Technical Overview – Nifty 50

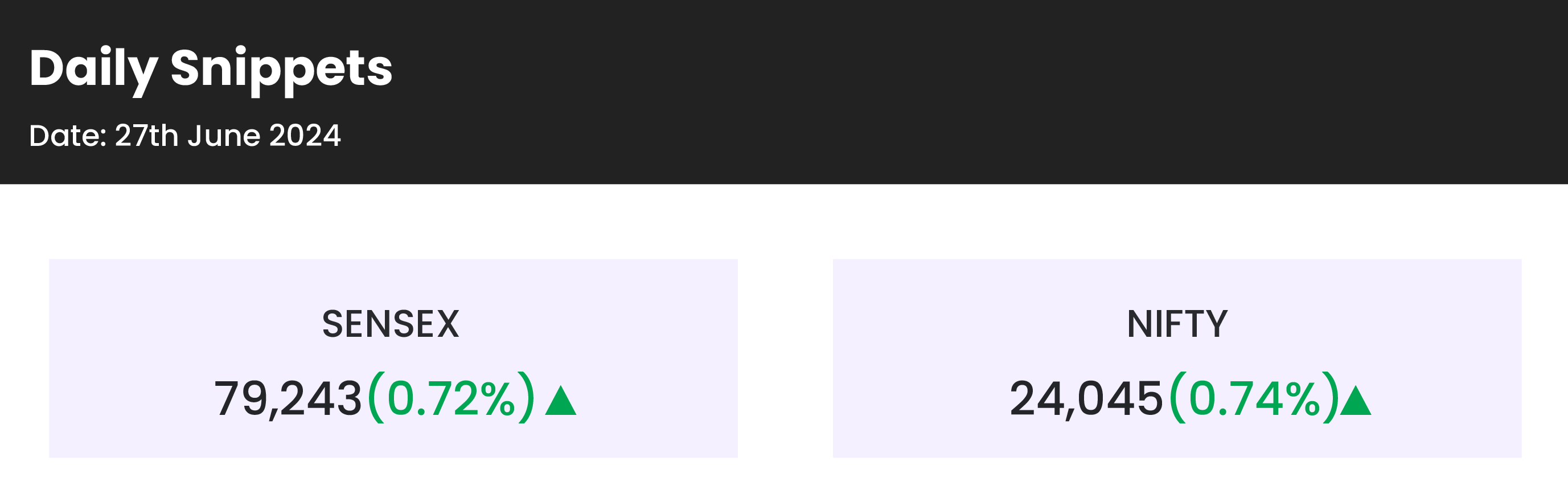

On June 27, 2024, NIFTY crossed over 24,000 levels for the first time ever. The benchmark index continues to rise this week and appears to be unstoppable. The index has created a powerful bullish candle for the day once more. The view of bulls is still dominant, and follow-through buying is still planned.

After exhibiting a horizontal resistance breach, the RSI (14) momentum indicator closed at the 69 level. It is expected that the bullish trend will continue because the MACD is rising and above its polarity. The index’s position above each major DEMA lends more credence to the overall bullishness.

The levels of support and resistance for the next sessions are 24,200 and 24,400, and 23,800 and 23,650, respectively.

Technical Overview – Bank Nifty

On a daily basis, the banking index has created a DOJI candlestick pattern. In the banking index, there is no discernible momentum shift. For the day, the Baking Index performed worse than the Benchmark Index. The index was able to come close to opening levels of yesterday and reversed from that level.

The RSI (14) momentum indicator closed at the 71 level mark, flattening due to a lag in momentum. It is expected that the bullish trend will continue because the MACD is rising and above its polarity. The index may experience some mean reversion swings because it is above each major DEMA, but still overall bullish view is intact.

The resistance and support levels for the upcoming sessions are 53,250–53,500 for resistance and 52,600–52,350 for support.

Indian markets:

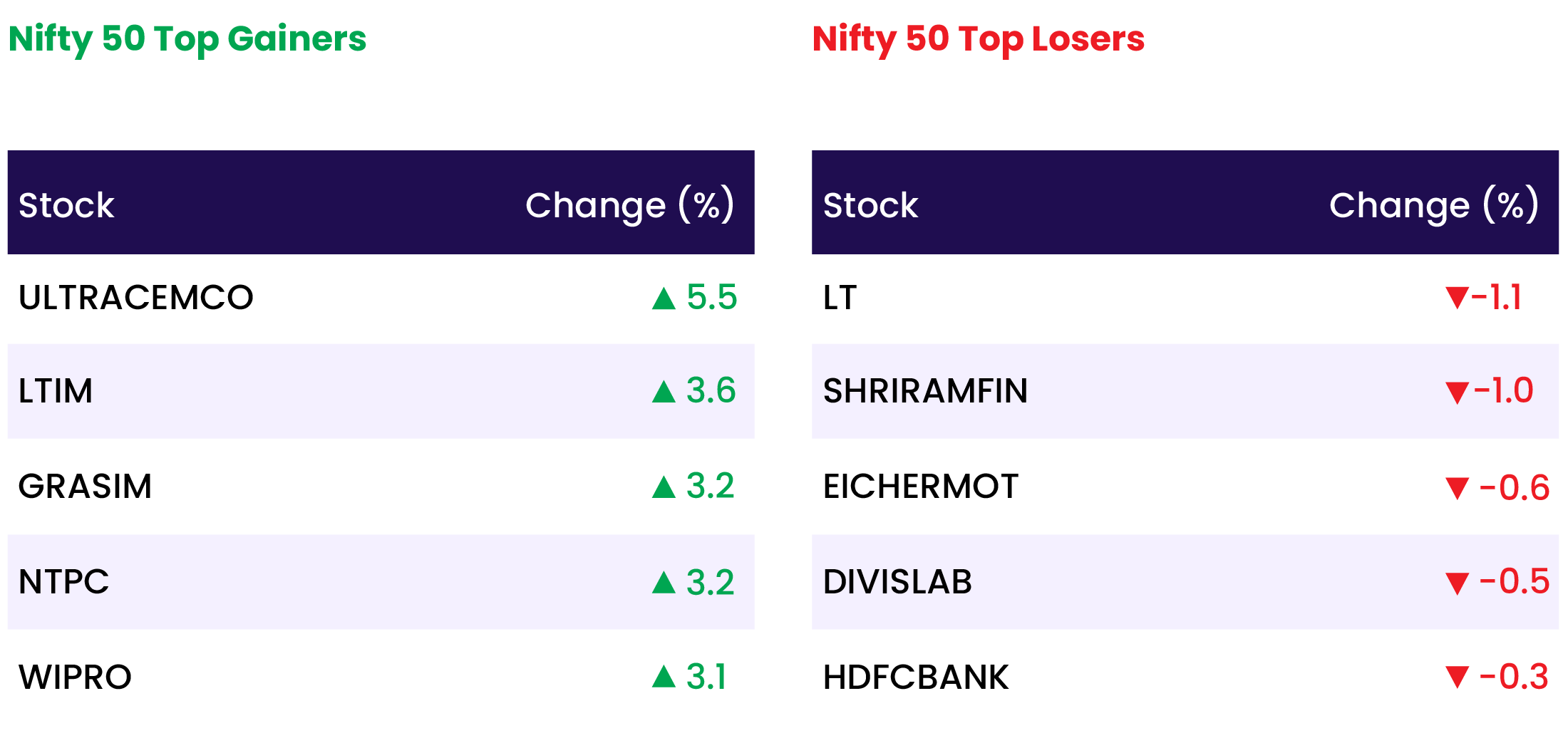

- Indian benchmark indices rallied for the third consecutive session on June 27, with the Nifty crossing 24,000 for the first time ever, driven by gains in Information Technology and energy stocks.

- The Nifty Bank index also reached a new record high of 53,180.75.

- Despite a weak start, the market quickly recovered and extended gains throughout the day, achieving new milestones.

- Among sectors, the IT and Power indices each rose by 1.7%, while the PSU Bank index declined by 1%.

- The BSE midcap index ended the day flat, while the smallcap index dropped by 0.5%.

Global Markets:

- Asia-Pacific markets fell on Thursday as the Japanese yen weakened to a near 38-year low, reaching 160.82 against the U.S. dollar late Wednesday, according to FactSet data.

- Japan’s retail sales growth for May was 3% year-on-year, surpassing the market forecast of 2%, as per a Reuters poll of economists. This follows a revised 2% growth in April.

- Japan’s Nikkei 225 declined by 0.82%, while the broad-based Topix lost 0.33%.

- In other markets, the Hong Kong Hang Seng index led regional losses, dropping over 2% to a near two-month low in its final hour of trade.

- Mainland China’s CSI 300 closed 0.75% lower, reaching a new four-month low.

- South Korea’s Kospi fell 0.29%, while the small-cap Kosdaq declined by 0.41%.

- Australia’s S&P/ASX 200 pared earlier losses but still ended 0.3% lower.

Stocks in Spotlight

- Route Mobile shares surged over 15%, reaching a 52-week high of Rs 1,894.4, following the announcement of a five-year partnership with Microsoft and Proximus Group for digital communications and cloud services.

- Dr. Reddy’s Laboratories shares increased nearly 3% after the company announced an agreement to acquire UK-based Haleon Plc’s global portfolio of consumer healthcare brands in the Nicotine Replacement Therapy (NRT) category outside the US.

- PI Industries shares climbed nearly 5% after the company offered to acquire Plant Health Care Plc for approximately Rs 346 crore.

News from the IPO world🌐

- Emcure Pharmaceuticals Limited Opens on 3rd July 2024.

- Vraj Iron and Steel IPO picks up pace on Day 2.

- Insurer Niva Bupa plans $360 million IPO.

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY IT | 2.0 |

| NIFTY OIL & GAS | 0.9 |

| NIFTY AUTO | 0.7 |

| NIFTY METAL | 0.6 |

| NIFTY HEALTHCARE INDEX | 0.4 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1510 |

| Decline | 2388 |

| Unchanged | 110 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,128 | 0.0 % | 3.7 % |

| 10 Year Gsec India | 7.0 | 0.1 % | 1.0 % |

| WTI Crude (USD/bbl) | 81 | 0.1 % | 14.9 % |

| Gold (INR/10g) | 70,995 | 0.1 % | 6.2 % |

| USD/INR | 83.44 | (0.1) % | 0.5 % |

Please visit www.fisdom.com for a standard disclaimer