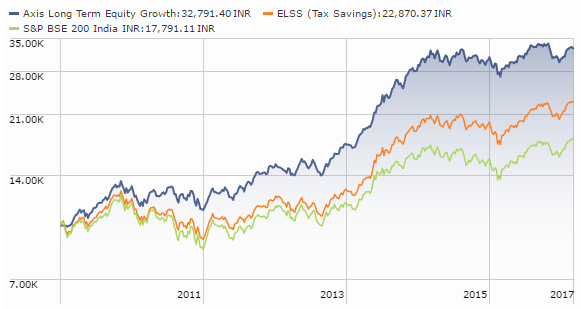

The fund has consistently outperformed its benchmark and delivered well above category-average returns (see graph). Over the period since its inception, the fund has outperformed the S&P BSE 200 by almost 85%.An amount of Rs.10,000 invested on 29 December in 2009, would have grown by over three times, close to Rs. 33,000

[Growth of Rs.10,000]

[Source: Morningstar.in | Years indicate end of respective calendar year | Graph begins from launch date – 29 December, 2009]

Axis Long Term Equity Fund comes from the reputed fund house of Axis Bank. Since its inception on 29th December, 2009, the fund has been striving to outperform its benchmark – S&P BSE 200. Rated 5 stars by Morningstar and managed by Fund Manager- Mr. Jinesh Gopani, Axis Long Term Equity Fund makes it to fisdom’s recommended short-list.

The stock-picking approach by the fund includes selecting stocks of companies with a scalable and superior business model coupled with high returns on capital and earning potential. Over the last few years, Axis Long Term Equity Fund has increased its large-cap allocation to around 75% and a mid-cap allocation of close to 25% and a negligible element of small-cap stocks.

Walking in late, the fund has managed to skip the bear-grip of 2008 and participate in the post-crisis recovery phase. While this may have given the trailing performance a jumpstart, the fund displayed resilience during the 2011 steep-drop as well. The fund has outperformed its category peers and benchmark significantly during the bullish phases of 2013 and 2014 as well. Most of its success is attributable to its growth and quality biased stock selection methodology.

The fund is overweight on financial services and consumer cyclical stocks. While these have been the front-running sectors in the bullish phase, the domestic consumer cyclical stocks are expected to witness a short-term slump given the current economic conditions in the country. However, this remains a sweet choice given that many high-quality stocks could be bought for cheap.

The bottom line would be that if you are looking for an ELSS Mutual Fund which can fetch you well above average returns while allowing for section 80C deduction benefits and tax-free capital gains, Axis Long Term Equity Fund is a fund worth looking at.

You can invest in Axis Long Term Equity fund through fisdom within 5 minutes. Log in to the fisdom app to check for similar recommendations in the ELSS category which can fetch you superior returns as well as help you save on tax.

[tek_button button_text=”Download Fisdom App” button_link=”url:https%3A%2F%2Fbit.ly%2F3eCufr7||target:%20_blank|” button_position=”button-center”]