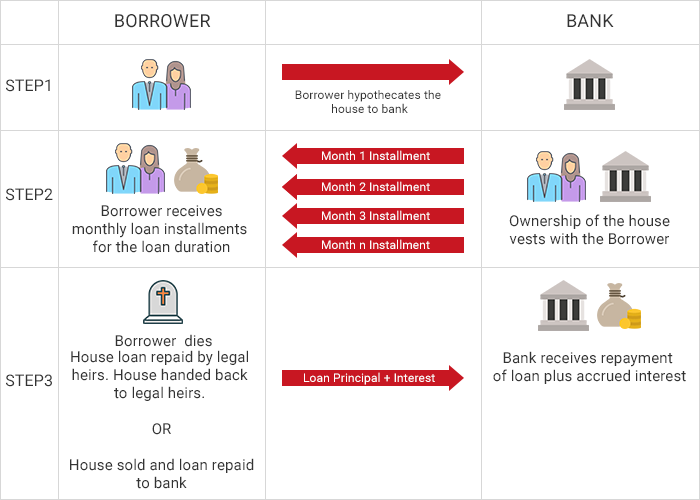

Introduced by the Union Government in the year 2007, reverse mortgage is a financial product designed to strengthen the financial and personal independence of senior citizens by providing a steady flow of income in old age to maintain their lifestyle and dignity. Reverse mortgage, in essence, is the opposite of home loan which enables senior citizens to mortgage their homes to a bank or a financial institute for a regular income and reside in their house for their entire lifetime.

Top 11 Salient Features of a Reverse Mortgage

- Reverse mortgage is available to home owners having a clear title to the property and who are above the age of 60. If the spouse is a co-applicant then she should be above 58 years of age.

- The pledged property should be permanent primary residence of the applicant.

- The minimum tenure of mortgage is 10 years and the maximum can vary from 15 to 20 years depending upon the lending institute.

- The maximum loan granted is upto 60% of the value of the property.

- The lender will re-evaluate the property after every 5 years. If the value of the property has gone up, the borrower has the option to increase their loan amount.

- The borrower has the option to take monthly, quarterly, annual or lump sum payment of the loan amount.

- The amount received is a type of interest payment and not a loan; hence the borrower is not liable to pay any taxes on the amount received.

- The interest rate on a reverse mortgage loan is determined by the prevailing market rates and can be either fixed or floating in nature.

- The annuity on the loan stops after the stipulated tenure, but the borrower and his spouse can continue to stay in the house until death of the last surviving borrower.

- The loan amount becomes due only after the last surviving borrower dies or the borrower chooses to sell his house.

- The lending institute can then sell the house to repay the loan along with the accumulated interest. The legal heir is given first option to settle the loan amount within a specific period of time and if the loan is not settled by the legal heir only then the property is put on sale.

Though reverse mortgage has been around for a decade now, it is not very prevalent in India. However, with an increase in the life expectancy, the older population is finding it more and more difficult to deal with the high cost of living and medical expenses that add on to the regular expense after a certain age. The concept of nuclear families and parents and children residing in different cities or even countries has added to the miseries of many senior citizens. And as each one wishes to live the last few years of his life in the comfort of his home without having to let go of his dignity, opting for a reverse mortgage can be a blessing for many such senior citizens in today’s time.

Reverse mortgage simplified:

[tek_button button_text=”Download Fisdom App” button_link=”url:https%3A%2F%2Fbit.ly%2F3guUEc5||target:%20_blank|” button_position=”button-center”]