Technical Overview – Nifty 50

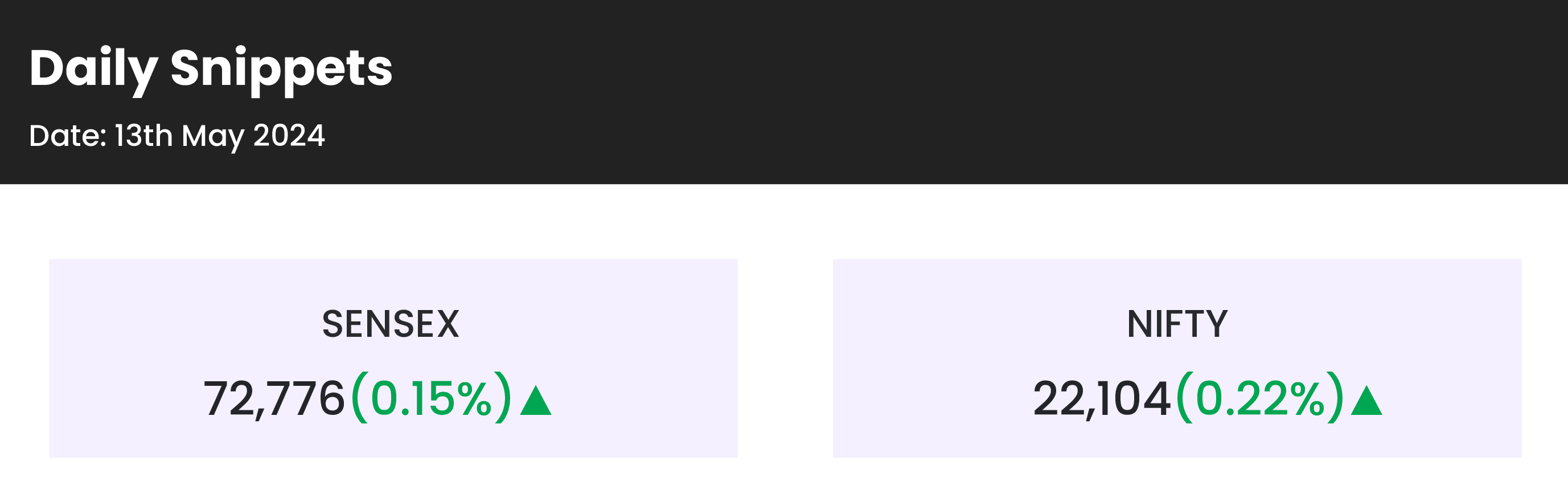

Benchmark index NIFTY closed at 22,104, moved by 49 points/ 0.22%. After bearish last week bulls are having some relief today. The index touched a low of 21,820 in the first hour of the trading session, index managed to take hold day’s low. The index rose almost 200 points from the day’s low and closed almost flat.

A bullish hammer formed on the channel band low as seen in the above chart. The index reversed from 100-DEMA, still index didn’t close above the last trading session high. On the weekly time-frame benchmark index, the momentum indicator 14-period RSI is making a hidden divergence and is above 57 levels.

With ongoing elections and nearing results India VIX, known as the fear indicator, still rising and made a high of 21.50 level and closed at 20.55 level up by another 11.50 %. What will happen if VIX goes up? The higher the VIX, the greater the level of fear and uncertainty in the market. PCR now rising and is at 0.78, indicating bears are still in heavy positions.

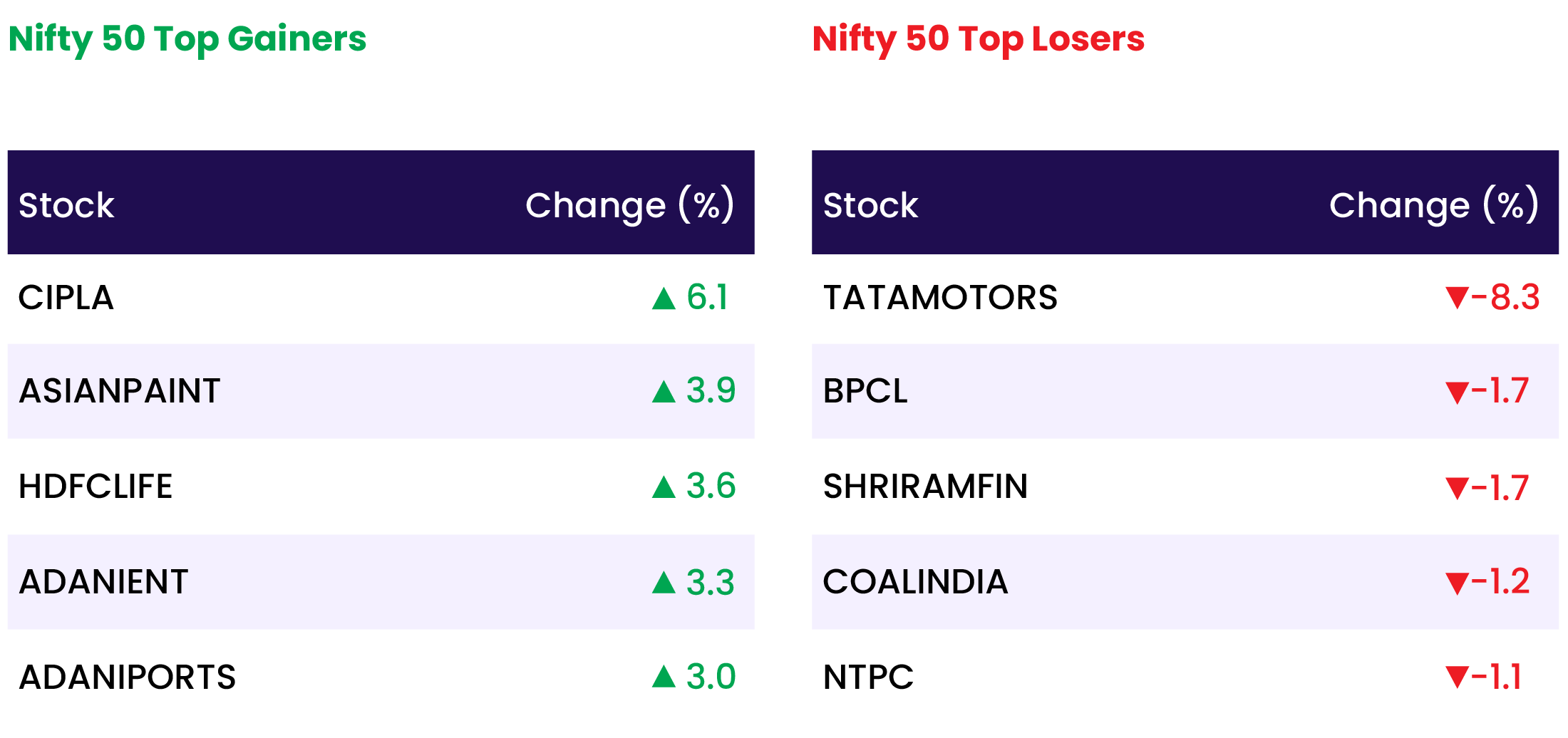

Cipla, Asian Paints, and Divis Labs were top gainers of the benchmark index, while Tata Motors crashed by 9%. Nifty Pharma was the biggest mover index and was up by almost 2%. Nifty Financial Services index moved by 156 points / 0.80%.

NIFTY MIDCAP 100 index is up by just 0.40% while NIFTY SMALLCAP 100 index is down by 0.50%. Both indices have made a good hammer.

The benchmark index has support levels 21,750 – 21,800 zone. Upcoming resistance levels are 22,220, 22,300.

Technical Overview – Bank Nifty

BANK NIFTY index closed at 47,754, moved by 333 points/ 0.70%. The index saw a good reversal from the day low of 46,980 level. Bulls are having relief after the index rose almost 0.80%, and a 7-trading session fall comes to a halt for the index.

The index formed a bullish hammer at the lower band of the channel. Index reversed from 100-DEMA 4th time in the last 2.5 months. Momentum indicator 14-period RSI is making a hidden divergence on the daily time frame and is reversing from the 40 level.

Bank of Baroda, Federal Bank, and IDFC Bank were top movers of the day while SBI dipped almost 1%.

Index resistance levels are 48,120, and 48,600 for upcoming trading sessions. Immediate support levels for the index are 46,950 and 46,550.

Indian markets:

- On May 13, the benchmark Sensex and Nifty 50 rebounded from morning losses, closing in positive territory after initially dropping nearly one percent.

- Despite increased volatility, as indicated by a 16% surge in the India VIX to a new 52-week high of 21.49, both the Sensex and Nifty 50 continued their upward trajectory for the second consecutive session on Monday.

- Notable sector performances included Nifty Pharma, surging by 1.8%, followed by Nifty Metal and Realty, each rising by 1.3%. Nifty Bank saw a 0.7% increase, while Nifty IT advanced by 0.4%. Conversely, Nifty Auto experienced a decline of 1.68%, with Nifty PSU Bank and Oil & Gas down by 1.2% and 0.8%, respectively.

- Investors are keeping an eye on U.S. inflation data and Federal Reserve speeches scheduled for the week ahead. Key events include the release of one-year inflation expectations and PPI data on Tuesday, followed by CPI data on Wednesday, which will serve as significant tests for the recent bond rally. Fed speeches are scheduled throughout the week.

Global Markets:

- In the Asia-Pacific region on Monday, markets generally declined as investors evaluated China’s April inflation figures, which surpassed expectations.

- China’s consumer price index rose by 0.3% year on year, surpassing Reuters’ forecast of a 0.2% increase.

- Japan’s Nikkei 225 closed 0.13% lower, and the broader Topix index dropped 0.15% to finish.

- South Korea’s Kospi index ended unchanged at 2,727.21, while the smaller Kosdaq index fell by 1.13%.

- Australia’s S&P/ASX 200 remained flat.

- Hong Kong’s Hang Seng index increased by 0.76%, while China’s CSI 300 index edged down slightly.

- In the U.S. on Friday, the Dow Jones Industrial Average recorded its eighth consecutive session of gains and marked its strongest week of 2024, with a 0.32% increase during the session.

- The S&P 500 rose by 0.16%, while the Nasdaq Composite dipped by 0.03%.

Stocks in Spotlight

- ABB India Ltd shares surged by 11% in today’s trading session, hitting a record high, following the company’s March quarter earnings surpassing market expectations. Analysts expressed optimism about the stock, noting an 82% year-on-year increase in net profit to Rs 467 crore, driven by higher revenue in the electrification and automation sectors.

- Polycab India Shares of the wire and cables manufacturer rose by 4% after reporting a 29% jump in net profit to Rs 553 crore for the quarter ended March, compared to Rs 428 crore in the same period last year. Revenue from operations also increased by 29% to Rs 5,592 crore, up from Rs 4,324 crore in the corresponding period of the previous fiscal year.

- Syrma SGS Tech shares dropped over 16% following the company’s underwhelming performance for the quarter ending March 2024. While net profit grew by six percent year-on-year to Rs 452.14 crore, the company experienced a 222bps contraction in EBITDA margin due to higher commodity costs and a strategic focus on high-volume automotive business.

- Tata Motors Ltd Shares of India’s leading EV player slumped 8 percent on expectations that JLR can potentially face a demand risk. The company also anticipates a sluggish start to FY25, citing an expected dip in local passenger vehicle (PV) demand amidst ongoing elections.

News from the IPO world🌐

- Go Digit IPO: Price band for Virat Kohli-backed Rs 2,615 crore IPO announced

- Rulka Electricals IPO to open on May 16

- Indegene makes stellar start, lists at 45% premium on market debut

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PHARMA | 1.8 |

| NIFTY HEALTHCARE INDEX | 1.6 |

| NIFTY METAL | 1.3 |

| NIFTY REALTY | 1.2 |

| NIFTY MIDSMALL HEALTHCARE | 0.9 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1777 |

| Decline | 2180 |

| Unchanged | 130 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,513 | 0.3 % | 4.8 % |

| 10 Year Gsec India | 7.1 | (0.2) % | 0.2 % |

| WTI Crude (USD/bbl) | 78 | (1.3) % | 11.2 % |

| Gold (INR/10g) | 71,942 | (0.9) % | 7.1 % |

| USD/INR | 83.52 | 0.1 % | 0.6 % |

Please visit www.fisdom.com for a standard disclaimer