Technical Overview – Nifty 50

A remarkable day for the benchmark index, with an 808-point gap-up opening in today’s session. The benchmark index has risen significantly, reaching a fresh all-time high of 23,239 points. The index has broken the upward channel and remained over 23,200. The index has created a lengthy lower shadow candle at ATH. Momentum indicator RSI (14) flipped from 50 to 67 levels.

On-balance volume, a volume indicator, has found support around its 50-month moving average. INDIA VIX fell nearly 15%, suggesting a decline in premiums and a decline in fear.

The index has risen with a large gap and the index may suffer strong volatility swings as a result of the election results; 23,050 and 22,825 are support levels to watch out for, while 23,350 and 23,500 might act as resistance.

Technical Overview – Bank Nifty

The BANK NIFTY index finished at 50,980 points, up 1996 points, or 4.07% on the day.

It was quite a remarkable day for the banking index, which reached 51,000 levels. The index climbed nearly 2000 points in a single trading session. The index has broken the upside wedge formation and formed a large, towering pin-bar candlestick. A strong day for the index, outperforming the benchmark index.

Momentum Indicator RSI (14) has breached a consolidation zone and is presently nearing 67 levels on a weekly basis.

The index may suffer strong volatility swings as a result of the election results; support levels to watch for include 50,050 and 49,500. Resistance levels can be seen at 51,500 and 52,000.

Indian markets:

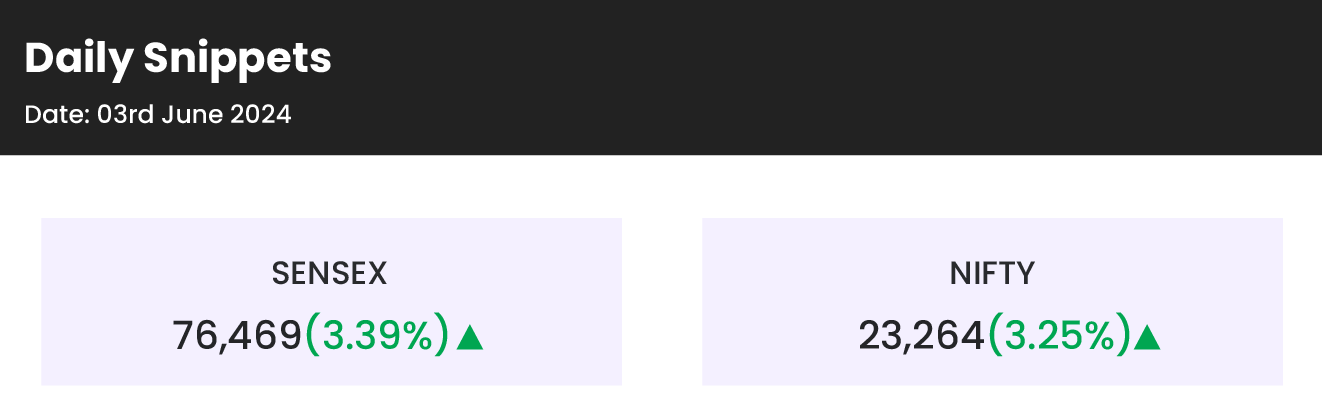

- Indian equity markets surged more than 3 percent on June 3 as Dalal Street celebrated exit polls predicting a significant win for the BJP-led NDA for the third consecutive term.

- Contributing to the rally were better-than-expected GDP data, the early onset of the monsoon, higher GST collections, and positive global markets.

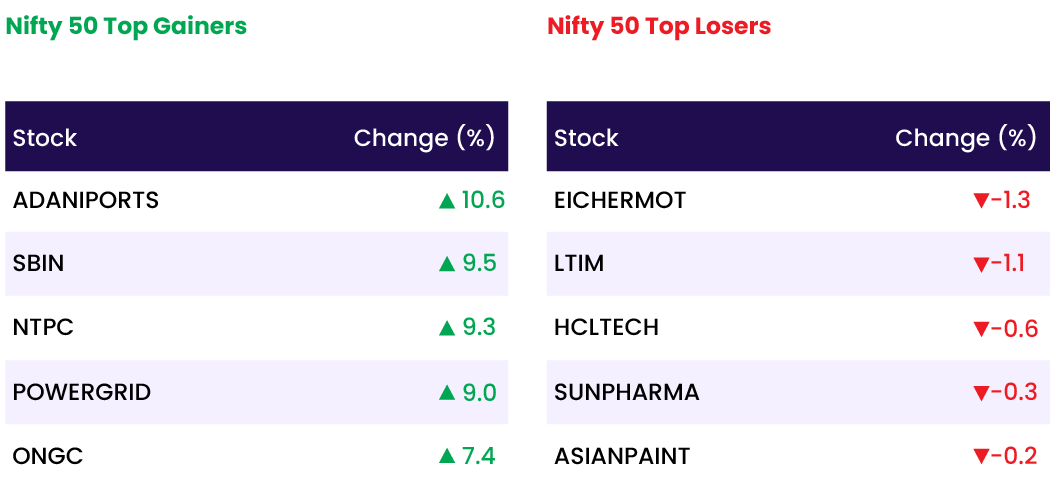

- All sectoral indices ended in the green, with capital goods, PSU Bank, oil & gas, power, and realty sectors up 5-8 percent.

- The BSE midcap index rose 3.5 percent, while the smallcap index added 2 percent.

Global Markets:

- India’s stock markets hit record highs on Monday, leading gains in Asian markets, following a private survey indicating that China’s manufacturing activity expanded at its fastest pace in nearly two years.

- India’s Nifty 50 index and the S&P BSE Sensex each rose by 3%, buoyed by exit polls over the weekend projecting that Prime Minister Narendra Modi and his Bharatiya Janata Party-led alliance are set for a rare third consecutive term in power.

- Meanwhile, Hong Kong’s Hang Seng index gained 1.77%, and mainland China’s CSI 300 closed 0.25% higher. Japan’s Nikkei 225 increased by 1.13%, while the broader Topix index rose 0.9%.

- In Australia, the S&P/ASX 200 added 0.77%.

- South Korea’s Kospi climbed 1.74%, with the smaller-cap Kosdaq rising 0.56%.

Stocks in Spotlight

- Suzlon shares jumped 5 percent after international brokerage Morgan Stanley assigned an ‘overweight’ rating to Suzlon Energy, with a target price of Rs 58.5 per share. This indicates a 22 percent upside, as Suzlon is well positioned to benefit from the shift towards greener, cleaner energy.

- Shares of PNC Infratech climbed over 5 percent after the company informed exchanges that its subsidiary, PNC Kanpur Highways Ltd, received a payment of Rs 390.62 crore from the National Highways Authority of India (NHAI) as part of a settlement agreement.

- IRB Infrastructure shares surged over 10 percent following reports that the government is likely to increase road toll charges by 3 to 5 percent, after putting the annual increase on hold in April due to the general elections, according to CNBC TV-18.

News from the IPO world🌐

- Hero FinCorp approves Rs 4,000 crore fundraise via IPO

- Kronox Lab Sciences IPO booked 11x on strong demand from retail, NII investors

- Canara Bank starts IPO process to take Canara HSBC Life public

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PSU BANK | 8.4 |

| NIFTY OIL & GAS | 6.8 |

| NIFTY REALTY | 6.0 |

| NIFTY BANK | 4.1 |

| NIFTY FINANCIAL SERVICES | 4.0 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2346 |

| Decline | 1615 |

| Unchanged | 154 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,686 | 1.5 % | 2.6 % |

| 10 Year Gsec India | 7.0 | (0.6) % | (1.5) % |

| WTI Crude (USD/bbl) | 77 | (2.8) % | 9.4 % |

| Gold (INR/10g) | 71,570 | (0.2) % | 7.0 % |

| USD/INR | 83.33 | 0.0 % | 0.4 % |

Please visit www.fisdom.com for a standard disclaimer