Technical Overview – Nifty 50

The benchmark index experienced a highly turbulent day, with highs that could not be sustained and a dip on the rise. The index formed a big spinning top candle on a daily time frame. Election results date nearing the market are experiencing tremendous volatility. The index closed flat, with resistance near 10 DEMA. The index is trading below the 10 and 20 DEMAs but above the 50 DEMAs.

On the monthly timeframe, the benchmark index formed a large DOJI pattern, while on the weekly timeframe, it formed a Dark Cloud Cover candle pattern. On the weekly timeframe, the index found support at the 10 EMA. Momentum indicator RSI (14) attempted to breach the channel upper band, but the breakout failed; nonetheless, RSI is currently trading above 55 levels.

Immediate support levels in the index may be seen around 22,350 and 22,200, while 22,650 and 22,800 levels should be actively monitored as resistance levels.

Technical Overview – Bank Nifty

The Banking index has developed a bullish candle on a daily basis, and as election results approach, the market has become more volatile. Though the index outperformed the benchmark index, it is consolidating between 48,300 and 49,100 levels on a 75-minute period.

On a weekly timeframe, the index has formed a long-legged DOJI pattern at the ATH levels. The index was unable to cross its previous ATH levels and is now forming a double-top structure; this structure will be verified if the index closes below the 20 EMA on a weekly basis. The momentum indicator RSI (14) is stabilizing at 53-63 levels.

Immediate support levels in the index may be seen around 48,700, 48,500, and 49,000, 49,300, which will be actively monitored for possible resistance levels.

Indian markets:

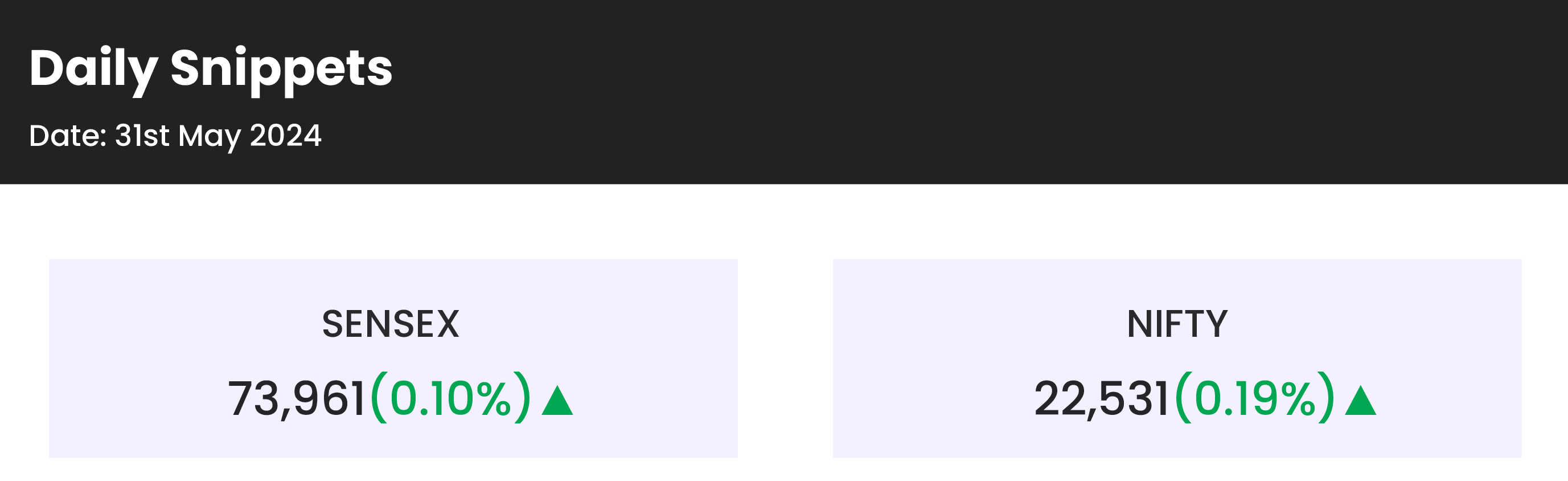

- The Indian stock market benchmarks, the Sensex and the Nifty 50, posted mild gains on Friday, May 31, breaking a five-session losing streak.

- This recovery was driven by key heavyweights such as HDFC Bank, ICICI Bank, L&T, and Reliance. Attention now shifts to the final phase of the General Election 2024 on Saturday, June 1, and the subsequent exit poll results.

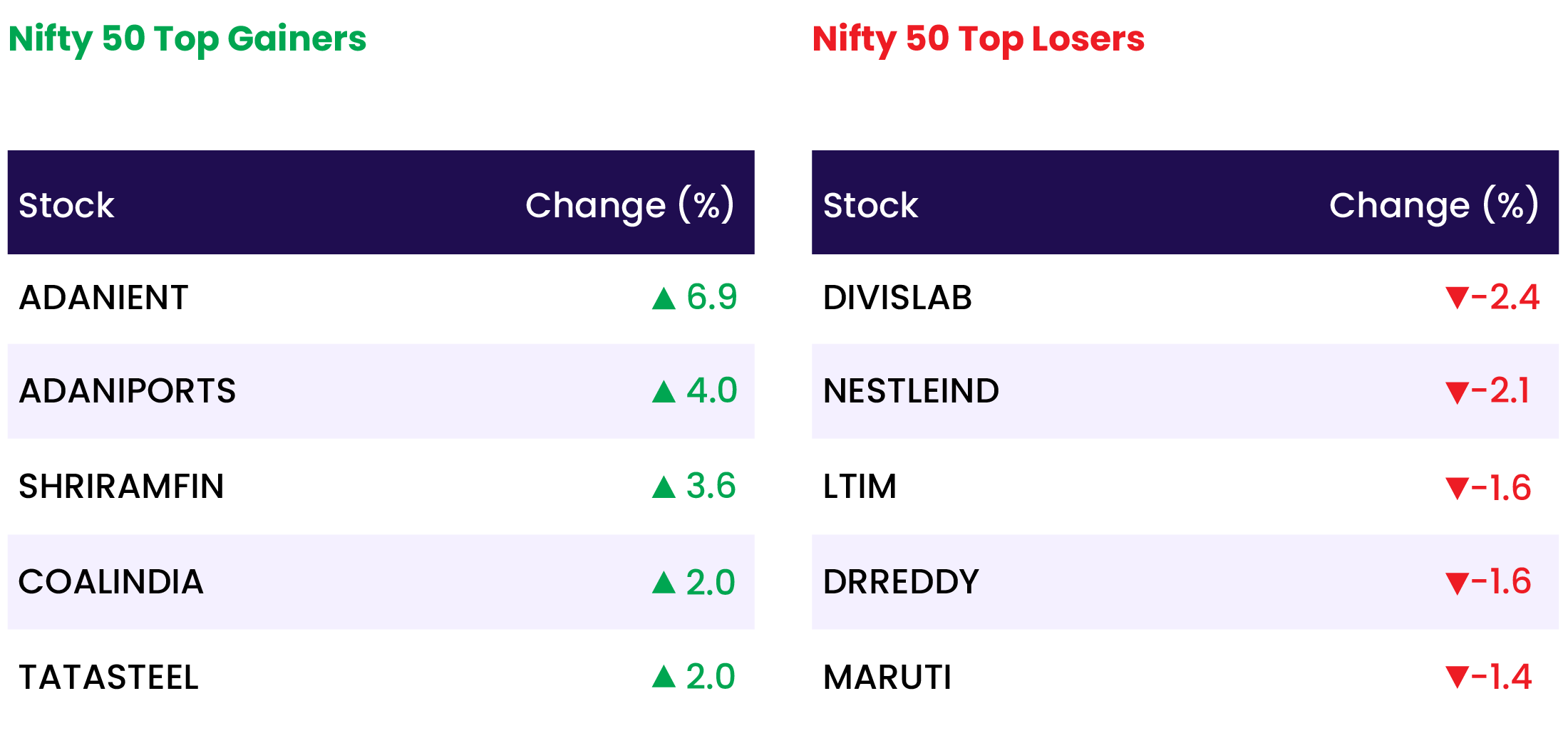

- Sector-wise, metals, power, telecom, and realty indices rose by 1-2 percent, while media, FMCG, healthcare, and IT indices declined by 0.3-1 percent.

- The BSE midcap index closed flat, whereas the smallcap index saw a gain of 0.8 percent.

Global Markets:

- Asia-Pacific markets mostly rose on Friday as investors analyzed data from major regional economies.

- Japan’s industrial output unexpectedly fell by 0.1% in April from the previous month, contrary to a Reuters poll forecast of a 0.9% increase.

- Despite this, Japan’s Nikkei 225 climbed 1.14% to close at 38,487.9, and the broader Topix index rose 1.7% to finish at 2,772.49.

- South Korea’s Kospi remained flat, ending at 2,636.52, while the smaller-cap Kosdaq declined by 0.96% to close at 839.98.

- In Australia, the S&P/ASX 200 index increased by 0.96%, closing at 7,701.7

Stocks in Spotlight

- Zomato: Shares fell over 5 percent intraday after foreign brokerage Macquarie forecasted a nearly 50 percent decline in its share price over the next 12 months due to increased competition in the quick commerce sector. Macquarie reiterated its “underperform” rating on Zomato, setting a price target of Rs 96, indicating a potential downside of 46 percent from Thursday’s close.

- One97 Communications: Shares dropped around 4 percent due to profit booking after hitting a 5 percent upper circuit for the third consecutive day earlier in the session. Additionally, a block deal involving 75.20 lakh shares, representing a 1.2 percent stake in the company, occurred on the exchanges. The block deal, executed at an average price of Rs 391 per share, was valued at Rs 296.30 crore.

- Welspun Corp: The stock plummeted 9 percent after the company’s FY25 guidance fell short of market expectations. Welspun Corp projected a revenue of Rs 17,000 crore for the current financial year, a 3.3 percent decline from the Rs 17,582 crore earned in FY24.

News from the IPO world🌐

- Hero FinCorp approves Rs 4,000 crore fundraise via IPO

- Ztech India IPO opens on May 29

- Canara Bank starts IPO process to take Canara HSBC Life public

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY REALTY | 2.3 |

| NIFTY METAL | 1.9 |

| NIFTY PSU BANK | 1.3 |

| NIFTY OIL & GAS | 0.7 |

| NIFTY CONSUMER DURABLES | 0.6 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1732 |

| Decline | 2099 |

| Unchanged | 84 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,111 | (0.9) % | 1.1 % |

| 10 Year Gsec India | 7.0 | (0.3) % | (0.9) % |

| WTI Crude (USD/bbl) | 78 | (1.7) % | 10.7 % |

| Gold (INR/10g) | 72,125 | 0.4 % | 7.2 % |

| USD/INR | 83.33 | 0.2 % | 0.3 % |

Please visit www.fisdom.com for a standard disclaimer