Technical Overview – Nifty 50

The benchmark index saw some profit booking from all-time highs. The index has dropped below the 24,800 level. The benchmark index encountered heat, while the other indices remained rather constant, with little correction. The index created a DOJI candlestick on the daily chart and closed near the 10-DEMA.

The fact that the RSI (14) momentum indicator has support near the 60 mark and index to find support near 20-DEMA. On the weekly the index is still moving higher above the important moving average (EMA), suggesting that the upward momentum is still in place. The MACD is still above the polarity and positive for the benchmark index.

Based on benchmark index OI data, a base formation may take place at the 24,500 level, where put writing is almost 33 lakhs. At 25,000, call writing is almost close to 81 lakhs, which might act as a resistance. The PCR value of the benchmark index is 0.61.

The view remains buy on dips. The support levels for the upcoming sessions are at 24,600 and 24,500 and resistance at 24,850 and 24,950, respectively.

Technical Overview – Bank Nifty

The banking index fell 0.30 percent but recovered from the 51,000 mark. The Baking Index found support at 51,000 and is currently consolidating between 51,000 and 52,700. The index encountered resistance at the 10-day moving average (DEMA). The banking index is under pressure, underperforming the benchmark index for the week.

The 41-point mark served as a base and support for the RSI (14) momentum indicator. The closing below the 10 and 20 DEMAs, which supported the index, indicates that the banking index remains under pressure. Despite the short-term positive momentum, the 10 DEMA has crossed below the 20 DEMA, indicating a sell in an up-trending market. On the daily chart, a negative MACD crossover indicates a lagging upward trend.

Based on benchmark index OI data, a base formation may take place at the 51,500 level, where put writing is close to 18 lakhs. At 52,000, call writing is almost close to 31 lakhs, which might act as a resistance. The PCR value of the benchmark index is 0.80.

The resistance and support levels for the upcoming sessions are 51,600, 52,000 for resistance, and 50,950, 50,450 for support.

Indian markets:

- Indian markets fell by over one percent on August 2, reflecting global equity declines due to rising concerns about the US economy and the tech sector’s outlook.

- Among sectoral indices, Nifty Realty was the hardest hit, losing 3 percent. It was followed by Nifty Auto and Nifty Metal, which dropped 3 percent and 2.7 percent, respectively.

- Nifty IT declined by 2.5 percent, and Nifty PSU Bank decreased by 1.7 percent. The only sector to gain was Nifty Pharma, which rose by 0.4 percent.

Global Markets:

- Japan’s benchmark indexes plunged on Friday, with most Asia-Pacific markets falling after a sell-off on Wall Street overnight due to recession fears.

- The Nikkei 225 tumbled 5.81%, marking its worst day since March 2020 and dropping below the 36,000 mark for the first time since January, according to Factset data.

- The broader Topix saw an even larger loss of 6.14%, experiencing its worst day in eight years.

- South Korea’s Kospi fell 3.65%, its worst day since August 2020, largely dragged down by banking stocks, while the small-cap Kosdaq plunged 4.20%, reaching its lowest level since November 2023.

- Australia’s S&P/ASX 200 dropped 2.11%, its worst day since March 2023, retreating from its all-time high on Thursday.

- Hong Kong’s Hang Seng index was 2.32% lower in its final hour of trading, while mainland China’s CSI 300 posted the smallest loss in Asia, dropping 1.02%.

- The gloomy sentiment in Asian markets followed a significant sell-off on Wall Street in Thursday’s session, where all three major U.S. indexes plunged on recession fears.

Stocks in Spotlight

- Zomato Shares surged over 12 percent as investors celebrated the food aggregator firm’s impressive earnings for the quarter ended June 2024, with all segments showing robust growth.

- Suzlon Energy |Shares climbed nearly 5 percent, rebounding from the previous session’s losses due to profit-booking. This surge was driven by investor interest following impressive Q1 performance, bullish brokerage comments, and a positive business outlook.

- G R Infraprojects Shares dropped nearly 5 percent after the company reported a nearly 50 percent year-on-year decline in consolidated net profit to Rs 155.5 crore in Q1 FY25.

News from the IPO world🌐

- Ola Electric IPO: Retail portion fully subscribed within 3 hours

- FirstCry set to file final papers for $3-3.5 billion IPO

- Paras Healthcare files IPO papers

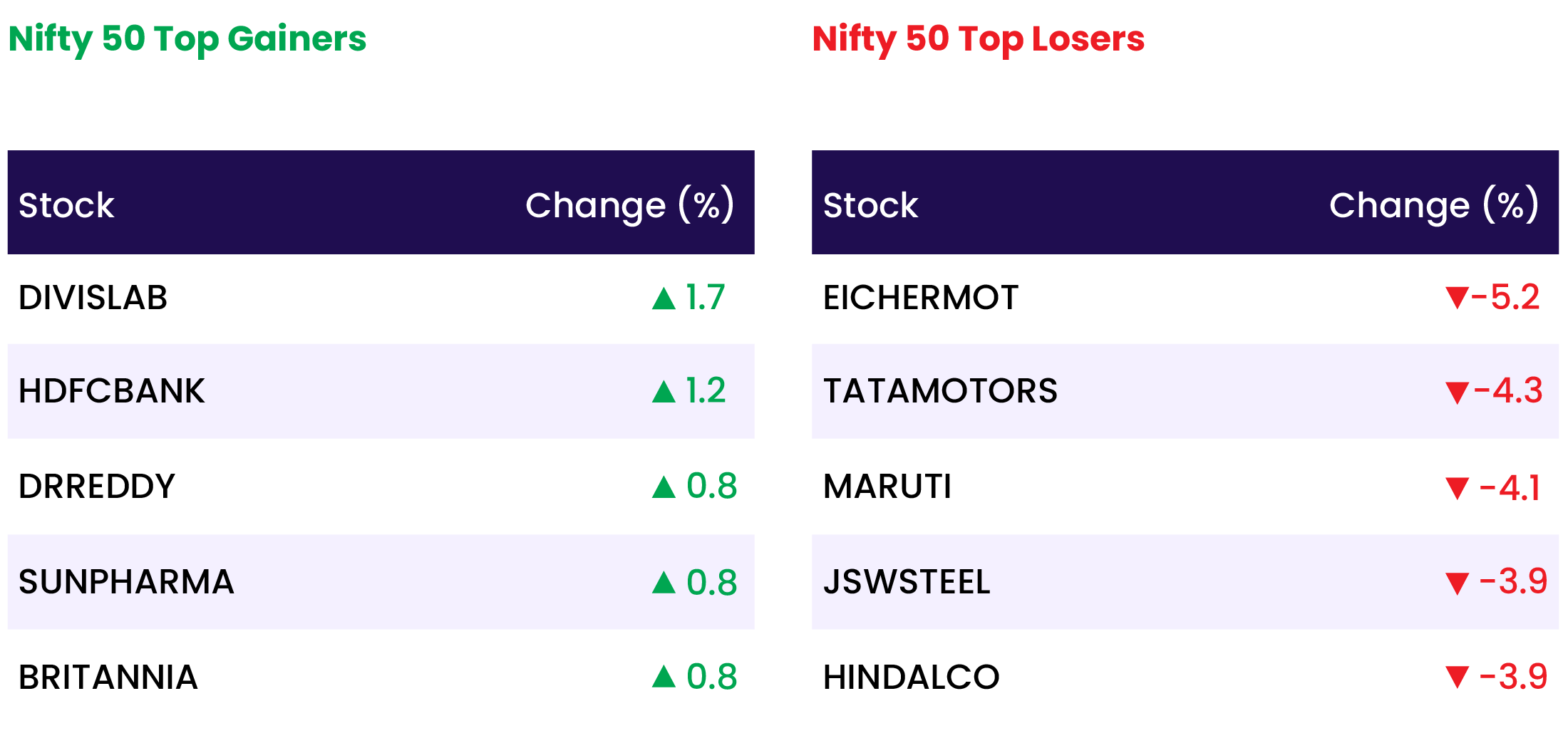

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PHARMA | 0.5 |

| NIFTY HEALTHCARE INDEX | 0.4 |

| NIFTY MIDSMALL HEALTHCARE | 0.1 |

| NIFTY FINANCIAL SERVICES | -0.3 |

| NIFTY PRIVATE BANK | -0.4 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1705 |

| Decline | 2212 |

| Unchanged | 116 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 40,348 | (1.2) % | 7.0 % |

| 10 Year Gsec India | 7.0 | 1.6 % | 11.3 % |

| WTI Crude (USD/bbl) | 76 | (4.5) % | 8.4 % |

| Gold (INR/10g) | 70,080 | 1.0 % | 3.9 % |

| USD/INR | 83.71 | 971.5 % | 0.8 % |

Please visit www.fisdom.com for a standard disclaimer