Technical Overview – Nifty 50

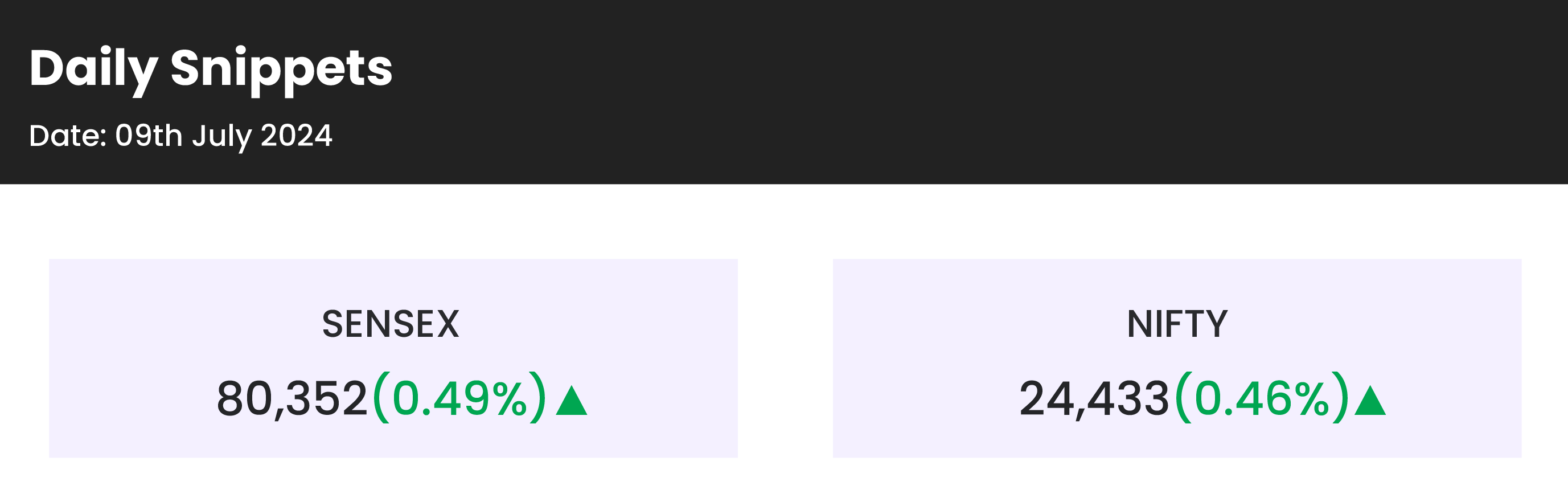

At 24,437, the index reached a fresh all-time high, seemingly unstoppable. The upward trend has not slowed down at all, with bulls dominating bears.

The momentum indicator RSI (14) has given a breakout of the falling wedge in a 75-minute time frame. The MACD is consistently rising and above its polarity, indicating that the upward trend should continue.

Diffusion Indicator: % of stocks above the Simple Moving Average 100 in the benchmark index are 90% which confirms the overall up move.

Based on benchmark index OI data, a base formation may take place at the 24,400 level, where put writing is almost 72 lakhs. At 24,500, call writing is almost 58 lakhs, which might act as a resistance. The PCR value of the benchmark index is 1.17.

The support and resistance levels for the next sessions are at 24,350 and 24,250 and 24,550 and 24,650, respectively.

Technical Overview – Bank Nifty

The banking index appears to be out of step with the benchmark index, with extremely uninteresting swings. During the past few sessions, the banking index has lagged behind the benchmark index.

On a daily timescale, the momentum indicator RSI (14) indicates a hidden positive divergence, indicating that the upward momentum is expected to persist. The index is bullish overall since it is above the major DEMA and finds support at the 10-DEMA. As long as the MACD keeps rising and stays above its polarity, the upward trend should hold.

For the next sessions, the resistance and support levels are 52,750, 53,000 for resistance and 52,250, 52,000 for support.

Indian markets:

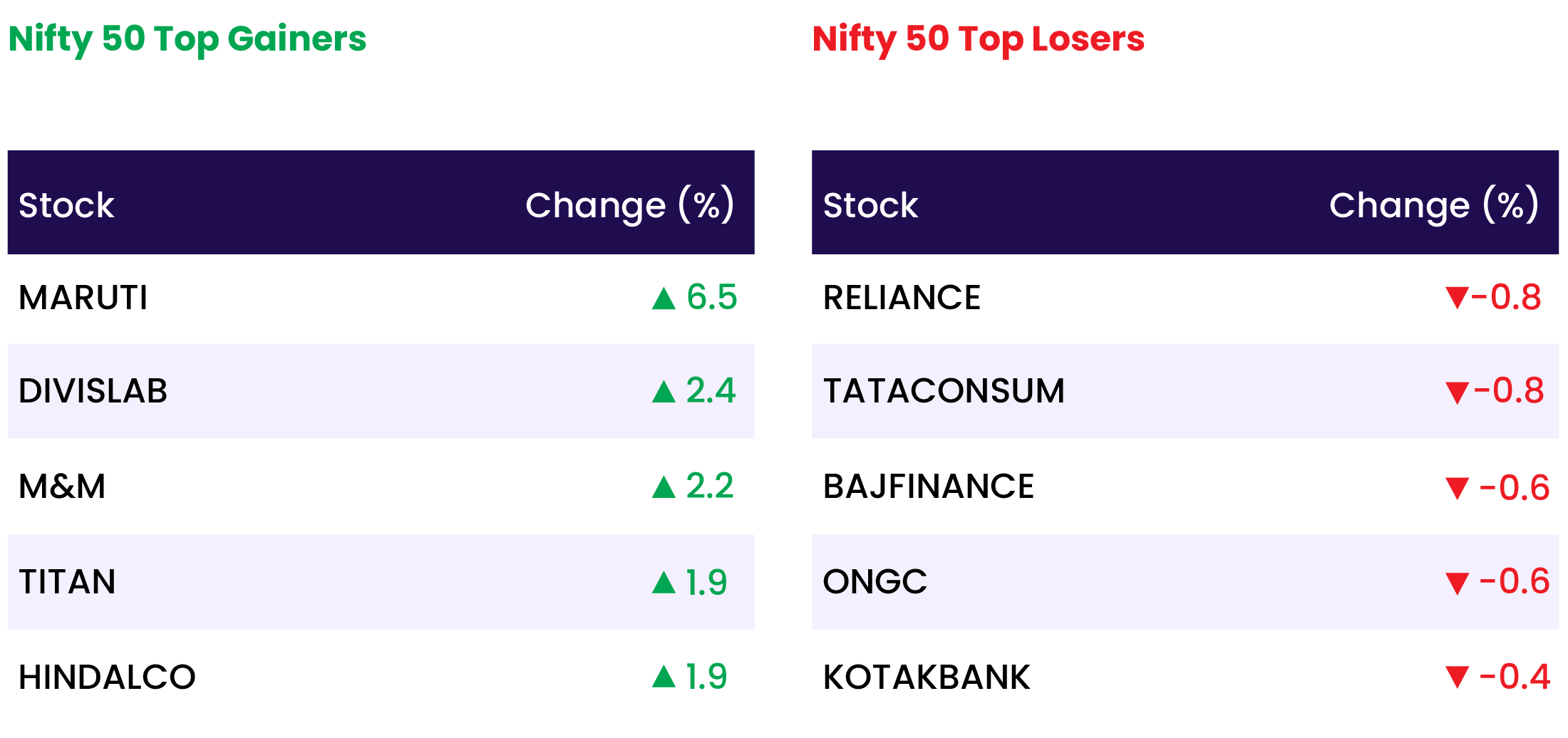

- Nifty and Sensex ended today’s trading session on a strong note as almost all indices edged higher, largely driven by a sharp surge in auto and pharma stocks. However, IT stocks slightly dampened the sentiment ahead of TCS’s Q1 results due on July 11.

- India VIX, the fear gauge, rose 3.3 percent to cross the 14 levels.

- The broader markets, including midcap and smallcap indexes, underperformed the headline indices, rising 0.3 percent and 0.2 percent, respectively. Since the start of July, the midcap index has gained 2 percent, while the smallcap index has risen 3.32 percent, data showed.

- Among individual sectors, auto rallied over 2 percent, emerging as the best performer. Other sectors that significantly contributed to the rally were FMCG, Pharma, Realty, Healthcare, and Public Sector Banks, all rising 1 percent. The IT index fell 0.2 percent, the only laggard among the indices.

Global Markets:

- Asian shares tracked Wall Street higher on Tuesday as markets hoped U.S. Federal Reserve Chair Jerome Powell would adopt a dovish tone regarding easing prospects later in the day, while the dollar steadied near four-week lows.

- The euro reclaimed some lost ground, and French shares were volatile. The risk premium of French bonds over German bonds narrowed as investors digested the shock election results that left France with a hung parliament.

- MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.3%, just below the two-year high hit on Monday. Japan’s Nikkei jumped 1% to a fresh record high.

- S&P 500 futures gained 0.2%, and Nasdaq futures firmed 0.3%, after Wall Street equities inched higher to close at record highs overnight.

- Chinese blue chips edged up 0.1%, while Hong Kong’s Hang Seng index remained flat.

Stocks in Spotlight

- Maruti Suzuki India shares surged nearly 5 percent, becoming the top Nifty gainer after the Uttar Pradesh government announced an immediate and complete waiver of registration tax on strong hybrid electric cars (HEVs) and plug-in hybrid electric vehicles (PHEVs).

- Affle India shares rallied 9.4 percent to reach a new 52-week high of Rs 1,465 in morning trade, continuing gains for the second consecutive session after Citi initiated coverage with a ‘buy’ rating, citing robust growth prospects.

- Jupiter Wagons shares fell nearly 3 percent in early trade after the company announced that its Fund Raising Committee had approved the launch of a qualified institutional placement (QIP), setting the floor price at Rs 689.47 per equity share.

News from the IPO world🌐

- Sebi puts SK Finance’s Rs 2,200-cr IPO in abeyance

- Softbank backed Firstcry, Unicommerce get SEBI approval for IPO

- Insurer Niva Bupa plans $360 million IPO.

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY AUTO | 2.2 |

| NIFTY CONSUMER DURABLES | 1.7 |

| NIFTY PHARMA | 1.6 |

| NIFTY PSU BANK | 1.3 |

| NIFTY REALTY | 1.1 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2013 |

| Decline | 1922 |

| Unchanged | 91 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,345 | (0.1) % | 4.3 % |

| 10 Year Gsec India | 7.0 | (0.0) % | 1.3 % |

| WTI Crude (USD/bbl) | 82 | (1.0) % | 17.0 % |

| Gold (INR/10g) | 72,458 | 0.2 % | 7.5 % |

| USD/INR | 83.47 | (0.0) % | 0.5 % |

Please visit www.fisdom.com for a standard disclaimer