Technical Overview – Nifty 50

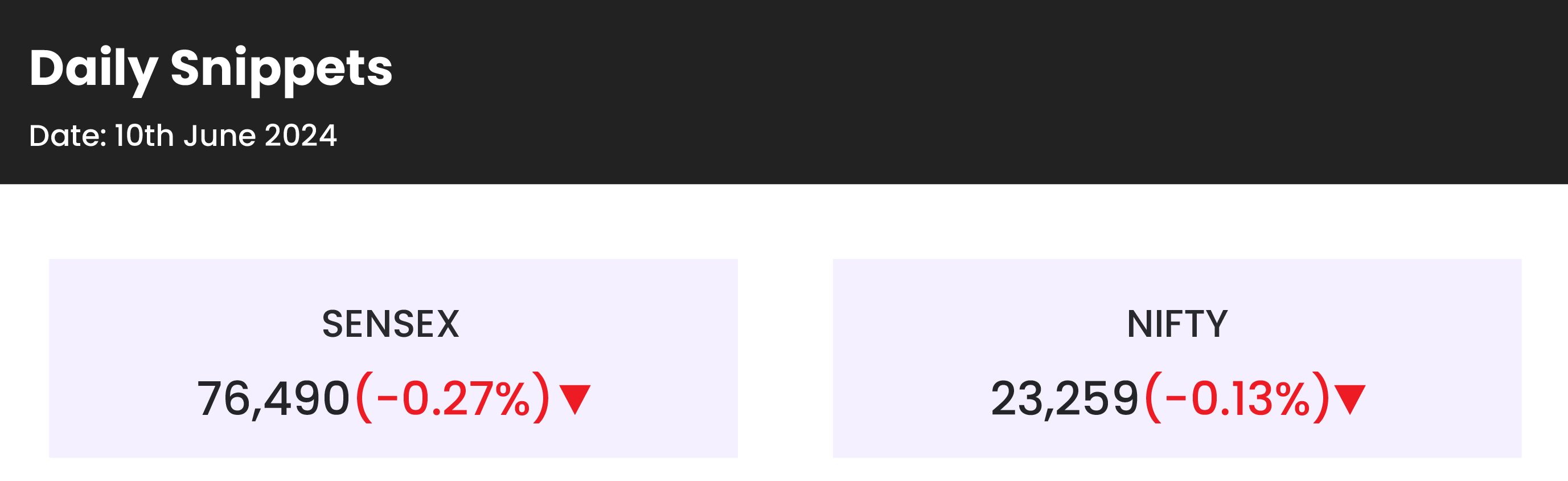

The benchmark index reached a new all-time high of 23,412. Following an extremely turbulent week, the index appears to be off to a sluggish start. For most of the session, the index held steady between 23,320 and 23,275, showing some action in the last 75 minutes of the session where the index dipped almost 130 points.

Benchmark Index is trading above key DEMAs; we may expect a mean reversion to 10 and 20 DEMAs. The momentum indicator RSI (14) is above 55, suggesting that positive momentum will continue. However, bearish divergence on the daily timeframe, which indicates a little downturn, should be viewed with caution.

Support levels for the following sessions are 23,150, 23,000, with resistance around 23,450, and 23,600.

Technical Overview – Bank Nifty

The banking index’s highs were unable to be sustained; the index peaked at 50,253 but then dropped down to roughly 49,900 levels.

The index is trading at the top bound of a rising wedge pattern and has developed an Inverted Hammer candle pattern on the daily timeframe. The index consolidated for the majority of the session, then dropped 400 points in the final 75 minutes. On the daily timeframe, the index is trading above the key DEMA, and the momentum indicator RSI (14) has support at the 41-44 level.

Support levels for the upcoming sessions are 49,600 and 49,300, with resistance around 50,250 and 50,500.

Indian markets:

- Indian markets fell on June 10 after three days of gains as investors awaited details on PM Narendra Modi’s new ministerial panel.

- Investors are also anticipating the US inflation data release and the Federal Reserve’s policy meeting on June 12.

- The FOMC will update its economic projections and dot plot, indicating potential interest rate cuts.

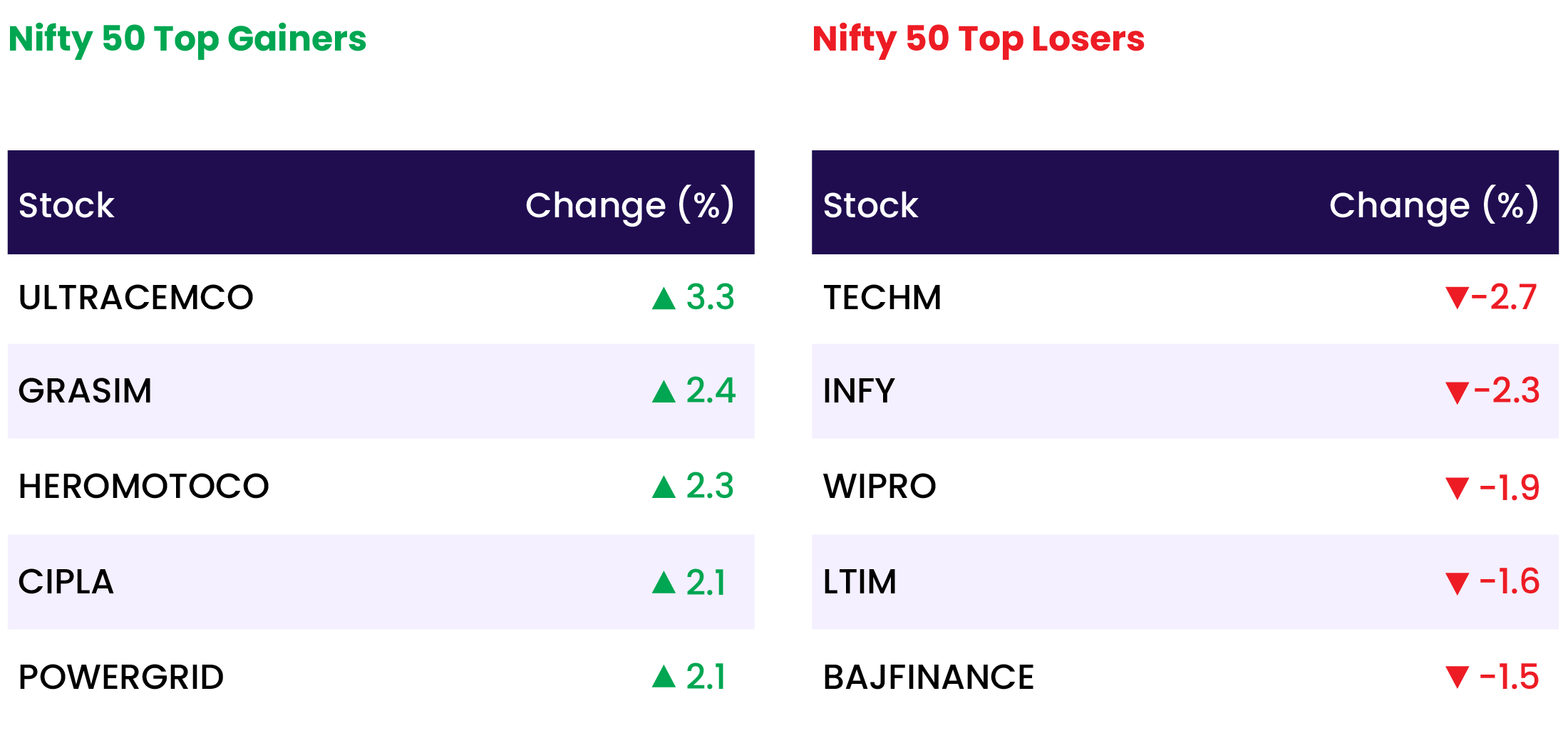

- Nifty Metal was the top sectoral gainer, rising 1.9%.

- Nifty Realty and Pharma indices gained 1.3% and 1%, respectively.

- Nifty Consumer Durables and Healthcare rose by 0.7% each.

- Nifty IT Index was the biggest loser, falling by 1.8%.

Global Markets:

- World stocks mostly declined on Monday after a stronger-than-expected US jobs report was released on Friday.

- The euro fell after French President Emmanuel Macron dissolved the National Assembly due to a setback in Sunday’s parliamentary elections.

- Far-right parties gained significantly in the elections, prompting Macron to call a snap election, which led to the euro dropping to its lowest price in nearly a month at $1.0766.

- The CAC 40 in Paris fell 1.7% to 7,866.87, Germany’s DAX declined 0.7% to 18,425.26, and Britain’s FTSE 100 decreased 0.4% to 8,215.84 in early trading.

Stocks in Spotlight

- Raymond surged 3.5 percent to a record high after its real estate division was declared the preferred developer for a redevelopment project in Bandra, Mumbai. The project is estimated to have a revenue potential exceeding Rs 2,000 crore.

- One 97 Communications, the parent company of Paytm, extended their gains by over 4 percent on June 10, rallying 14 percent over the last two sessions. This surge followed a revision in the circuit filter from 5 percent to 10 percent by the NSE. Nuvama Institutional Equities noted that Paytm is among the stocks potentially entering the futures and options segment, pending SEBI’s proposed revision in eligibility criteria for stock derivatives, which is currently under stakeholder consultation.

- Rail Vikas Nigam Limited (RVNL) traded slightly lower on June 10 after the company emerged as the lowest bidder for a Southern Railway project. On June 7, RVNL secured a ₹495 crore order from National Thermal Power Corporation (NTPC), and on June 6, it won orders worth ₹515 crore from Dakshin Haryana Bijli Vitran Nigam Limited and Eastern Railway for constructing the Sitarampur bypass line under the Asansol division.

News from the IPO world🌐

- Ixigo IPO retail portion subscribed over 5x on day 1

- Leela seeks $2.5 bn valuation IPO likely in 9 months

- Kedaara-backed Ajax Engineering is said to plan India IPO

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY MEDIA | 1.9 |

| NIFTY REALTY | 1.3 |

| NIFTY PHARMA | 1.0 |

| NIFTY PSU BANK | 0.7 |

| NIFTY CONSUMER DURABLES | 0.7 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2631 |

| Decline | 1360 |

| Unchanged | 138 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,799 | (0.2) % | 2.9 % |

| 10 Year Gsec India | 7.0 | 0.2 % | (0.1) % |

| WTI Crude (USD/bbl) | 76 | 0.6 % | 5.8 % |

| Gold (INR/10g) | 71,305 | (2.3) % | 4.7 % |

| USD/INR | 83.52 | 0.0 % | 0.5 % |

Please visit www.fisdom.com for a standard disclaimer