Technical Overview – Nifty 50

The Index has rallied almost 1.20% in two trading sessions suggesting a bullish outlook for the index.

Nifty rollover stood at 65.12% which is significantly lower compared to last month’s rollover of 69.77% and its 3-month average and 6-month average of 71.25% and 74.48% respectively. Lower rollover with an increase in open interest and a price increase indicates hesitancy to carry forward the existing positions in the May series.

The Index is trading above its 9 & 21 EMA and the RSI (14) has moved near 60 levels with a bullish crossover. The MACD indicator is reading above its line of polarity.

The Index is approaching its upper band of the rising channel pattern on the daily chart. The immediate resistance is placed at 22,800 levels and support is placed at 22,500 levels.

Technical Overview – Bank Nifty

The Banking Index rallied almost 1000 points in the last two trading sessions indicating a bullish momentum.

The Bank Nifty has witnessed a bullish breakout above its horizontal trend line on the daily chart signifies bullish sentiments. The momentum oscillator RSI (14) is reading in a higher low formation above the upward-rising trend line on the daily chart. The oscillator presently has taken support of a trend line and has moved above 50 levels with a bullish crossover.

The immediate support for the Banking Index is placed at 48,400 levels and resistance is capped at 50,000 levels.

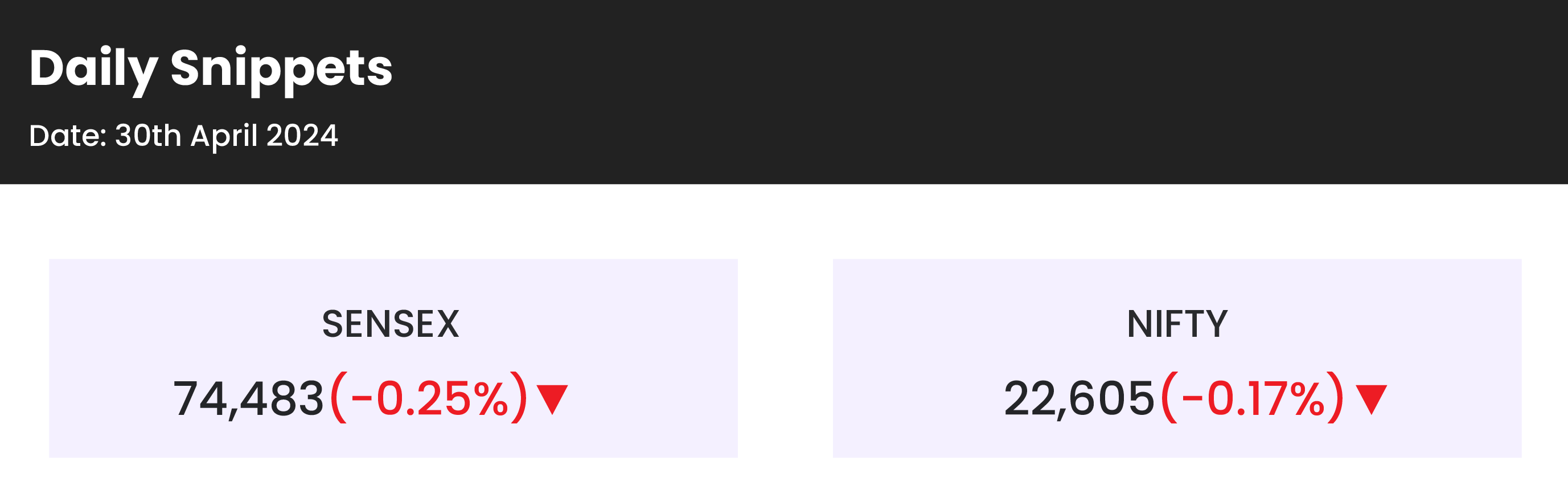

Indian markets:

- The market experienced high volatility during the session, with intraday gains being completely erased, resulting in a lower closing.

- Selling pressure was observed in sectors such as IT, metal, media, and oil & gas.

- Despite the overall market decline, the Nifty Midcap 100 and Nifty Bank indices reached their record highs intraday.

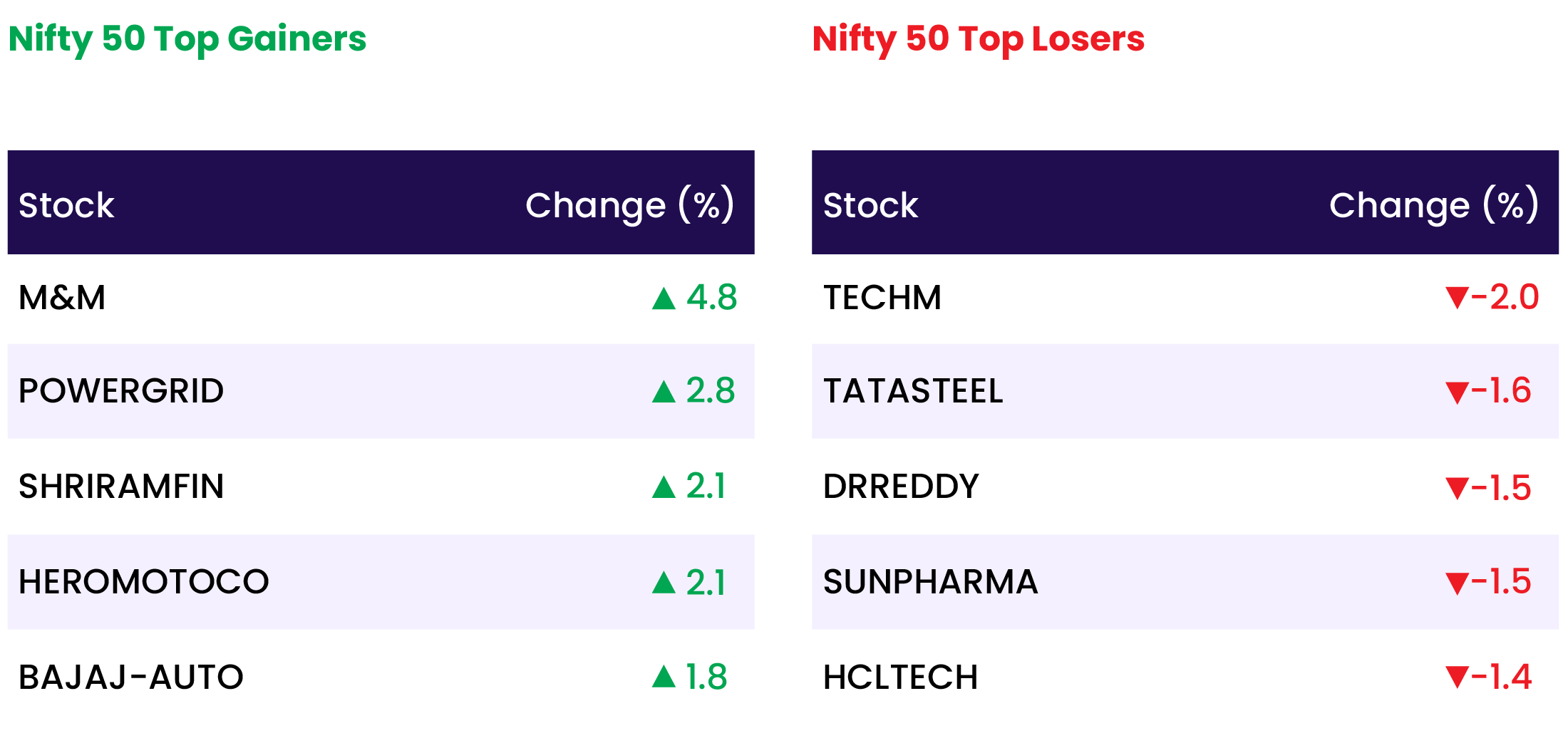

- Sector-wise, IT, metal, media, oil & gas, and healthcare stocks witnessed declines ranging from 0.4% to 1%, while auto, power, and realty sectors saw gains of over 1% each.

- In contrast to the benchmarks, the broader indices performed relatively well, with the BSE midcap index reaching a new high and closing 0.5% higher, while the smallcap index ended the day flat

Global Markets:

- European markets displayed mixed performance on Tuesday amid the release of a slew of earnings reports and key data indicators.

- The regional Stoxx 600 index showed minimal movement, trading marginally lower by 0.01% at 12:17 a.m. London time.

- In Asia-Pacific, markets mostly experienced gains, following trends set by Wall Street, with a focus on China’s manufacturing purchasing managers’ index for April.

- U.S. stock futures exhibited little change following a positive start to the week, with investors anticipating megacap earnings, the Federal Reserve interest rate decision, and a jobs report.

- The Federal Reserve is widely anticipated to maintain interest rates at current levels, but market participants are attentive to any potentially hawkish remarks from Fed Chair Jerome Powell, particularly in light of recent inflation data.

Stocks in Spotlight

- Tata Chemicals witnessed a significant decline of up to 3 percent in its stock price, largely attributed to the company’s disappointing earnings performance during the January-March quarter. The chemical manufacturer reported a net loss of Rs 841 crore for Q4FY24, a stark contrast to the net profit of Rs 692 crore recorded in the corresponding period the previous year. Additionally, revenue experienced a substantial decline of 21.1 percent, dropping to Rs 3,475 crore from Rs 4,407 crore reported in the same quarter last year.

- Manappuram Finance saw a surge of approximately 5 percent, reaching Rs 207 per share in the afternoon on April 30, following SEBI’s approval for its subsidiary Asirwad Microfinance to launch an initial public offering (IPO). The non-banking finance company (NBFC) had submitted an addendum to the proposed Rs 1,500-crore IPO of Asirvad Micro Finance to SEBI on February 16. Asirvad Micro Finance had initially filed a DRHP with SEBI on October 5, 2023, but the IPO was put on hold by SEBI in January 2024.

- KEC International witnessed a nearly 3 percent increase in its share price following the announcement of new orders worth Rs 1,036 crore across its transmission and distribution, as well as railways businesses.

- Mahindra & Mahindra (M&M) witnessed a surge of over 4 percent, reaching a new record high of Rs 2,152 per share on April 30, propelled by the launch of its compact SUV – XUV 3XO. Priced competitively at Rs 7.49 lakh, the vehicle enters the market to contend with rivals like Maruti Suzuki Brezza, Tata Nexon, and Hyundai Venue. The company’s management has expressed ambitions to secure a position among the top two players in the compact SUV segment within three years.

News from the IPO world🌐

- Swiggy secures shareholder nod for a potential $1.2 billion IPO

- Healthcare tech firm Indegene’s Rs. 1800 crore IPO to open on May 6th

- JNK India made an impressive debut with a premium of over 50%

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY AUTO | 1.8 |

| NIFTY REALTY | 1.5 |

| NIFTY PSU BANK | 0.5 |

| NIFTY CONSUMER DURABLES | 0.2 |

| NIFTY FINANCIAL SERVICES | 0.1 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1822 |

| Decline | 1995 |

| Unchanged | 133 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,386 | 0.4 % | 1.8 % |

| 10 Year Gsec India | 7.2 | (0.0) % | 1.1 % |

| WTI Crude (USD/bbl) | 83 | (1.5) % | 15.2 % |

| Gold (INR/10g) | 72,324 | 0.3 % | 6.3 % |

| USD/INR | 83.45 | 0.1 % | 0.4 % |

Please visit www.fisdom.com for a standard disclaimer