Technical Overview – Nifty 50

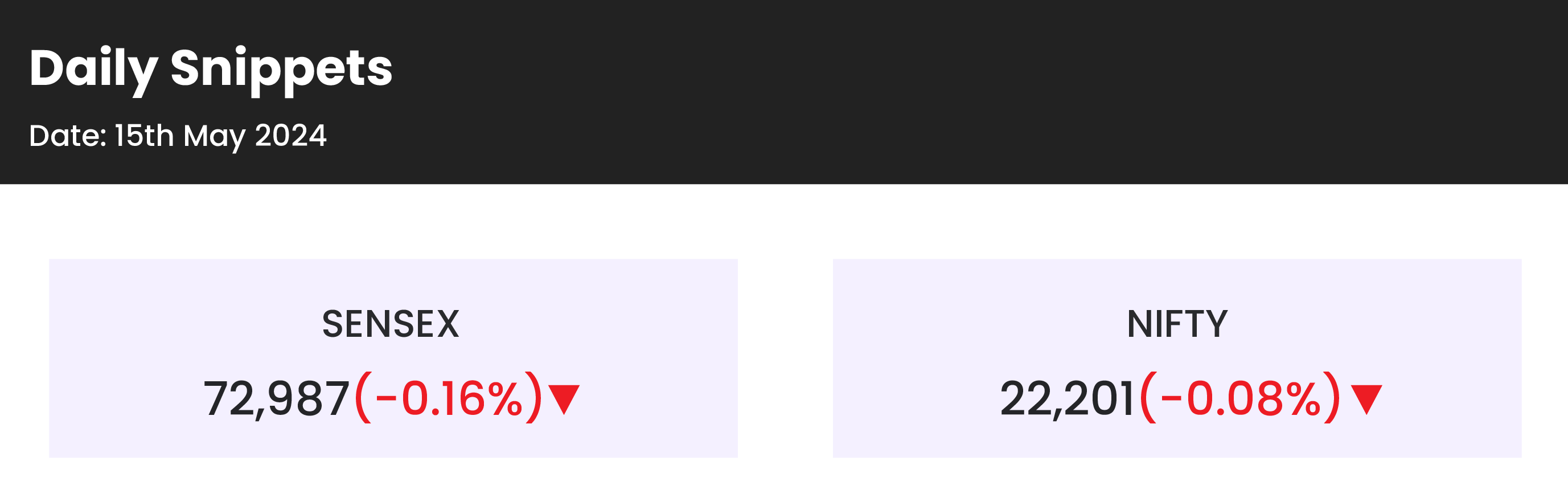

Benchmark index NIFTY closed at 22,201, down by 17 points/ -0.08%. The benchmark index closed flat and no momentum is seen upon follow-up buying. The index hovered around 22,150 – 22,230 levels for most of the session.

The index reversed from 20-DEMA and closed near to last session’s close. A DOJI candle formed in today’s session, with no momentum on the upside after a 2% rise in the index from Monday’s session low. ADX below 20, is at the 18.80 level indicating no move on either side of the index.

India Vix closed at 20.27 near to yesterday’s close no further decline in VIX as of today’s session. Put-Call Ratio declines from 0.90 to 0.74 in today’s session. A heavy call writing is there at 22,300, 22,500 levels.

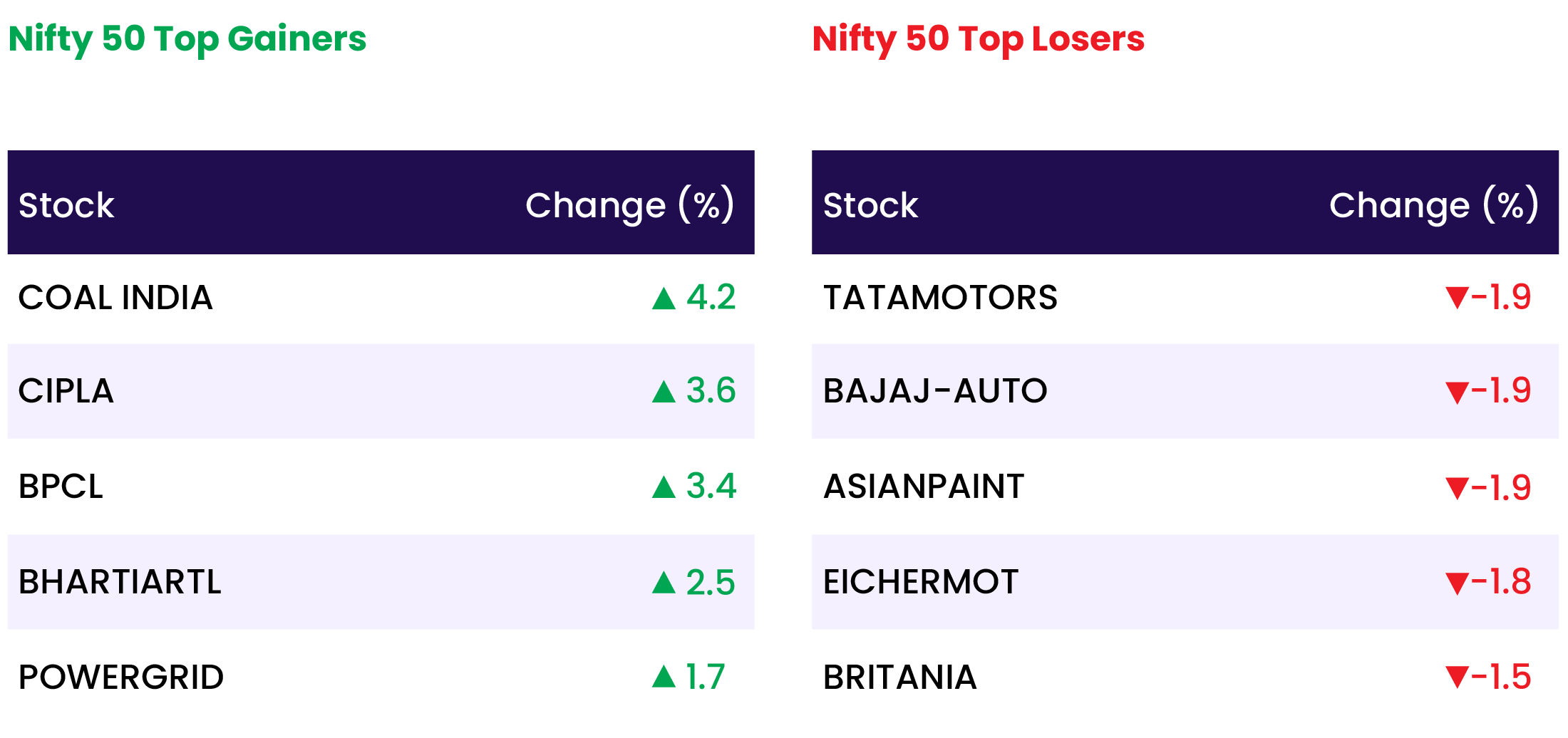

Nifty Energy and Nifty Realty were the top mover index and were up by almost 1%. The Nifty Financial Services index remained flat and closed at 21,260. NIFTY MIDCAP 100 index moved by 483 points / 1.00% while NIFTY SMALLCAP 100 index moved by 94 points / 0.38%.

The benchmark index has support levels of 22,080 and 21,900 zones. Resistance levels for upcoming sessions are 22,350 and 22,450.

Technical Overview – Bank Nifty

BANK NIFTY index closed flat at 47,687, down by 172 points/ 0.36%. The index closed flat while underperforming benchmark index for the day.

Index managed to sustain and close near 50-DEMA, still trading below 10 & 20 DEMA. Momentum indicator 14-period RSI is now at 46 not a big change for the day. 14 period ADX is at 20, below 20 refers to sideways or non-momentum moves in the index.

Bank of Baroda and Bandhan Bank were top movers of the day while AU Bank dipped by almost 2% and HDFC was down by more than 1%

Index resistance levels are 48,200, and 48,600 for upcoming trading sessions. Immediate support levels for the index are 46,950 and 46,550.

Indian markets:

- The Sensex and Nifty 50, key indicators of the domestic stock market, concluded with slight declines on Wednesday, May 15, halting their three-day winning streak. This dip was primarily driven by losses in certain heavyweight stocks such as HDFC Bank, Tata Motors, and Reliance Industries.

- Despite mixed signals from global markets, domestic market sentiment remained subdued, partly due to a notable outflow of foreign capital leading up to the outcome of the 2024 Lok Sabha elections.

- On the other hand, the BSE MidCap and Smallcap indices saw gains of 0.6 percent and 1 percent, respectively, indicating positive momentum in broader market segments.

- Sector-wise, there was a mixed performance observed, with the energy and realty sectors experiencing gains while FMCG and auto sectors closed in negative territory. Nonetheless, the broader indices managed to secure modest gains, ranging from 0.5% to 1%.

Global Markets:

- Asia-Pacific markets were mixed Wednesday, tracking Wall Street gains overnight that saw the Nasdaq Composite index hit a fresh record closing high despite strong inflation data.

- The producer price index reading for April came in at 0.5%, above the 0.3% that economist polled by Dow Jones had expected.

- Markets in South Korea and Hong Kong were shut on Wednesday for a public holiday

- Investors also assessed Australia’s annual budget released late on Tuesday.

- The People’s Bank of China kept its one-year medium term lending facility rate unchanged at 2.5%. Mainland China’s CSI 300 index fell 0.85%.

- In Australia, the S&P/ASX 200 index closed 0.35% higher.

- Japan’s Nikkei 225 gained 0.08% to end at 38,385.73, while the broader Topix ended.

Stocks in Spotlight

- Cipla witnessed a notable surge of 3.5% in its shares following three block deals on the exchanges. Approximately 2.04 crore shares, representing a 2.52% stake in the pharmaceutical company, were traded in these transactions. Cipla subsequently confirmed that the Hamied family, its promoters, had divested a 2.5% stake in the company.

- Life Insurance Corporation of India (LIC) experienced a significant rise of 6% in its share price after receiving a three-year extension from the Securities and Exchange Board of India (SEBI) to achieve a 10% public shareholding. On May 15, the largest life insurer in the country announced that it had until May 16, 2027, to meet this requirement, nearly two years after its initial public offering.

- Siemens shares surged by 6.4% on May 15, reaching a 52-week high of Rs 7,240 per share on the National Stock Exchange (NSE). The company’s strong performance in the March quarter, surpassing street estimates, was attributed to robust margin performance and increased other income, resulting in a significant profit beat. Analysts believe Siemens is well-positioned to capitalize on substantial railway and metro infrastructure investments, particularly due to its potential for large system orders.

News from the IPO world🌐

- Go Digit IPO: Fidelity, Goldman Sachs, ADIA and others invest Rs 1,176 crore in anchor round

- Awfis Space Solutions Limited IPO to open on May 22

- Indegene makes stellar start, lists at 45% premium on market debut

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PSU BANK | 1.4 |

| NIFTY REALTY | 1.0 |

| NIFTY OIL & GAS | 0.6 |

| NIFTY CONSUMER DURABLES | 0.5 |

| NIFTY METAL | 0.3 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2161 |

| Decline | 1641 |

| Unchanged | 133 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,558 | 0.3 % | 4.9 % |

| 10 Year Gsec India | 7.1 | (0.4) % | (0.3) % |

| WTI Crude (USD/bbl) | 78 | (1.4) % | 10.9 % |

| Gold (INR/10g) | 72,475 | 0.4 % | 7.7 % |

| USD/INR | 83.51 | (0.1) % | 0.6 % |