Technical Overview – Nifty 50

The benchmark index closed at 22648 level rising 0.19% intraday. The Benchmark index managed to sustain above the previous trading session low of 22,568. It was able to sustain the previous trading day selloff. After rising 91 points in the first 75 minutes’ the index remained sideways. Price has been trading in a range around 22,630 – 22,700 levels throughout the day.

ADX is still below 20 indicating no momentum on either side of the market. RSI still sustains above 50, which indicates no sign of bearishness. Price is taking support and sustaining above 20-EMA on a 75-minute time frame.

The index is inching towards a near all-time high, the price needs to sustain above 22780 to move towards 22,800, and 22,900 levels. Index near-term support levels are 22,560, 22,385.

Technical Overview – Bank Nifty

The Bank Nifty index closed at the 49,231 level rising 0.34% intraday Bank Nifty index gained 115 points in the initial 75 minutes but couldn’t sustain and fell. Index hovered around the previous trading session shooting star candle low of 49,250 level. The index fell 153 points intraday.

Index underperformed benchmark index where benchmark index nifty was up 0.19% while Bank Nifty was down by 0.34%. 14-period RSI shows a negative divergence in the daily time frame.

Immediate support levels for Bank Nifty are 48,900, 48,380, and 48,100. For any further up the index needs to sustain An all-time high level of 50,000.

Indian markets:

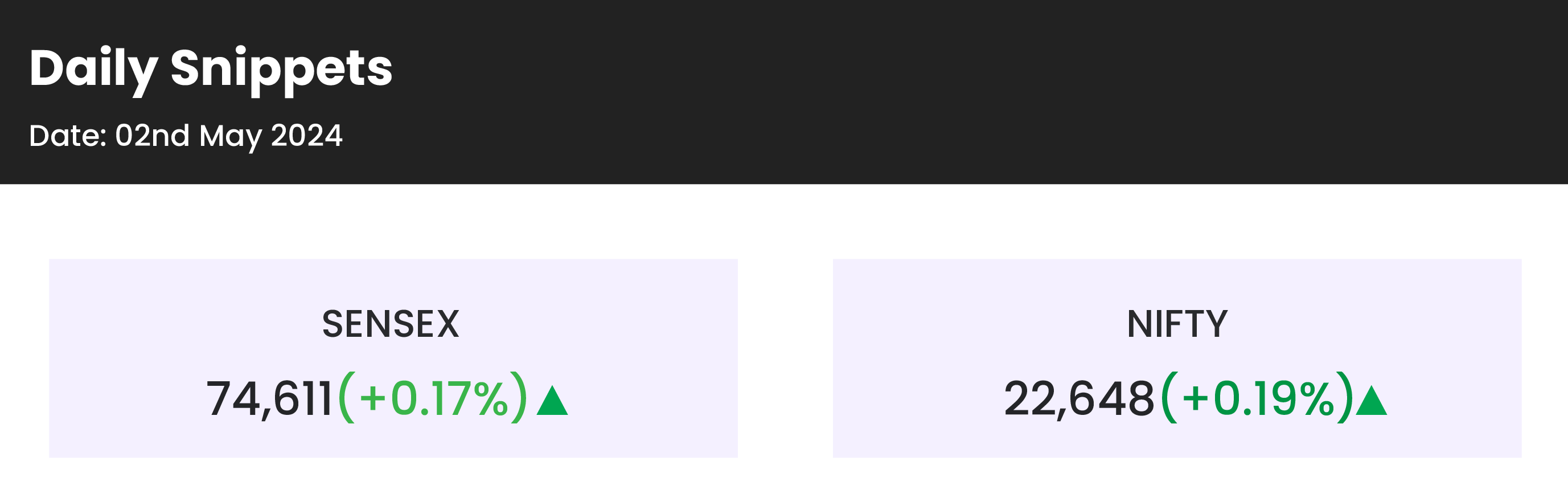

- The Indian stock market reacted calmly to the US Federal Reserve’s unchanged policy, with both the Sensex and Nifty closing slightly higher on Thursday, May 2. Investors digested the Fed Chair’s comments on rate hikes, leading to a rebound from previous losses.

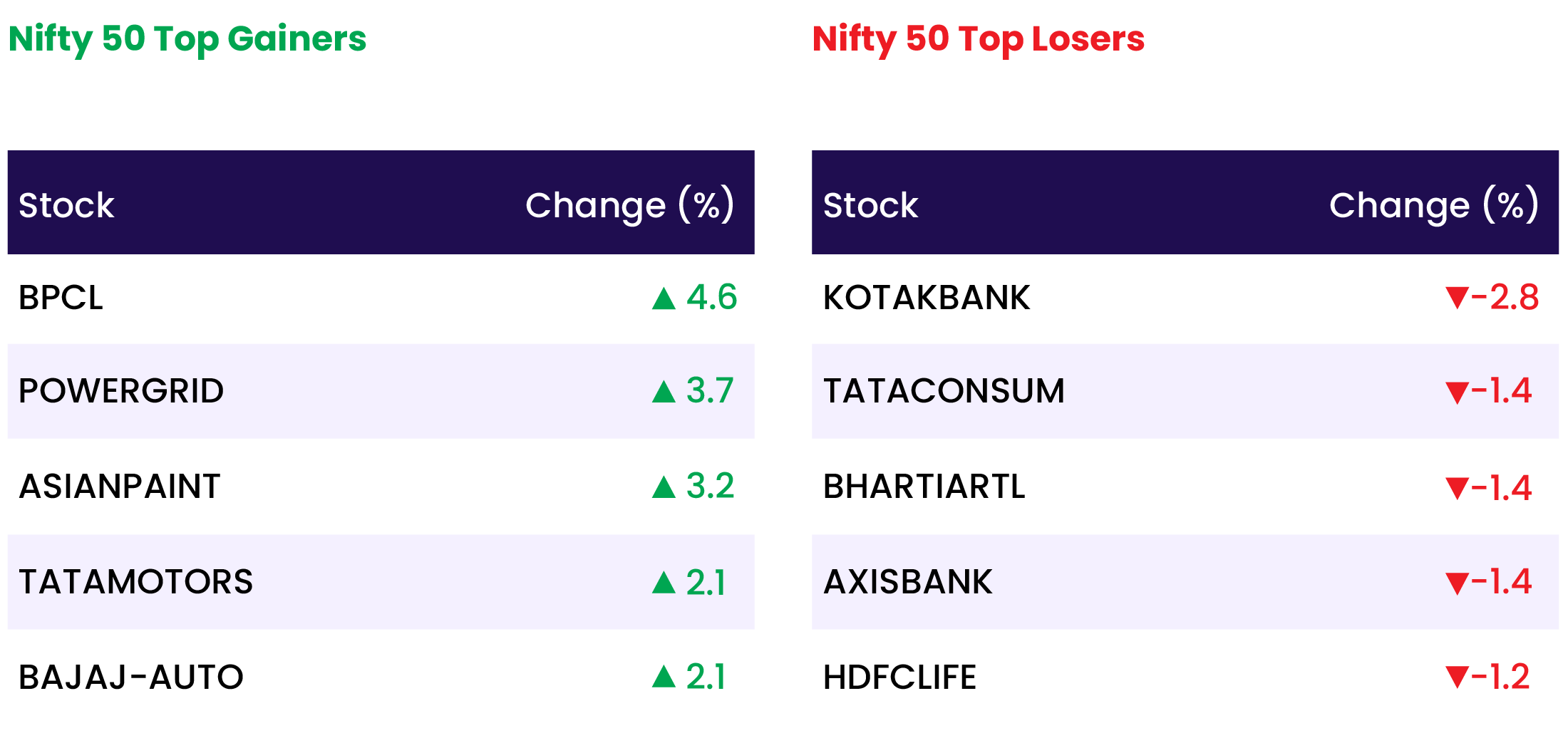

- Sector-wise, the auto, metal, oil & gas, and power sectors saw gains of one percent each, while the bank and realty sectors closed with marginal losses.

- The broader indices continued to surpass the benchmarks, as the BSE midcap index reached a new high and closed with a one percent gain, while the smallcap index rose by 0.3 percent.

Global Markets:

- Asia-Pacific stock markets were mixed after the U.S. Federal Reserve held interest rates steady.

- Hong Kong’s Hang Seng index led gains in Asia, jumping by 2.4%, while the Hang Seng Tech index surged by 4.4% on positive updates from Chinese EV makers.

- Japan’s Nikkei 225 closed 0.1% lower at 38,236.07, while the broader Topix remained flat at 2,728.53.

- Australia’s S&P/ASX 200 rose by 0.23% to close at 7,587.00.

- South Korea’s Kospi fell by 0.31% to close at 2,683.65, with attention on slower consumer price growth in April.

- European stocks were slightly lower, reacting to the Fed’s decision and corporate earnings reports.

Stocks in Spotlight

- Ashok Leyland shares saw a remarkable surge of 4 percent following the announcement that the company’s combined sales of M&HCV and LCV units, including exports, reached 14,271 units, marking a notable 10 percent increase compared to the same period last year. Additionally, the stock reached its all-time high during the session.

- Godrej Industries witnessed a decline of 7 percent in its stock value after the founding family agreed to split the 127-year-old conglomerate into two separate entities. This restructuring involves dividing operations into two distinct branches: Godrej Enterprises and Godrej Industries, reflecting a significant change in the conglomerate’s structure.

- BHEL stock experienced a 4 percent rise subsequent to the state-run company’s initiation of a Strategic Partnership Agreement (SPA) for its railway signaling business with HIMA Middle East FZE, Dubai, a wholly-owned subsidiary of HIMA Paul Hildebrandt GmbH, Germany.

News from the IPO world🌐

- Swiggy secures shareholder nod for a potential $1.2 billion IPO

- Healthcare tech firm Indegene’s Rs. 1800 crore IPO to open on May 6th

- TBO Tek IPO to open for subscription on May 8

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY AUTO | 1.1 |

| NIFTY METAL | 1.1 |

| NIFTY OIL & GAS | 0.8 |

| NIFTY PHARMA | 0.8 |

| NIFTY FMCG | 0.5 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1867 |

| Decline | 1967 |

| Unchanged | 123 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 37,903 | 0.2 % | 0.5 % |

| 10 Year Gsec India | 7.2 | (0.5) % | 0.6 % |

| WTI Crude (USD/bbl) | 79 | (4.5) % | 12.2 % |

| Gold (INR/10g) | 71,089 | (0.3) % | 6.0 % |

| USD/INR | 83.44 | 0.0 % | 0.5 % |

Please visit www.fisdom.com for a standard disclaimer