Indian markets overview:

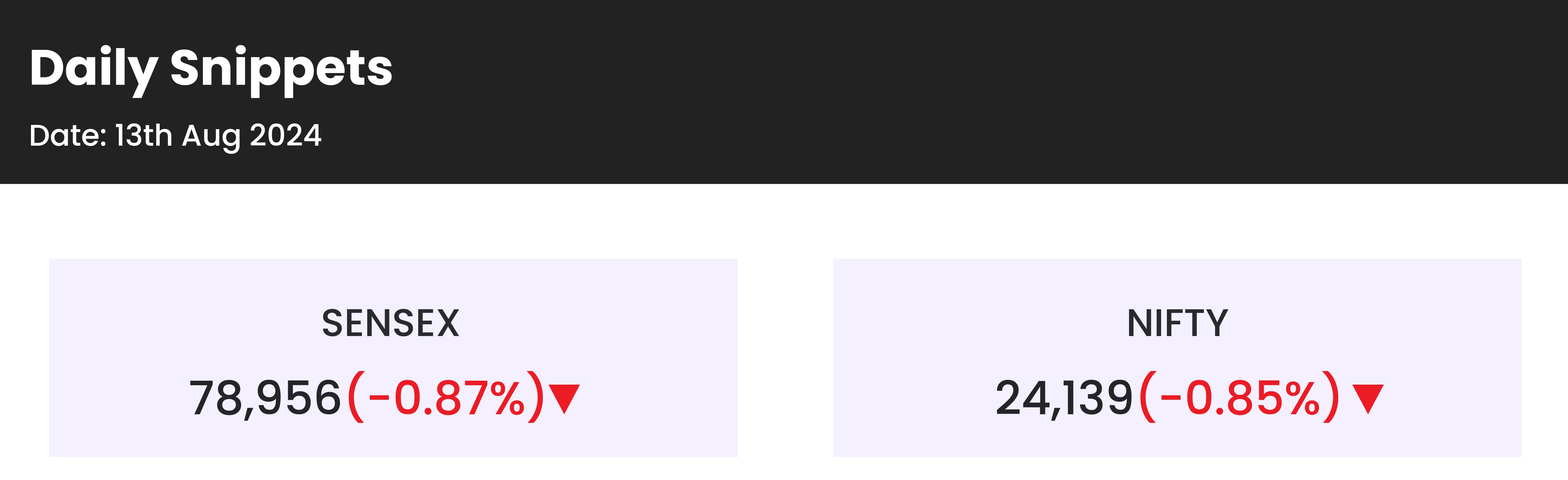

- Indian equity markets fell by around 1% on August 13, with the Sensex closing below 79,000 and the Nifty dropping below 24,200.

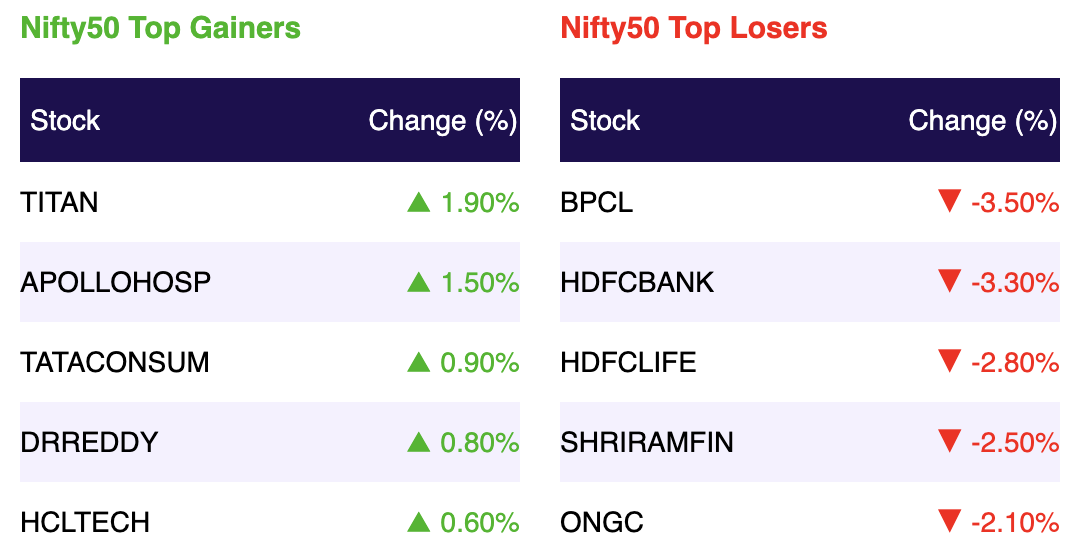

- The decline, driven by a sell-off in banking, metals, and auto stocks, was influenced by mixed macroeconomic data, including a near 5-year low in July’s CPI and slower IIP growth at 4.2% in June.

- Additionally, foreign fund outflows and mixed global trends added to the negative sentiment.

- All the sectoral indices ended in the red with bank, power, oil & gas, metal, media, telecom down one percent each.

- BSE Midcap and Smallcap indices also lost one percent each.

- The benchmark Nifty fell below 24,200, breaking the rising wedge pattern on the 75-minute chart but found support at 24,100.

- The RSI (14) bounced off 40, and the index remains above key DEMAs despite closing below the 10 and 20 DEMAs, indicating a mixed outlook.

- Weekly charts show the index trading above the major EMA and consolidating between 23,900 and 24,500.

- The short-term outlook is negative to sideways, with support at 24,000 and 23,900, and resistance at 24,250 and 24,350.

Technical Overview – Bank Nifty

- The banking index dropped below 50,000, ending 1.50% lower for the day and consolidating between 49,600 and 50,800.

- It is approaching the lower band of a rising channel on the weekly chart and facing resistance at the 10 DEMA while hovering near the 100 DEMA.

- The MACD shows negative crossovers on both daily and weekly charts, indicating weak upside momentum. Upcoming resistance levels are 50,000 and 50,300, with support at 49,650 and 49,450.

Stocks in Spotlight

- Inox Wind shares rose over 4% after the wind energy solutions provider secured a 51 MW equipment supply order from Everrenew for its 3 MW class Wind Turbine Generators (WTGs).

- Marico shares climbed over 2% after the FMCG giant announced that its operations in Bangladesh have returned to normal levels. Operating conditions in the market have been gradually improving, with the majority of retail sales force and distributors resuming activities since last week.

- HDFC Bank shares dropped 3% on August 13 after investors were disappointed by the MSCI Global Standard Index’s decision to increase the bank’s weightage in two stages instead of one, resulting in a lower-than-expected weight change.

News from the IPO world🌐

- Jhunjhunwala-backed Inventurus Knowledge Solutions company files DRHP with Sebi

- Logistics company Shadowfax eyes Rs 3,000 crore IPO

- Interarch Building Products announces Rs 850-900 price band for Rs 600 crore IPO

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY CONSUMER DURABLES | 1.3 |

| NIFTY MIDSMALL HEALTHCARE | 0.1 |

| NIFTY HEALTHCARE INDEX | 0.1 |

| NIFTY IT | 0.0 |

| NIFTY PHARMA | -0.1 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1266 |

| Decline | 2676 |

| Unchanged | 84 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| 10 Year Gsec India | 7.0 | 1.8 % | 20.8 % |

| WTI Crude (USD/bbl) | 76 | (4.8) % | 8.3 % |

| Gold (INR/10g) | 70,295 | (0.1) % | 3.9 % |

| USD/INR | 83.96 | 0.0 % | 1.1 % |

| Hang Seng | 17,174 | 0.4 % | 2.3 % |

| Shanghai Composite | 2,868 | 0.3 % | (3.2) % |

| Dow Jones | 39,357 | (0.4) % | 4.4 % |

| DAX | 17,726 | 0.0 % | 5.7 % |

| FTSE 100 | 8,210 | 0.5 % | 6.3 % |

| Nikkei | 36,233 | 3.5 % | 8.8 % |

| Straits Times | 3,259 | 0.7 % | 0.9 % |

Please visit www.fisdom.com for a standard disclaimer