Technical Overview – Nifty 50

One more day, one more All-Time high, bullish trend for the benchmark index appears to be continuing. The index gapped open and closed around the rising channel’s upper band. The index produced a DOJI candlestick during the session and was fairly sideways.

The benchmark index’s upward trend has been confirmed by the momentum indicator RSI (14) which has closed above the 71 level and is still rising. The benchmark index’s momentum appears to be drying up constituent volumes.

Because the MACD is rising and above its polarity on a daily time frame, the upward trend should continue. The increase in breadth for equities in the index above the 100-day moving average (100SMA) was confirmed, going from 78% to 84%.

At the 24,200 level, where put writing is nearly 70 lakhs contract, a base formation may occur based on benchmark index OI data. Resistance may occur at 24,300, the call writing contract’s approximate value of 90 lakhs. 1.08 is the PCR value for the benchmark index.

At 24,150 and 24,000 and 24,400 and 24,500, respectively, are the support and resistance levels for the upcoming sessions.

Technical Overview – Bank Nifty

On July 3, the benchmark index had strong bullish momentum that resulted in a new all-time high of 53,257. Index increased by about 2% in the first hour of trading and then steadied for the rest of the session. On a daily basis, the index created a bullish long-legged candlestick.

In the previous session, the index found outstanding support at 10-DEMA and rose from there. The momentum indicator RSI (14) is showing a concealed positive divergence on a 125-minute period. The daily time-frame index has broken and closed above a horizontal resistance. Given that the MACD is rising and above its polarity on a daily timeframe, the upward trend should continue. The fact that the index is above each major DEMA adds extra support to the general bullishness.

The resistance and support levels for the upcoming sessions are 52,500, 52,700 for resistance and 52,450, 52,000 for support.

Indian markets:

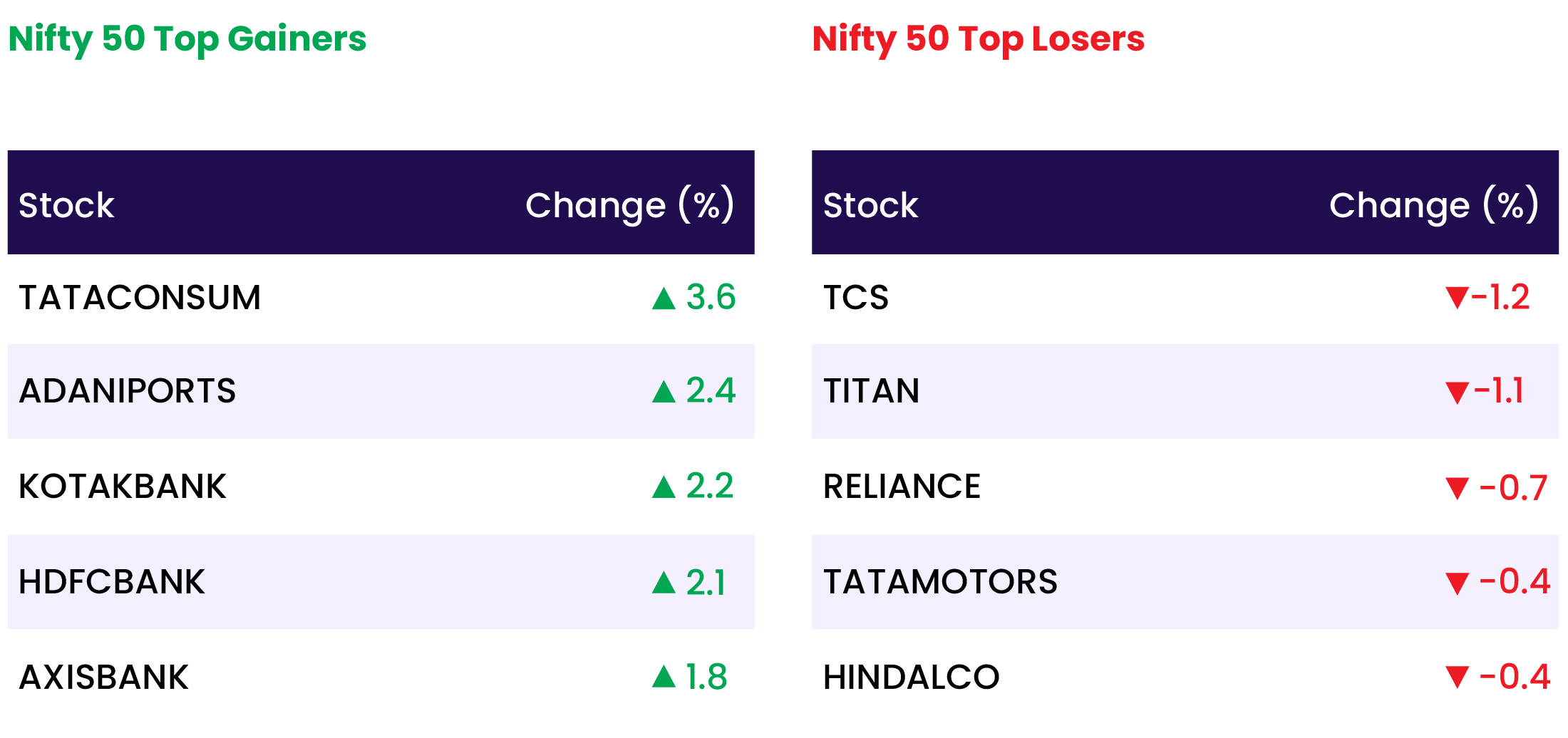

- On July 3, Dalal Street saw a strong performance as major benchmarks reached significant milestones due to widespread buying across sectors, except for media. The BSE Sensex and Nifty50 hit record highs of 80,074.3 and 24,309.15, respectively.

- The Nifty Bank index also reached a new high of 53,256.70 during the day, closing 1.77 percent higher at 53,089.25.

- Sector-wise, all indices except media ended in the green, with power, capital goods, banking, and metals sectors gaining 1-2 percent.

- Additionally, the BSE midcap and smallcap indices each increased by nearly 1 percent.

Global Markets:

- European markets higher as choppy trend continues ahead of elections; Maersk up 3.2%.

- Overnight, Asia-Pacific markets mostly rose following remarks by U.S.

- Federal Reserve Chair Jerome Powell indicating progress in curbing inflation, alongside investor assessment of various regional economic data points.

- Japan’s Nikkei 225 climbed 1.26%, surpassing the 40,000 level, while the Topix edged up 0.08%.

- South Korea’s Kospi increased by 0.26%, and the Kosdaq Index added 0.5%.

Stocks in Spotlight

- MOIL’s stock surged by as much as 6.8 percent after the company reported record quarterly sales and production for the April-June quarter of FY25. The company’s sales grew by 14.5 percent year-on-year, reaching an all-time high in Q1FY25, driven by unprecedented quarterly production levels.

- On July 3, HDFC Bank shares surged 2.2 percent to reach an all-time high of Rs 1,791 per share following the release of June shareholding data. With foreign investors’ stakes falling below 55 percent in the June quarter, analysts predict a potential doubling of the bank’s weighting in the MSCI Standard index during the next reshuffle.

- V-Mart Retail shares rose 5.2 percent to hit a 52-week high of Rs 3,035, driven by the company’s strong quarterly updates, which highlighted healthy revenue and same-store sales growth (SSSG). In Q1FY25, the retailer’s revenue increased by 16 percent year-on-year to Rs 790 crore, supported by an 11 percent rise in SSSG and the addition of new stores.

News from the IPO world🌐

- Emcure Pharmaceuticals IPO fully subscribed on Day 1

- Softbank backed Firstcry, Unicommerce get SEBI approval for IPO

- Insurer Niva Bupa plans $360 million IPO.

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PRIVATE BANK | 2.0 |

| NIFTY FINANCIAL SERVICES | 1.8 |

| NIFTY BANK | 1.8 |

| NIFTY METAL | 1.1 |

| NIFTY PSU BANK | 1.1 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2355 |

| Decline | 1566 |

| Unchanged | 100 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,332 | 0.4 % | 4.3 % |

| 10 Year Gsec India | 7.0 | (0.1) % | 1.2 % |

| WTI Crude (USD/bbl) | 83 | (0.7) % | 17.7 % |

| Gold (INR/10g) | 71,932 | 0.8 % | 7.4 % |

| USD/INR | 83.43 | 0.1 % | 0.5 % |