Company Background

Established in 2016, Go Digit General Insurance Limited operates as a digital full-stack insurance provider, presenting a suite of insurance solutions including motor, health, travel, property, marine, liability insurance, and more, all of which customers can tailor to their preferences.

By December 31, 2023, the company had expanded its distribution network to cover 24 out of India’s 36 states and union territories, cultivating partnerships with approximately 61,972 Key Distribution Partners. These partners comprise around 58,532 Point of Sale Persons (POSPs), individual agents, corporate agents, brokers, and other affiliates.

Company Key Highlights

Go digit General Insurance stands as a forefront digital full-stack non-life insurance provider, harnessing technology to drive innovation across product design, distribution, and customer engagement for non-life insurance offerings. The company provides a range of insurance products including motor, health, travel, property, marine, and liability insurance, among others, allowing customers to tailor their coverage to suit their specific requirements.

- High-quality customer experience:

The company is committed to fostering trust and transparency in customer interactions by streamlining insurance processes and providing clear, customizable products that elevate the customer journey. With a steadfast dedication to enhancing customer experiences, the company has achieved remarkable satisfaction rates, boasting net promoter scores of 75.4% for non-claims and 96.8% for motor claims as of December 31, 2022. Additionally, users of the “Digit Insurance” mobile app, available on both Android and iOS platforms, have consistently expressed high satisfaction levels.

- Advanced technology platform:

Their technology stands out as a pivotal factor in distinguishing themselves within the insurance industry, facilitating swift underwriting processes. By combining AI-driven analytics with human evaluation, they optimize the entire value chain, delivering advantages to customers, partners, and employees alike, all while enhancing efficiency. In-house microsystems revolving around their technological backbone streamline routine tasks such as policy design, underwriting, pricing, issuance, servicing, and claims management. Operating entirely in the cloud, the platform ensures agility, connectivity, and scalability for seamless operations.

- Predictive Underwriting Models:

Drawing on their proficiency in the motor insurance sector, they’ve harnessed their extensive data repository to develop intricate underwriting models. These models facilitate precise risk evaluation and loss forecasting at a detailed level for their motor insurance offerings. Such a method bolsters cost control, empowering them to refine product customization and broaden their clientele. The resultant data fuels a pricing feedback loop, aiding in ongoing product enhancements and cost efficiencies.

Key Business Strengths

- The Company offers a simple and tailored customer experience.

- It also has a strong focus on empowering their distribution partners.

- It has developed predictive underwriting models.

- It has built a technology – enabled platform.

- Experienced management team.

Key Risks to Business

- Go Digit General Insurance faces profitability hurdles due to past losses, uncertain future prospects, and challenges in assessing business performance.

- The company experiences volatile operating results marked by fluctuating profit/loss figures and low operating profit ratios, signalling operational instability and potential financial strain.

- A Majority revenue comes motor insurance.

- It operates in a highly competitive industry.

Fisdom Research Assessment:

Despite the company’s robust technological infrastructure and market position indicating potential future profitability, its shift from motor insurance to health insurance poses a significant risk if profitable underwriting isn’t achieved in the latter segment. Heavy investment in health insurance without corresponding returns could lead to adverse outcomes, necessitating vigilance from investors on the business front. Even on the valuation front, the IPO appears overvalued.

Considering these factors and the company’s competitive stance within the digital full-stack General Insurance sector, we maintain a “NEUTRAL” rating for this IPO.

Offer Details

| Offer period | |

| Bid/Offer Opens On: | Wednesday, May 15, 2024 |

| Bid/Offer Closes On: | Friday, May 17, 2024 |

| Issue Size | Price Band | Bid Lot |

| ~ Rs.2,480 – Rs.2,615 Cr | Rs. 258 – Rs.272 | 55 |

| Particulars | Lots | Shares | Amount |

| Retail | |||

| Minimum | 1 | 55 | RS. 14,960 |

| Maximum | 13 | 715 | Rs. 1,94,480 |

| S-HNI | |||

| Minimum | 14 | 770 | Rs. 2,09,440 |

| Maximum | 66 | 3,630 | Rs. 9,87,360 |

| B-HNI | |||

| Minimum | 67 | 3,685 | Rs. 10,02,320 |

Issue Structure

| QIB Shares Offered | Not more than 75% of the offer size |

| Retails Shares Offered | Not more than 10% of the offer size |

| NII (HNI) Shares Offered | Not more than 15% of the Net Issue |

Indicative IPO Timeline

| Bid/Offer Opening Date | Wednesday, May 15, 2024 |

| Bid/Offer Closing Date | Friday, May 17, 2024 |

| Finalization of the basis of allotment with The designated stock exchange | Tuesday, May 21, 2024 |

| Initiation of refunds | Wednesday, May 22, 2024 |

| Credit of equity shares to depository Accounts | Wednesday, May 22, 2024 |

| Listing Date | Thursday, May 23, 2024 |

Other Details

| Book Running Lead Managers | ICICI Securities Limited, Axis Capital Ltd, Morgan Stanley India Company Private Ltd HDFC Bank Ltd, IIFL Securities Ltd, Nuvama Wealth Management Ltd |

| Objects of the Issue | 1) To undertake its existing business activities 2) To undertake the activities proposed to be funded from the Net Proceeds. Further, the Company expects to receive the benefits of listing the Equity Shares on the Stock Exchanges, which, the company believes, will enhance the visibility and its brand image among its existing and potential customers. |

| Listing At | BSE, NSE |

Financial Elements

| Particulars | Dec-23 | Mar-23 | Mar-22 | Mar-21 |

| Total Asset (Cr.) | ₹ 3,620 | ₹ 3,347 | ₹ 2,919 | ₹ 1,875 |

| Revenue (Cr.) | ₹ 131 | ₹ 39 | -₹ 294 | -₹ 119 |

| PAT (Cr.) | ₹ 129 | ₹ 36 | -₹ 296 | -₹ 123 |

| Basic EPS | ₹ 1.48 | ₹ 0.41 | -₹ 3.55 | -₹ 1.50 |

| Diluted EPS | ₹ 1.46 | ₹ 0.40 | -₹ 3.55 | -₹ 1.50 |

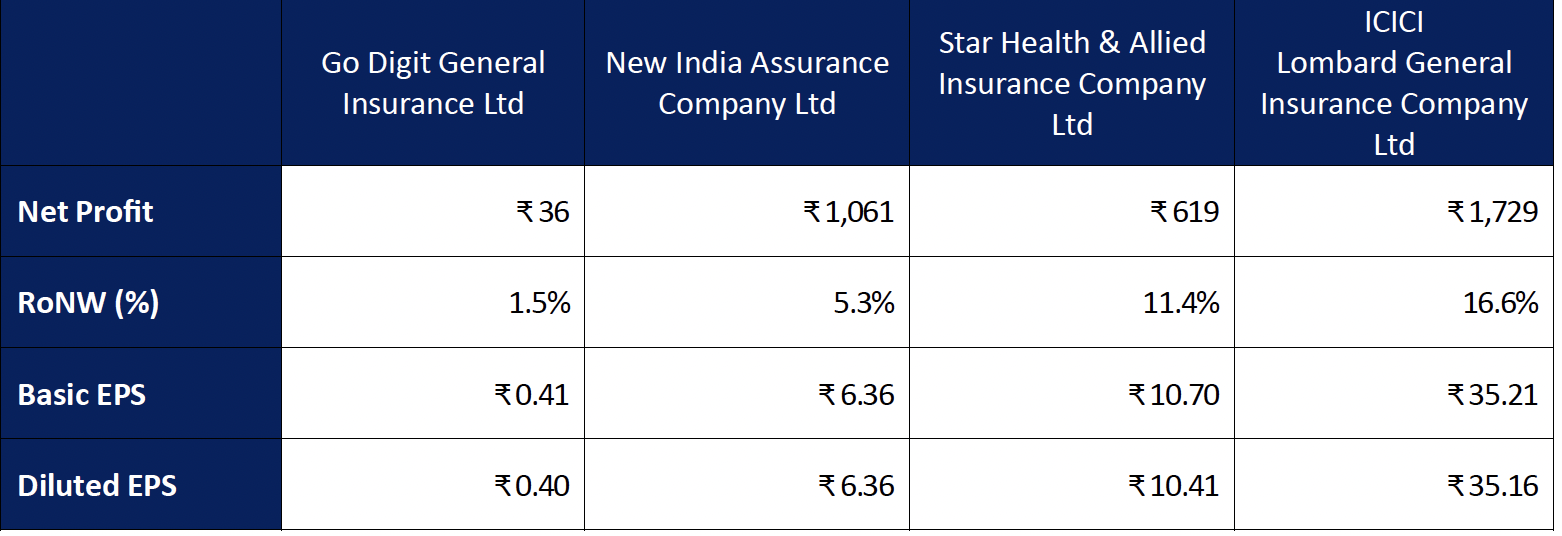

Comparison with Listed Industry Peers (Fiscal 2023)

Disclaimer

This document is not for public distribution and is meant solely for the personal information of the authorized recipient. No part of the information must be altered, transmitted, copied, distributed, or reproduced in any form to any other person. Persons into whose possession this document may come are required to observe these restrictions. This document is for general information purposes only and does not constitute investment advice or an offer to sell or solicitation of an offer to buy/sell any security, and is not intended for distribution in countries where distribution of such material is subject to licensing, registration, or other legal requirements.

The information, opinions, and views contained in this document are as per prevailing conditions and are of the date appearing on this material only and are subject to change. No reliance may be placed for any purpose whatsoever on the information contained in this document or on its completeness. Neither Finwizard Technology Private Limited (“Fisdom”), its group companies, its directors, associates, employees, nor any person connected with it accepts any liability or loss arising from the use of this document.

The views and opinions expressed herein are based solely on the past performance of the schemes and/or securities and do not necessarily reflect the views of Fisdom. Past performance is no guarantee and does not indicate or guide future performance. The information set out herein may be subject to updating, completion, revision, verification, and amendment, and such information may change materially.

Investing in securities markets involves risks, including the potential loss of principal amount in part or in full. The recommendations are based on the past performance of schemes and/or securities, which is not necessarily indicative of future performance. The recommendations do not guarantee future results, and the value of the invested principal amount and investment returns may fluctuate over time. Therefore, it is essential to review your investment objectives, risk tolerance, and liquidity needs before making any investment decisions.

While the information and data contained in this document have been obtained from sources believed to be reliable, Fisdom does not guarantee its accuracy, adequacy, completeness, timeliness, reliability, or availability of any information provided in this document. Fisdom is not responsible for any errors or omissions, regardless of the cause, or for the results obtained from the use of information contained in this document. Fisdom accepts no liability for any losses or damages arising directly or indirectly (including special, incidental, or consequential losses or damages) from the use or reliance placed on any information or data contained in this document, including, without limitation, any lost profits, trading losses, or damages resulting from any errors, omissions, interruptions, deletions, or defects in any manner contained herein.

Readers/Investors should be aware that this document may not be suitable for all types of investors. Investors should independently evaluate any investment or strategy discussed herein. Any decision(s) based on the information contained in this report shall be the sole responsibility of the Reader/Investor.

Fisdom is a SEBI Registered Investment Advisor (RIA) [Registration No: INA200005323] and Research Entity [Registration No: INH000010238]. This document is prepared and distributed in accordance with the SEBI (Investment Advisers) Regulations, 2013, and other relevant regulations. Please read all relevant offer documents, risk disclosure documents, and terms and conditions related to the services provided by Fisdom before making any investment decision. For more details, please visit our official websites at www.fisdom.com and www.Finity.in.