Technical Overview – Nifty 50

Another high volatility day for the benchmark index, with a new record high of 23,664. On a daily basis, the index formed a Bearish Engulfing candlestick pattern. The index is finding support at a rising trend line on the 75-minute time frame. The index had strong volatility in the closing few minutes of the session.

Momentum indicator RSI (14) is above 67, suggesting an overall positive outlook. The index is trading above the 10, 20, 50, and 100 DEMA levels, confirming the general trend. MACD is trading above its polarity, with the MACD line moving further higher.

The support levels for the upcoming sessions are 23,400 and 23,200, with resistance around 23,700 and 23,850.

Technical Overview – Bank Nifty

On the daily timeframe, the index broke the rising wedge formation to the upside and set a new all-time high. On the daily timeframe, an extremely bullish session banking index was established, with a large tall bullish candle. The banking index outpaced the benchmark index throughout the day.

Index made a big doji candle formation in a 75-minute time frame. In the last moments of the day, the index saw some significant volatility.

Momentum indicator RSI (14) has risen over 65, supporting the general optimistic perspective. The index is trading above the 10, 20, 50, and 100 DEMA levels, confirming the general trend. MACD is trading above its polarity, with the MACD line moving further higher.

The support levels for the upcoming sessions are 51,000 and 50,600, with resistance around 52,000 and 52,500.

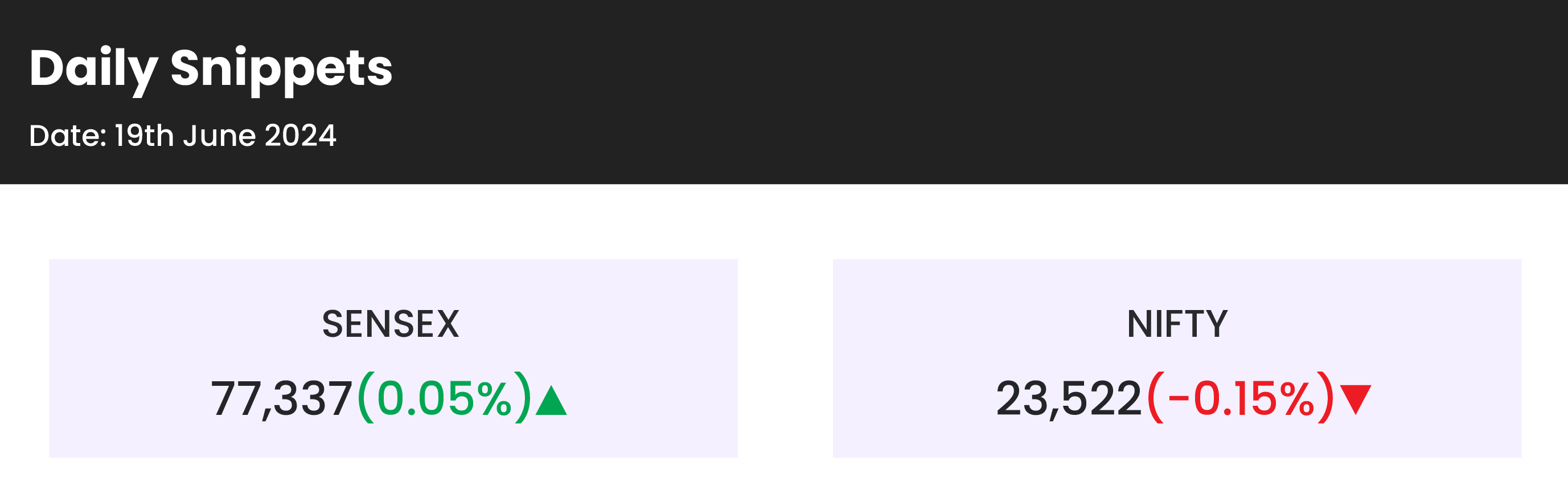

Indian markets:

- Indian benchmark indices ended on a mixed note in the highly volatile session on June 19, after hitting fresh all-time highs intraday.

- Buoyed by positive global cues, the benchmark indices opened at new record highs. However, they erased all gains in the initial hours, fluctuating between gains and losses throughout the session, and finished with marginal changes.

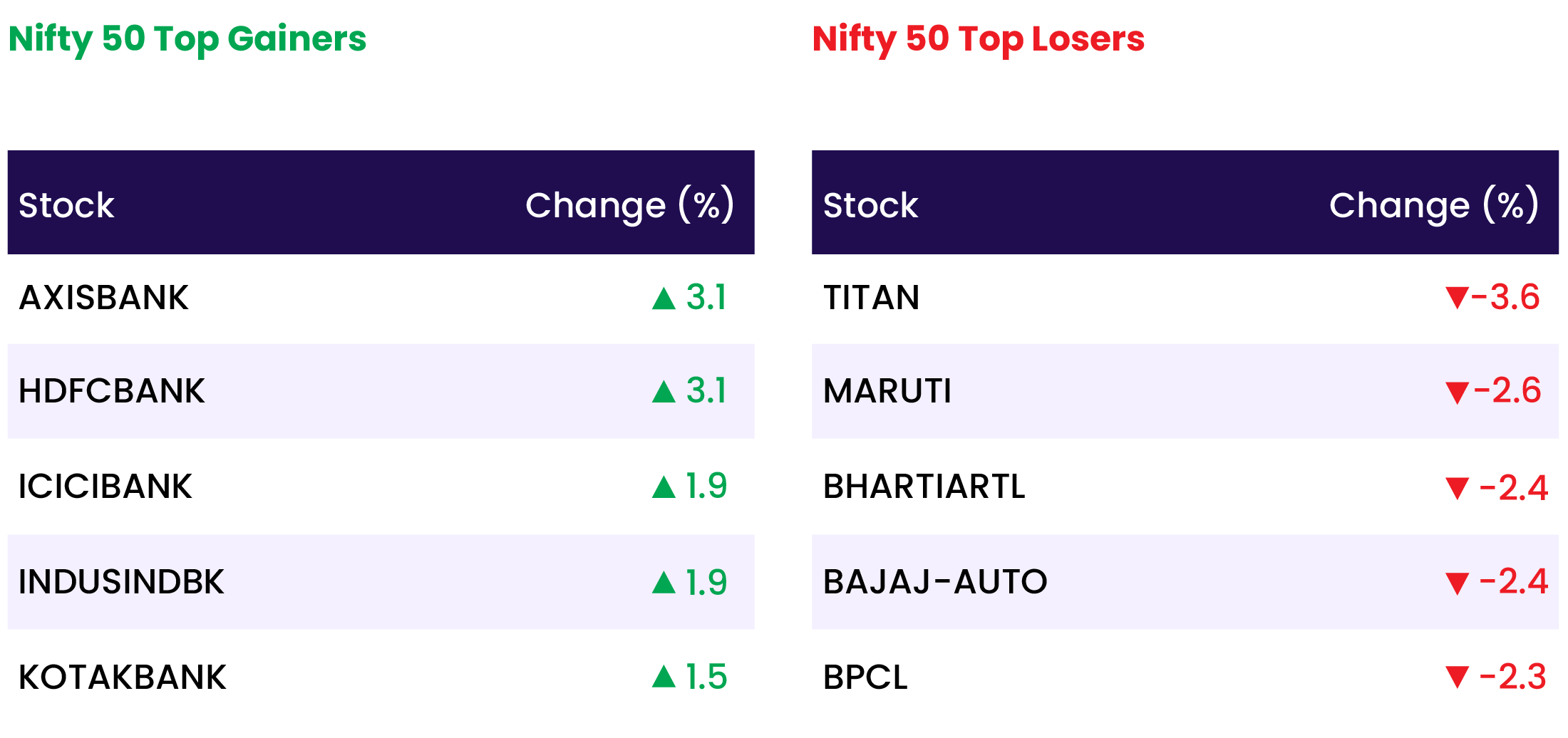

- Among sectors, only banking (up 2 percent) and IT (up 0.4 percent) showed gains, while all other indices ended in the red. The auto, capital goods, metal, oil & gas, power, and realty sectors were down by 1-3 percent.

- The BSE Midcap index fell by 1 percent, and the Smallcap index shed 0.6 percent.

Global Markets:

- Hong Kong markets jumped nearly 3% to lead gains in Asia on Wednesday, driven by energy and basic material stocks. In contrast,

- Mainland China’s CSI 300 dipped 0.47%. Japan’s Nikkei 225 climbed 0.23%, while the broad-based Topix ended 0.47% higher.

- South Korea’s Kospi gained over 1.23%, bolstered by a 1.75% rise in heavyweight Samsung Electronics. Australia’s S&P/ASX 200 lost 0.11%.

- Overnight in the U.S., the broad market S&P 500 advanced 0.25%, while the Nasdaq Composite climbed 0.03%, also closing at a fresh high. The Dow Jones Industrial Average added 0.15%.

Stocks in Spotlight

- Zomato: Shares of Zomato gained 5 percent as the company’s intention to acquire Paytm’s ticketing business received strong endorsements from brokerages. Target prices for Zomato are now as high as Rs 280, implying a 48 percent potential upside from the June 18 closing price.

- Indus Towers: Shares slumped 2.8 percent after Vodafone Group offloaded an 18 percent stake in the company for Rs 15,300 crore through block deals. The company plans to use the proceeds to repay its existing lenders. Meanwhile, Vodafone’s ownership in Indus Towers reduced to 3.1 percent post the stake sale.

- Sona BLW Precision: Sona BLW shares jumped over 3 percent after the firm received certification for its traction motor for electric three-wheelers from the Ministry of Heavy Industries under a Production-Linked Incentive (PLI) scheme.

- Defence stocks: Shares of Bharat Dynamics (BDL), Hindustan Aeronautics (HAL), and Bharat Electronics (BEL) experienced declines of up to 5 percent as investors engaged in profit booking after a relentless rally in recent trading sessions.

News from the IPO world🌐

- Stanley Lifestyles IPO opens on June 21

- DEE Development Engineers IPO sails through on Day 1 on robust retail, NII demand

- Akme Fintrade IPO Day 1: Issue fully subscribed on strong retail, NII demand

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PRIVATE BANK | 2.0 |

| NIFTY BANK | 1.9 |

| NIFTY FINANCIAL SERVICES | 1.6 |

| NIFTY IT | 0.4 |

| NIFTY PSU BANK | 0.1 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1634 |

| Decline | 2235 |

| Unchanged | 105 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,835 | 0.2 % | 3.0 % |

| 10 Year Gsec India | 7.0 | (0.1) % | (0.4) % |

| WTI Crude (USD/bbl) | 78 | (0.2) % | 11.5 % |

| Gold (INR/10g) | 71,508 | 0.1 % | 4.7 % |

| USD/INR | 83.52 | (0.0) % | 0.6 % |

Please visit www.fisdom.com for a standard disclaimer