SIP or Systematic Investment plan is a mode of investing in mutual funds. This mode requires investors to make small periodic contributions towards mutual fund investments over a predetermined period. It is commonly used by new investors who are not entirely familiar with the markets and would like to make small investments in mutual funds to gain limited exposure at the start of their investment journey.

Many investors often wonder how to go about making SIP payments towards mutual funds? Do they need to remember to make monthly payments? Can the SIP process be automated? The simple answer to all these questions is i-SIP biller.

Here, we will discuss the i-SIP biller option in detail and also provide important steps to be followed to set up the same in SBI.

How to automate SIP payments?

With various technological advancements, investors can easily make SIP payments through automated processes. Once the

Unique Registration Number or URN number is generally provided through email once an investor registers himself/herself for a mutual fund investment and makes the first payment. Investors then need to add the (URN) to their respective bank accounts. This can be done through net banking such that the SIP payment can be automated.

What is the process to add i-SIP biller in SBI?

Investors also have an option of enrolling for Systematic Investment Plans through i-SIP or internet based SIP via internet banking. This option makes mutual fund investments easy and convenient for investors. This process is entirely paperless and is a secure option involving no additional fees.

The pre-condition for accessing this facility is that investors should have access to internet banking services and these have to be KYC compliant. Also, the investor’s bank should be among those approved for offering the i-SIP facility. Biller addition must be completed within 10 days of URN generation. In case it is not done within 10 days, it may result in deactivation of URN.

The process of setting up i-SIP billers is different for each bank. Mentioned below are the steps to be followed for adding i-SIP biller with SBI:

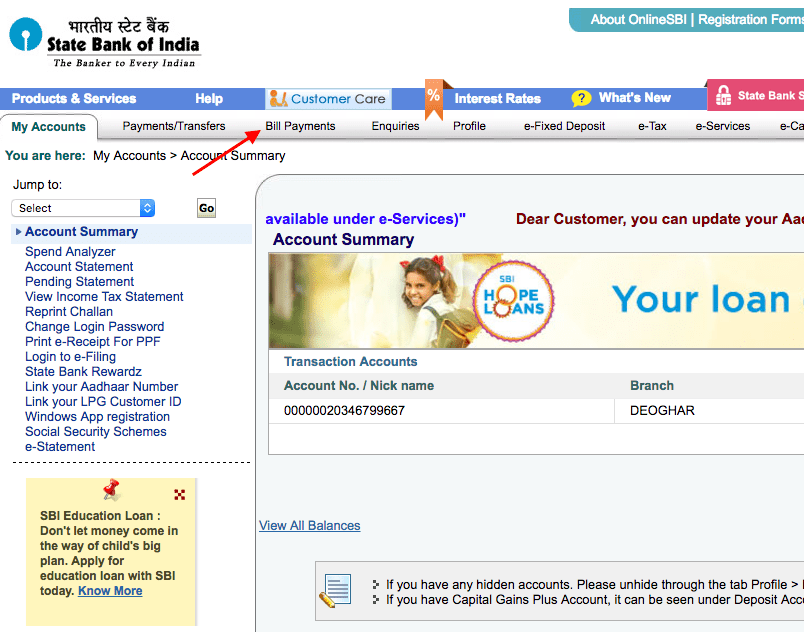

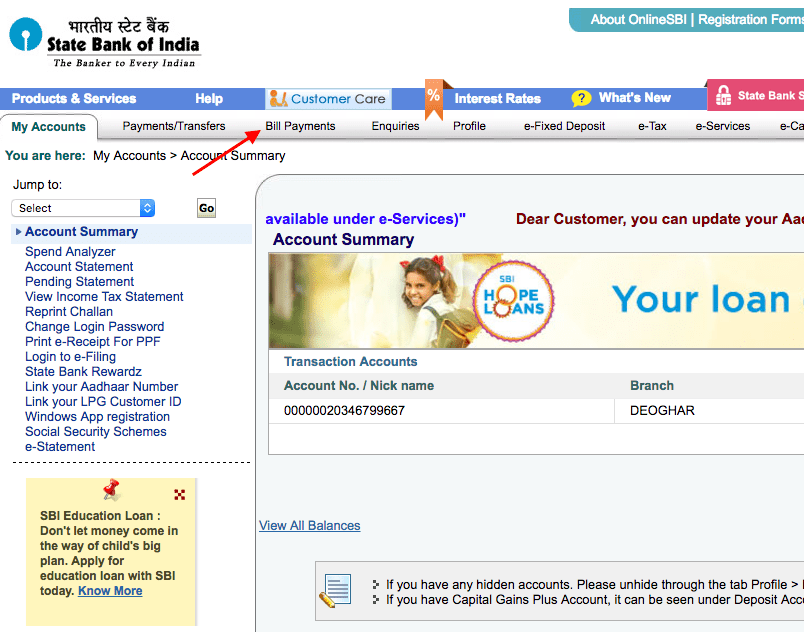

1.Go to the SBI net banking page

2.Enter log-in credentials and click on login

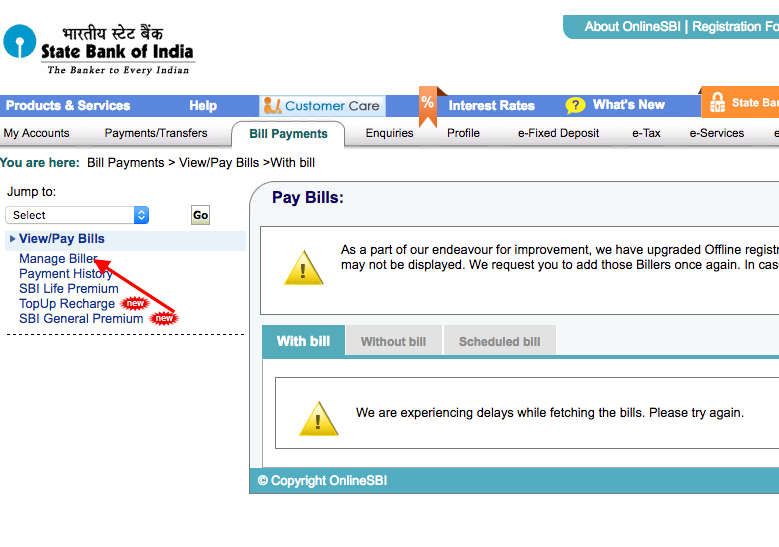

3.Go to the “Bill payment” tab

4.Click on the “Manage Biller” from the drop down options

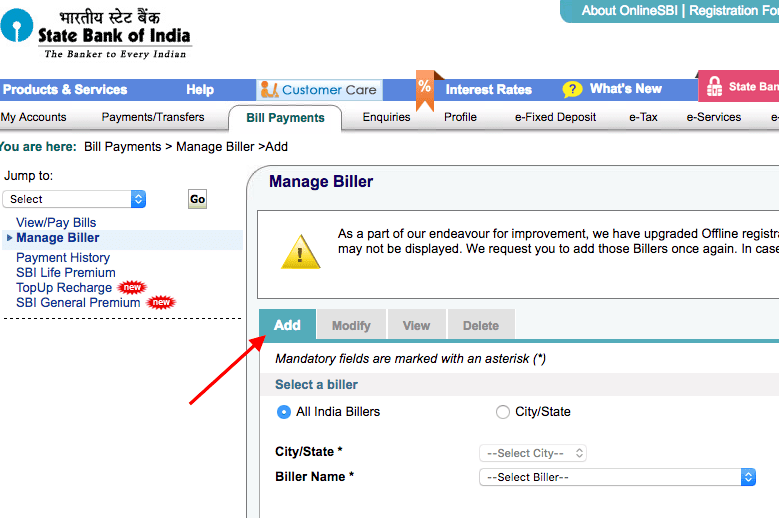

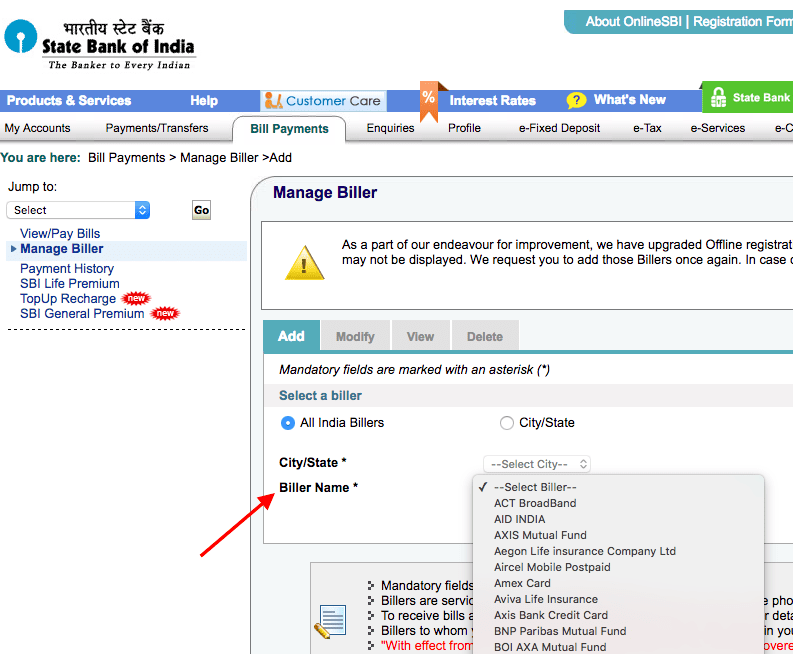

5.Click on the “Add” option from this

Here, one can see the list of all available AMCs or Asset Management Companies/Fund houses operating in India. An investor can select the fund house of choice from the drop-down. The next steps are as below:

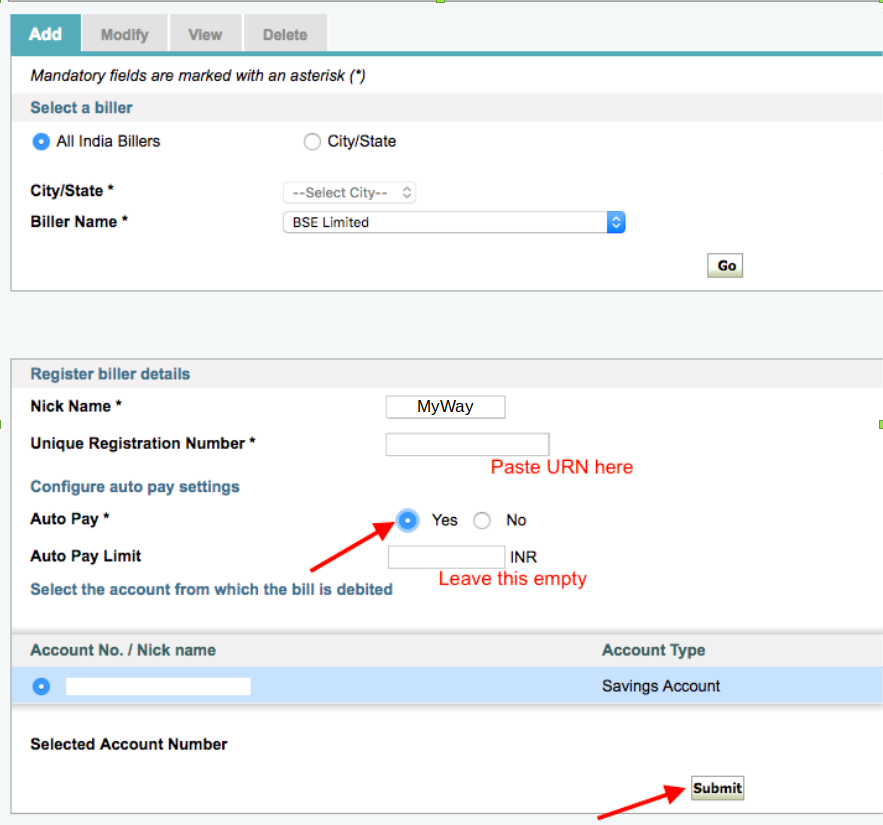

6.By clicking on the “Go” option, the investor will be redirected to a form for filling ‘manage biller’ details. Here the investor must provide following details:

- Add a nickname to the SIP for easy identification in future

- Details of Unique Registration Number(URN) of the fund selected

- During auto pay, there will be two options – Yes or No. If selecting ”Yes” for autopay, the investor has to mention the amount of SIP instalment that will automatically debited from the bank account chosen

- Auto-pay limit can be left blank, as this is not essential

- Choose the account details from where amount will be deducted

- Lastly, click on “Submit”.

7.Post this, investor will receive an OTP on registered mobile number

8.After entering the password, click on “Confirm”

Once the above-mentioned steps are completed, a confirmation message will appear on the screen. Investors can take a print-out of the same or save it as a soft copy for future reference. Completing these steps will allow an investor to start the i-SIP, which can be used for future SIP investments.

Additional read – Online SIP cancellation

What are the benefits of investing in SIP?

SIP has many advantages, including rupee cost averaging, compounding, disciplined savings, etc. Here are some of the benefits in detail:

Anyone can invest

SIP allows any investor, whether new or seasoned, risk-averse or risk-taker, affluent or working class, to start investing small amounts and see the investment grow over time. Most mutual fund SIPs need a minimum investment amount of Rs. 500 per month. This mode is simple and convenient to invest in and track. It also helps inculcate a sense of financial discipline and saving.

Rupee cost averaging

Rupee cost averaging benefit allows investors to buy more units through SIP when the market is on a downswing. In case of market upswings, investors will buy less units of the same fund. This is because SIP allows investors to modify the purchase quantity as per market corrections. This reduces the total cost of investment and also adds on to total gains.

Investment flexibility

SIP offers flexibility especially to investors who want to avoid long-term commitment through investment in instruments such as Public Provident Fund (PPF) or Unit Linked Insurance Plans (ULIPs). These are mostly ended and allow investors to withdraw as per individual comfort. Investors can either withdraw full or part of the investment without incurring any costs. In SIP, the amount of investment is flexible and can be increased or decreased as per personal preference.

Higher long-term returns through compounding

SIPs can offer double the returns as compared to other traditional forms of investment, such as bank FDs. This helps in beating inflation. These are based on the principle of compounding. Therefore, a small amount invested for a longer duration can fetch better returns as compared to a one-time lump sum investment.

Caters to emergency financial needs

Since SIP investments can be withdrawn at any time during the tenure, these can help in meeting any emergency financial situations like hospitalisation or job loss.

How to modify or delete i-SIP in SBI Internet Banking?

i-SIP is a facility that allows you to register for SIP (Systematic Investment Plan) in mutual funds online using SBI Internet Banking. To modify or delete i-SIP in SBI Internet Banking, you can follow these steps:

- Log in to your SBI Internet Banking account and click on ‘Bill Payments’ from the main menu.

- In the ‘Bill Payments’ section, click on ‘Manage Biller’ option and then click on ‘View’ tab.

- You will see a list of billers that you have registered for i-SIP. Select the biller that you want to modify or delete and click on ‘Go’ button.

- You will see the details of the biller and the i-SIP. To modify the i-SIP, click on ‘Modify’ button and make the necessary changes such as amount, frequency, autopay limit, etc. To delete the i-SIP, click on ‘Delete’ button and confirm your action.

- You will receive an OTP (One Time Password) on your registered mobile number. Enter the OTP and click on ‘Confirm’ button to complete the process.

- You will get an acknowledgement message with a reference number for your modification or deletion request. You can also check the status of your request by clicking on ‘Status Enquiry’ option under ‘Bill Payments’ section.

Conclusion

To enhance the convenience offered by SIP investments, investors can add i-SIP biller in SBI by following the easy steps shared above. This will ensure timely deposit of investment amount every month and continuity of investment for a longer time horizon for maximising benefits.

FAQs

An i-SIP or an internet-based SIP is a paperless mode of making SIP investment. Once an investor has set up the i-SIP, he/she needs to add the Asset Management Company (AMC) as a biller with the bank using internet banking.

SIP is tax free only if made in ELSS or equity linked savings schemes. Investors of this scheme can claim up to Rs. 1.5 lakhs as tax deduction under Section 80C of the Income Tax Act.

SIP investment is suitable for all investment horizons, including short term and long-term goals. These cater to wealth creation goals of investors while offering liquidity. A PPF is a long-term investment with a lock-in period of 15 years, therefore offers less liquidity.

SIP is ideal for imbibing a financial discipline and is suitable for investors who want to park small portions of their income in mutual funds. Lump sum investments may not be suitable for all, as it requires availability of substantial funds.

There is generally no penalty for non-payment of SIP installments. However, in most cases, SIP is automatically cancelled if an investor fails to make the payments for three consecutive periods.