Technical Overview – Nifty 50

On July 18, the benchmark index reached a new all-time high of 24,840 points. The first part of the session saw some volatility in the markets, although it recovered from the 24,500 level. But there is pressure on the entire market, particularly on the midcaps, which is indicative of a weak undertone. The benchmark index closed at the upper band of the rising higher-high trend line.

The momentum indicator, RSI (14) broke out of its six-week congestion and retested the breakout level of 68. As long as the daily MACD rises and stays above its polarity, the rising trend ought to continue. The 10-DEMA provided support for the index, and it is currently trading above the major DEMA, pointing to an overall higher trend.

Based on benchmark index OI data, a base formation may take place at the 24,600 level, where put writing is almost 38 lakhs. At 25,000, call writing is almost close to 46 lakhs, which might act as a resistance. The PCR value of the benchmark index is 1.30.

The support and resistance levels for the next sessions are at 24,700 and 24,600 and 24,900 and 25,000, respectively.

Technical Overview – Bank Nifty

The banking index saw considerable volatility over the day, peaking around 52,800, which also served as the day’s resistance. The index has been consolidating in range over the past 13 days; between 51,800 – 52800.

On a daily timeline, the momentum indicator RSI (14) exhibits a hidden positive divergence, indicating that the rising momentum is probably going to continue. The 20-DEMA provided support for the index during the previous session, although bulls’ enthusiasm for baking the index seemed to be dwindling. The MACD shows a negative crossover over the daily chart, which suggests a lag in momentum.

Based on benchmark index OI data, a base formation may take place at the 52,500 level, where put writing is close to 11 lakhs. At 53,000, call writing is almost close to 10 lakhs, which might act as a resistance. The PCR value of the benchmark index is 1.10.

In the event of a decline, the opinion is still to buy on dips and to pyramid over 52,800 levels. The resistance and support levels for the upcoming sessions are 52,650, 52,850 for resistance, and 52,000, 51,750 for support.

Indian markets:

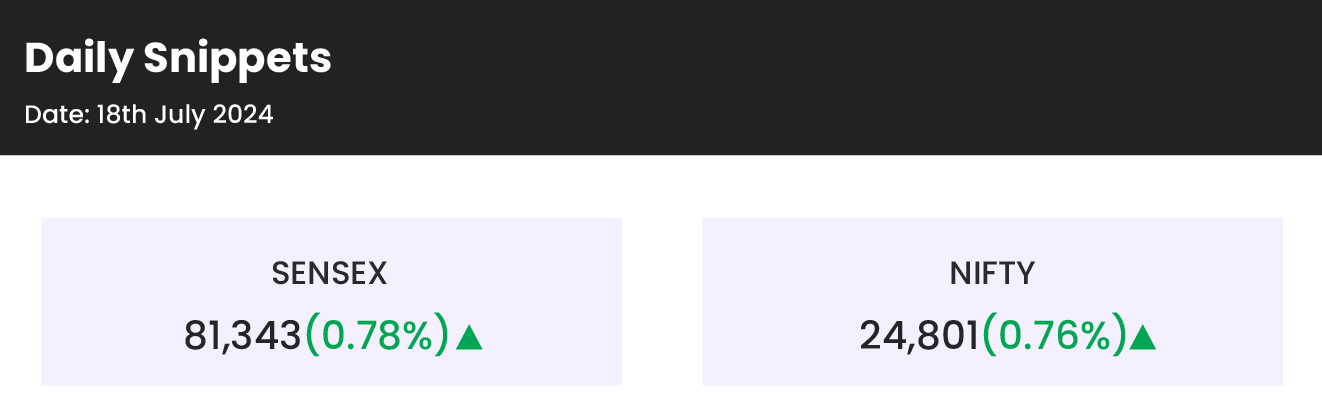

- The Indian equity market escalated to fresh record highs and extended its winning streak for the fourth straight session on July 18, driven by strong performances in the IT, banking, and FMCG sectors.

- Despite weak global cues causing the indices to open lower, with the Nifty starting below 24,550, the market recovered in the initial hours.

- After a period of lackluster trading in the first half, significant buying interest in FMCG, IT, and banking stocks propelled the benchmarks to new all-time highs.

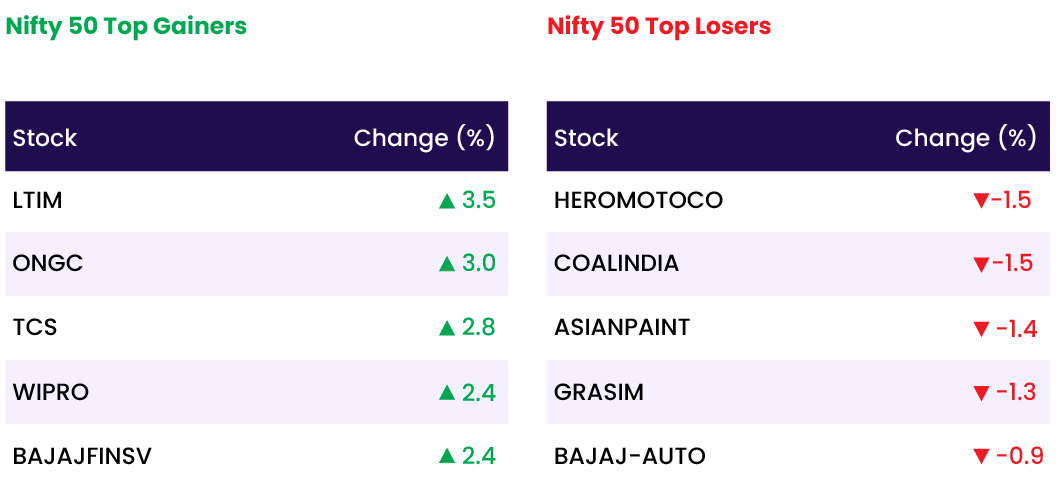

- Among the sectors, banking, auto, IT, FMCG, and telecom stocks experienced gains ranging from 0.3% to 2%. In contrast, sectors like capital goods, metal, power, and media saw declines of 1% to 3.5%.

- The BSE midcap and smallcap indices each dropped by 1%.

Global Markets:

- Most Asia-Pacific markets declined on Thursday, largely due to a drop in chip-related stocks following reports of tighter export restrictions from the U.S. and comments from former U.S. President Donald Trump that heightened geopolitical tensions.

- In Japan, the Nikkei 225 fell by 2.36%, while the Topix decreased by 1.6%.

- South Korea’s Kospi index dropped by 0.67%, and the small-cap Kosdaq declined by 0.84%,

- Contrarily, Hong Kong’s Hang Seng index saw a gain of 0.64% in its last hour of trading, and China’s CSI 300 rose by 0.55%.

- Australia’s S&P/ASX 200 fell by 0.27%, concluding the session at 8,036.50.

Stocks in Spotlight

- Mahanagar Telephone Nigam Limited (MTNL) shares surged by 19 percent to reach a multi-year high of Rs 63.32 on the NSE amid heavy trading volumes. This sharp rally followed the government’s deposit of Rs 92 crore to clear immediate bond interest dues for the state-owned telecom service provider.

- Just Dial shares soared by over 11 percent after delivering a strong performance in the April-June quarter (Q1FY25), meeting market expectations.

- LTIMindtree shares climbed by 3.5 percent as investors welcomed a strong start to FY25, following the company’s steady earnings report for the April-June quarter. The upbeat sentiment was further bolstered by the management’s positive commentary, which hinted at early signs of recovery.

News from the IPO world🌐

- Sanstar’s Rs 510-cr IPO to open on July 19; sets price band at Rs 90-95 per share

- Swiggy announces $65 million ESOP programme for employees ahead of IPO

- Insurer Niva Bupa plans $360 million IPO.

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY IT | 2.2 |

| NIFTY FMCG | 1.0 |

| NIFTY FINANCIAL SERVICES | 0.6 |

| NIFTY BANK | 0.4 |

| NIFTY PRIVATE BANK | 0.4 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1424 |

| Decline | 2500 |

| Unchanged | 92 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 41,198 | 0.6 % | 9.2 % |

| 10 Year Gsec India | 7.0 | (0.0) % | 0.9 % |

| WTI Crude (USD/bbl) | 81 | (1.4) % | 14.7 % |

| Gold (INR/10g) | 74,070 | 0.2 % | 8.6 % |

| USD/INR | 83.57 | (8.3) % | 0.6 % |

Please visit www.fisdom.com for a standard disclaimer