Technical Overview – Nifty 50

The benchmark index reached a fresh all-time high of 25,080, but failed to sustain it and fell to 24,950. The index has provided a flag and pole breakout and is currently trading near the retest level. Despite the fact that NIFTY closed higher, the Midcap and small-cap indices were under pressure. Index has formed a Doji candlestick on the daily chart at its all-time high.

The fact that the RSI (14) momentum indicator took support at the 60 mark and had a hidden positive divergence gave a confirmation of upside continuation. On the weekly and daily charts, the index is still moving higher above the important moving average (EMA), suggesting that the upward momentum is still in place. The MACD is still above the polarity and positive for the benchmark index.

Based on benchmark index OI data, a base formation may take place at the 24,800 level, where put writing is almost 18 lakhs. At 25,000, call writing is almost close to 47 lakhs, which might act as a resistance. The PCR value of the benchmark index is 0.96.

The view remains buy on dips. The support levels for the upcoming sessions are at 24,900 and 24,800 and resistance at 25,100 and 25,200, respectively.

Technical Overview – Bank Nifty

Banking index closed flat for the day; it has been under pressure and underperforming the benchmark index. The banking index has gone into consolidation and is having difficulties breaking the 52,000 barrier, where OI call writing is high.

The 41-point mark served as a base and support for the RSI (14) momentum indicator. The closing below the 10 and 20 DEMAs, which supported the index, indicates that the banking index remains under pressure. Despite the short-term positive momentum, the 10 DEMA has crossed below the 20 DEMA, indicating a sell in an up-trending market. On the daily chart, a negative MACD crossover indicates a lagging upward trend.

Based on benchmark index OI data, a base formation may take place at the 51500 level, where put writing is close to 16 lakhs. At 52,000, call writing is almost close to 33 lakhs, which might act as a resistance. The PCR value of the benchmark index is 0.66.

The resistance and support levels for the upcoming sessions are 51,600, and 52,000 for resistance, and 50,950, and 50,450 for support.

Indian markets:

- After reaching new record highs, Indian markets gave up most of their morning gains on August 1, ending the day with a modest increase.

- Among sectoral losers, Nifty Media led with a 1.9% drop, followed by Nifty Realty and Nifty PSU Bank, down 1.7% and 1% respectively. The Consumer Durables and IT indices fell 0.5% and 0.4%. On the gainers’ side, Nifty Oil and Gas rose 0.4%, while Nifty Healthcare increased by 0.3%.

- Investors are closely watching jobless claims data, due later on Thursday, and July’s unemployment figures, which will provide further insights into the US labor market. Additionally, traders are anticipating the Bank of England’s interest rate decision due in London.

Global Markets:

- Asia-Pacific markets were mixed on Thursday after comments from U.S. Federal Reserve Chair Jerome Powell indicated a possible rate cut in September if inflation data remains “encouraging.”

- Japan’s Nikkei 225 tumbled 2.49% to close at 38,126.33, while the broad-based Topix plunged 3.24% to 2,703.69. In contrast, Australia’s S&P/ASX 200 reached new all-time highs, gaining 0.28% to end at 8,114.7.

- South Korea’s Kospi climbed 0.25% to finish at 2,777.68, while the small-cap Kosdaq rose 1.29% to 813.53.

Stocks in Spotlight

- Coal India Shares rose 3.5% after the company reported a 4.2% year-over-year increase in consolidated net profit and a 1.3% rise in revenue for the quarter ended June.

- Aster DM Healthcare Shares gained 6% after its first-quarter revenue rose over 19%, in line with analysts’ estimates. The company’s revenue from operations increased nearly 24%.

- On August 1, ITC Ltd reported a marginal rise in its standalone net profit for the June quarter, reaching Rs 4,917 crore compared to Rs 4,903 crore in the same quarter the previous year, falling short of Street expectations.

News from the IPO world🌐

- Ola electric IPO opens august 2 at ₹72-76 per Share

- FirstCry set to file final papers for $3-3.5 billion IPO

- Paras Healthcare files IPO papers

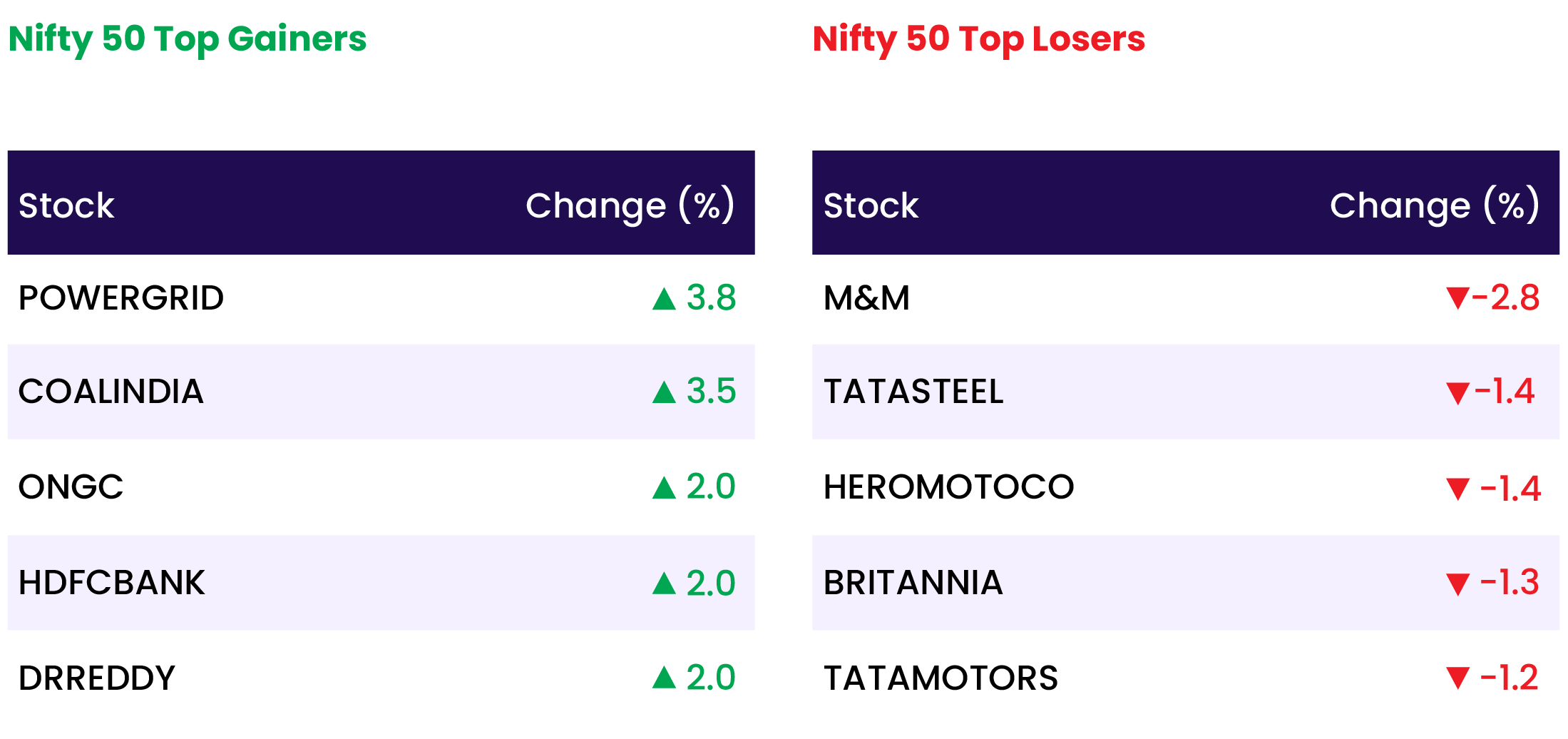

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY OIL & GAS | 0.4 |

| NIFTY HEALTHCARE INDEX | 0.3 |

| NIFTY FMCG | 0.2 |

| NIFTY FINANCIAL SERVICES | 0.1 |

| NIFTY PHARMA | 0.1 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1577 |

| Decline | 2383 |

| Unchanged | 88 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 40,843 | 0.2 % | 8.3 % |

| 10 Year Gsec India | 7.0 | 1.6 % | 9.7 % |

| WTI Crude (USD/bbl) | 80 | 6.9 % | 13.5 % |

| Gold (INR/10g) | 69,340 | 0.4 % | 2.9 % |

| USD/INR | 83.74 | 0.0 % | 0.8 % |

Please visit www.fisdom.com for a standard disclaimer