Technical Overview – Nifty 50

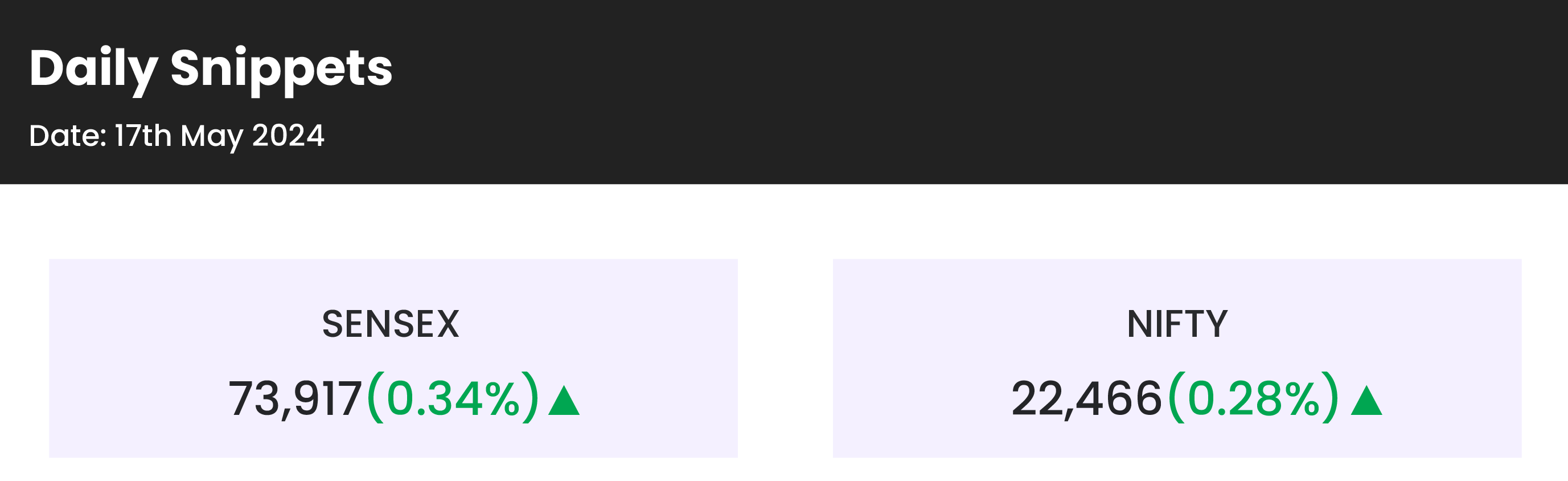

At 22,466, the benchmark NIFTY index climbed 62 points, or 0.28%. The benchmark index increased by almost 600 points or 3% during the course of this week. The benchmark index has reached 22,500 thanks to bullish momentum.

14-period momentum indicator Now that the RSI has crossed 50, there is evidence of further positive momentum. The 10, 20, and 50 DEMAs are currently being traded above the index. The lower band reversal of the channel and the 100-DEMA look to be favoring bulls. India’s VIX dropped by over 1.00%; the index’s upward momentum has diminished, and it closed at 19.80, below 20.

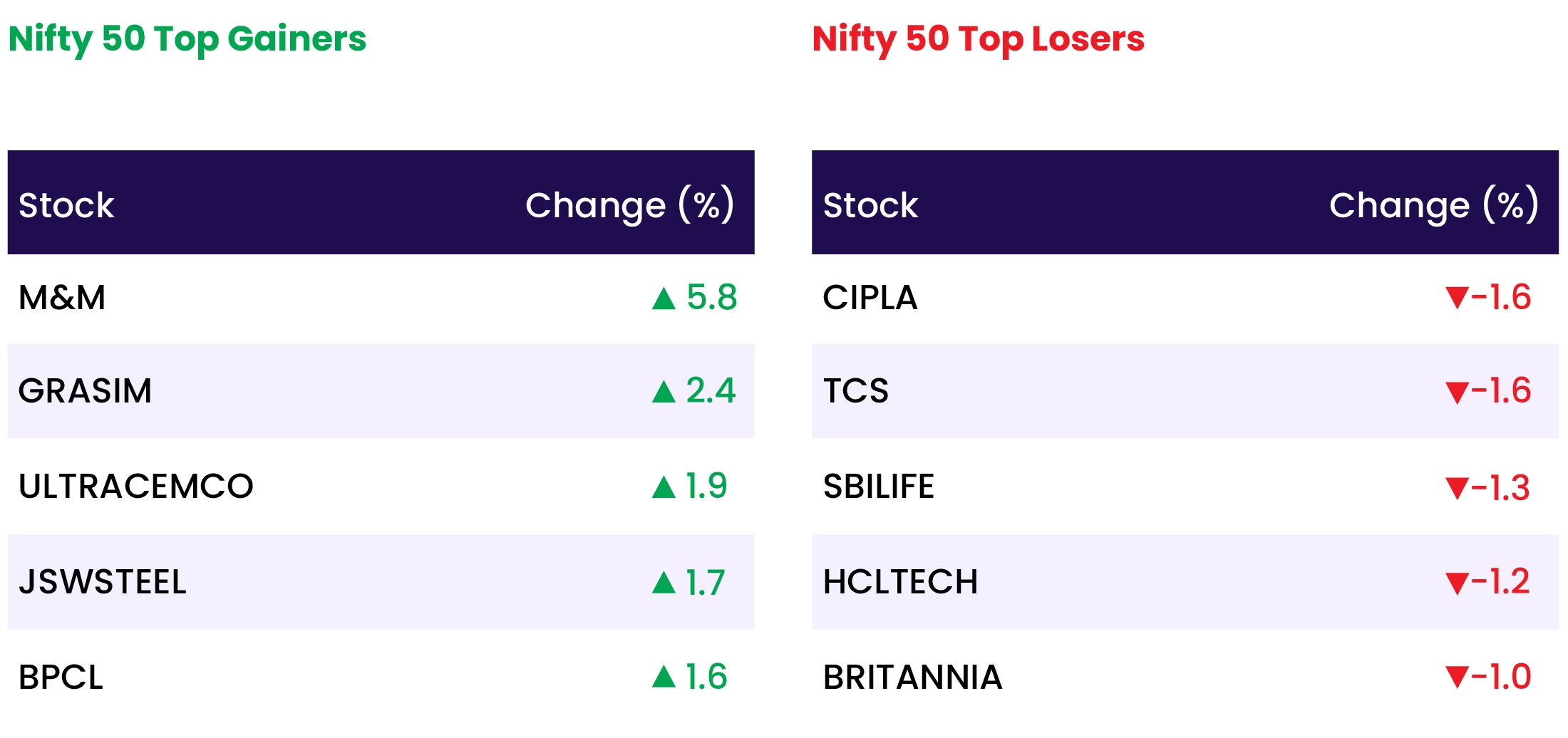

The SMALLCAP 100 index and the MIDCAP 100 index, which moved by 1.60% and 1%, respectively, have a very strong momentum. The top movers of the day were JSW Steel, Kotak Mahindra Bank, and Mahindra & Mahindra.

The benchmark index has support levels in the 22,340 and 22,050 zones. The resistance levels used in the upcoming sessions will be 22,590 and 22,650.

Technical Overview – Bank Nifty

To settle at 46,116, the BANK NIFTY index moved 138 points, or 0.29%. Positive momentum may persist during the next week.

After the previous day’s hammer formation, the index continued to move sideways in the second part of the session, indicating follow-up purchasing. The index has closed above both the 10 and 20 DEMAs. The 14-period RSI momentum indicator is currently above 51 levels and is trending positively.

The majority of the index’s components closed flat. The best-performing banks of the day were Kotak Mahindra Bank and Bandhan Bank, which both saw increases of about 1.50% and 0.90% respectively, while Bank of Baroda saw a decrease of about 1%.

In the next few sessions, the index will test resistance at 48,200 and 48,600. 47,300 and 46,950 are the index’s immediate support levels.

Indian markets:

- Indian markets rose for the second consecutive session, with Nifty closing above 22,450.

- Broader markets also gained, with BSE MidCap hitting a new record high and BSE SmallCap just 100 points away from its all-time peak.

- Sectoral indices saw Nifty Consumer Durables leading with a 2.8 percent increase.

- Nifty Realty, Metal, and Auto each rose by 1.7 percent.

- The Nifty IT index was the top loser, dropping 0.9 percent.

- Globally, markets ended marginally lower as investors monitored comments from Federal Reserve officials.

- Three Fed officials, including Cleveland Fed President Loretta Mester, New York Fed President John Williams, and Richmond Fed President Thomas Barkin, suggested keeping borrowing costs high until there’s more evidence of easing inflation.

- Fed officials signaled no rush to cut interest rates, arguing for patience in reaching the 2 percent inflation target

Global Markets:

- European markets were lower on Friday after snapping a nine-day winning streak in the previous session, with earnings weighing on positive sentiment.

- U.S. stock futures remained little changed overnight after the Dow Jones Industrial Average briefly touched the key 40,000 milestone for the first time.

- Asia-Pacific markets largely fell on Friday as investors assessed key China data to gauge the state of the world’s second-largest economy.

Stocks in Spotlight

- M&M’s share price surged nearly 6 percent following strong Q4 results that prompted brokerages to raise target prices and maintain an upbeat outlook. The bullish sentiment is driven by a promising growth outlook in the auto segment and a potential recovery in the farm equipment business for FY25.

- Info Edge, the parent company of Naukri, saw its shares rise by 6 percent on May 17 after reporting a net profit of Rs 162 crore for the quarter ended March, a significant turnaround from the Rs 447 crore loss in the same period last year.

- Crompton Greaves’ shares surged 15 percent after the FMEG company reported a 56 percent sequential increase in consolidated net profit. The revenue for the quarter was Rs 1,961 crore, marking a 9 percent year-on-year increase from Rs 1,791 crore in the same period last year.

News from the IPO world🌐

- Go Digit retail portion subscribed 1.4 times

- Awfis Space Solutions Limited IPO to open on May 22

- Aadhar Housing Finance makes a flat debut

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY CONSUMER DURABLES | 2.8 |

| NIFTY AUTO | 1.7 |

| NIFTY REALTY | 1.7 |

| NIFTY METAL | 1.6 |

| NIFTY MEDIA | 1.0 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2325 |

| Decline | 1479 |

| Unchanged | 115 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,869 | (0.1) % | 5.7 % |

| 10 Year Gsec India | 7.1 | 0.2 % | (0.2) % |

| WTI Crude (USD/bbl) | 79 | 0.7 % | 11.6 % |

| Gold (INR/10g) | 72,890 | (0.2) % | 7.4 % |

| USD/INR | 83.47 | 0.1 % | 0.7 % |

Please visit www.fisdom.com for a standard disclaimer