Voters want conflicting things. They want a lot of government expenditure, but they don’t want higher taxes.

— Bruce Rauner

The interim budget 2019 invited quite a euphoria in the parliament as the NDA-led government presented a bouquet of sops to almost every section of the society – the farmers, military, MSMEs, film-makers and yes, the middle-class of India.

The budget was no less than a classic election budget where expenses were read out with compassion and doubts on sources of revenue were brushed under the carpet. But, that’s the beauty of democracy – the larger public of the economy does not understand public economics.

The comprehensive highlights are already doing rounds in the press and social media, but here I would like to present the top five highlights that would probably matter the most – at least from a personal finance perspective.

|

Interim Budget 2019 Highlight |

How does it impact you? |

| Increased standard deduction | You can claim an additional INR 10,000 as a deduction from your income |

| Increased income tax rebate | Indians earning up to INR 5 Lakh do not need to pay income tax; utilizing 80C investment limits – INR 6.5 Lakh p.a. becomes non-taxable |

| TDS limit hiked – post-office savings scheme | No TDS till interest earned on post office savings exceed INR 40,000 p.a. (previous INR 10,000) |

| Scope for tax exemption on notional rent expanded | You can now own a second home without paying tax on notional rent |

| Increase in gratuity limit | Gratuity can be earned up to INR 20 Lakh (previous: INR 10 Lakh) |

Most expected an increase in the section 80C limit and/or a roll-back of the LTCG tax on equities introduced in the previous budget. However, expecting the government to cut taxes mostly paid by the rich – especially during the election season was too wishful at best.

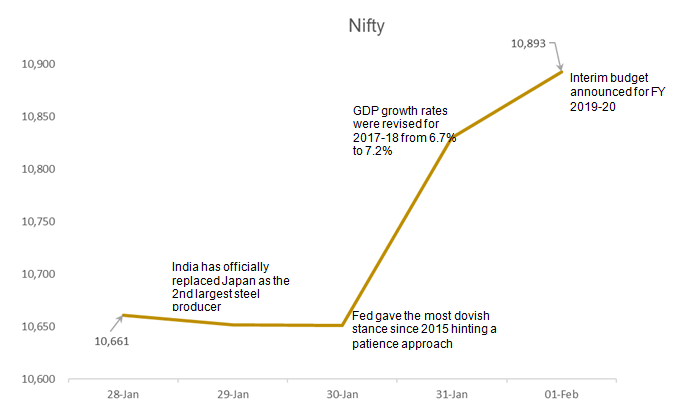

While there was no relief specifically for equity investors, the week has seen quite a run-up – especially as it approached the interim budget day.

While the interim budget made the day a tad bit exciting, the announcements should be taken with a pinch of salt. At least till the post-election full budget continues the line of thought.

If you have any concern, please write to us at ask@fisdom.com or call at +918048039999, we would be happy to answer your query.