Technical Overview – Nifty 50

The Benchmark index had a pretty tumultuous session, the index lost some points in the first hours, and rebounded swiftly from a 24,200 low. The index created a DOJI candlestick and closed flat for the day. The index has been trading in a range, with resistance at 10 and 20 DEMA. The momentum indicator RSI (14) found support at 40 and reversed thereafter. The index has closed below the 10 and 20 DEMAs, but remains above the other key DEMAs, reflecting an overall positive view. The weekly chart shows the index trading above the main EMA, taking support at the 10 EMA, and consolidating between the 23,900 and 24,500 levels. The short-term outlook is negative to sideways. Support levels for the upcoming sessions are 24,000 and 23,900, while resistance is at 24,450 and 24,550.

Technical Overview – Bank Nifty

The Banking index has been trading in a fairly narrow range, ranging between 49,600 to 50,900. The index has been finding support near 100-DEMA. On a weekly chart, the Banking index has been moving in a rising channel and is now approaching its lower band, where the lower band and the 200-DEMA converge.

On the weekly chart, the momentum indicator RSI (14) has broken a rising trend line and is around the 55 level, indicating a loss of bullish momentum. The banking index closed below the 10, 20, and 50 DEMA, which serve as resistance.

MACD has a negative crossover on the daily chart, indicating lagging upside momentum on the daily chart and a negative crossover on the weekly chart.

The resistance and support levels for the upcoming sessions are 50,800, 51,100 for resistance, and 50,300, 50,500 for support.

Indian markets:

- The domestic benchmark equity indices, Sensex and Nifty 50, ended Monday’s session largely unchanged amid mixed global signals.

- By Monday afternoon, both indices had recovered earlier losses and continued to gain, supported by positive trends in international markets and fresh inflows of foreign capital.

- Earlier in the day, the indices had dipped as investors were cautious following concerns related to a report by US short-seller Hindenburg Research. The report alleged that the SEBI chairman and her spouse had undisclosed involvement in obscure offshore funds based in Bermuda and Mauritius. The BSE midcap index closed flat, while the smallcap index rose by 0.5 percent.

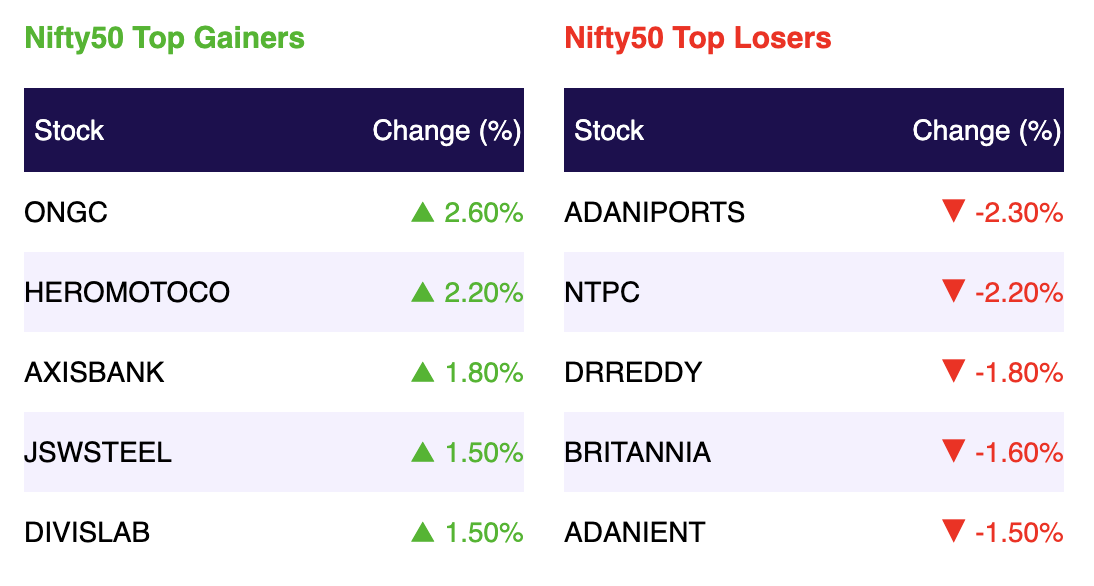

- Sector-wise, FMCG, power, PSU banks, and media stocks declined by 0.5-2 percent, while banking, telecom, IT, oil & gas, metal, and realty stocks gained 0.3-1 percent.

Global Markets:

- Asia-Pacific markets saw a mostly positive performance on Monday after a volatile week characterized by sharp sell-offs followed by a significant rebound, particularly in Japanese stocks.

- Australia’s S&P/ASX 200 climbed 0.46%.

- While South Korea’s Kospi rose 1.15%. The small-cap Kosdaq also gained 1.08%, with major chipmaker SK Hynix advancing 3.21%.

- Hong Kong’s Hang Seng index was up 0.13% in its final trading hour, whereas Mainland China’s CSI 300 edged down 0.17%.

- U.S. futures were trending lower as investors looked ahead to crucial inflation data expected later this week. On Friday, major Wall Street indices saw gains, recovering from the previous week’s market downturn.

- On Friday, the Dow Jones Industrial Average fell 0.6%, the S&P 500 remained largely unchanged, and the Nasdaq Composite slipped 0.18%.

Stocks in Spotlight

- Shares of Suzlon Energy surged to a 5 percent upper circuit, reaching a multi-year high of Rs 80.36 on the NSE on August 12. The multibagger stock, which surpassed a market capitalization of Rs 1 lakh crore last week, has delivered a remarkable 47 percent return in just the past month. This marks the stock’s highest trading level since March 2010.

- Inox Wind shares soared 20 percent following the management’s confident execution outlook and strong June quarter results. Despite the monsoon season making the first two quarters typically weaker for the wind energy sector, the company expects a stronger performance in the second half of the year, according to Devansh Jain. In Q1 FY25, Inox Wind delivered its best financial performance to date, posting a net profit of Rs 50 crore for the June quarter, compared to a loss of Rs 65 crore in the same period last year. Total revenue increased by 85 percent year-on-year, reaching Rs 651 crore.

- Shares of Ola Electric hit the 20 percent upper circuit for the second consecutive session, continuing their strong post-listing performance. This comes after a similar 20 percent surge on the company’s market debut on August 9. The Bhavish Aggarwal-led company is set to announce its Q1 results on August 14. Ola Electric Mobility will hold its first board meeting since listing on August 14, 2024, where the company will review and approve the unaudited standalone and consolidated financial results for the quarter ending June 30, 2024, as per a recent filing.

News from the IPO world🌐

- Logistics company Shadowfax eyes Rs 3,000 crore IPO

- Saraswati Saree’s Rs 160 crore IPO opens on August 12

- After robust IPO response, Unicommerce GMP signals a bumper listing on Tuesday

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY REALTY | 1.3 |

| NIFTY CONSUMER DURABLES | 0.9 |

| NIFTY METAL | 0.8 |

| NIFTY OIL & GAS | 0.5 |

| NIFTY PRIVATE BANK | 0.4 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1941 |

| Decline | 2126 |

| Unchanged | 118 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,498 | 0.1 % | 4.7 % |

| 10 Year Gsec India | 7.0 | 1.7 % | 19.0 % |

| WTI Crude (USD/bbl) | 76 | (0.8) % | 8.3 % |

| Gold (INR/10g) | 69,838 | 0.3 % | 4.0 % |

| USD/INR | 83.97 | 0.0 % | 1.1 % |