Technical Overview – Nifty 50

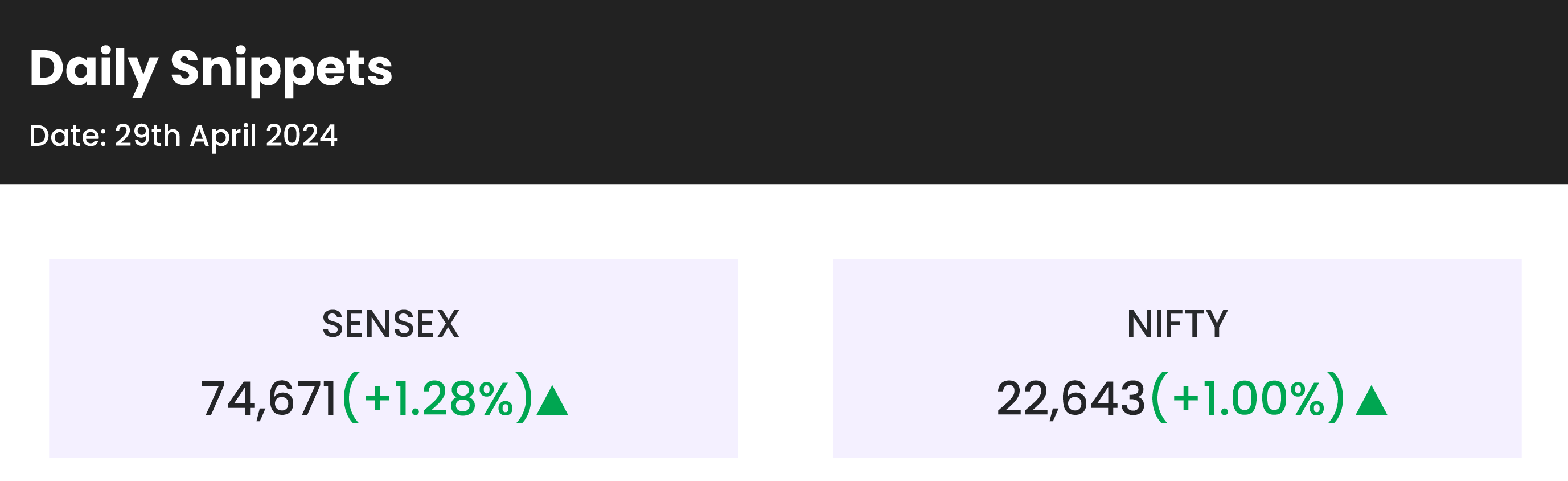

The Benchmark index witnessed a gap-up opening following its global peers and traded in a higher high higher low formation on the intraday time frame. The Index has recovered its previous day’s loss and the index closed near the 22,600 mark with more than 0.75% gains.

Nifty rollover stood at 65.12% which is significantly lower compared to last month’s rollover of 69.77% and its 3-month average and 6-month average of 71.25% and 74.48% respectively. Lower rollover with an increase in open interest and a price increase indicates hesitancy to carry forward the existing positions in the May series.

Nifty50’s futures Contract expiring on 30th May 2024 is trading at its lowest premium in the last 1 year compared to the underlying Nifty price.

A situation where the future prices are above the spot prices is normally known as Contango. This circumstance is generally a sign of bullishness. The immediate support for the Index is placed at 22,400 levels and resistance is capped at 22,800 levels. If the Index witnessed a breakdown below 22,400 levels, then the gate is open till 22,300 mark. Similarly, a close above 22,800 will trigger more upside till the 23,000 level.

Technical Overview – Bank Nifty

The Banking Index rallied more than 1000 points and formed a tall bullish candle on the daily chart. The Bank Nifty has witnessed a bullish breakout above its horizontal trend line on the daily chart signifies bullish sentiments.

The higher high higher low formation was consistently on the mark throughout the day for the Banking Index. The prices have taken support near its 9 & 21 EMA and reversed sharply from there. The momentum oscillator RSI (14) is reading in a higher low formation above the upward-rising trend line on the daily chart. The oscillator presently has taken support of a trend line and has moved above 50 levels with a bullish crossover.

The immediate support for the Banking Index is placed at 48,800 levels and resistance is capped at 50,000 levels. If the Index witnessed a selling below 48,800 levels, then the gate is open till the 48,000 mark. Similarly, a close above 50,000 will trigger more upside till the 50,500 level.

Indian markets:

- The market rebounded strongly, completely reversing the losses from the previous session, with the Nifty ending above 22,600.

- Buying activity was observed across various sectors, except for real estate.

- Positive global cues set the tone for the day, leading to a bullish start in the market.

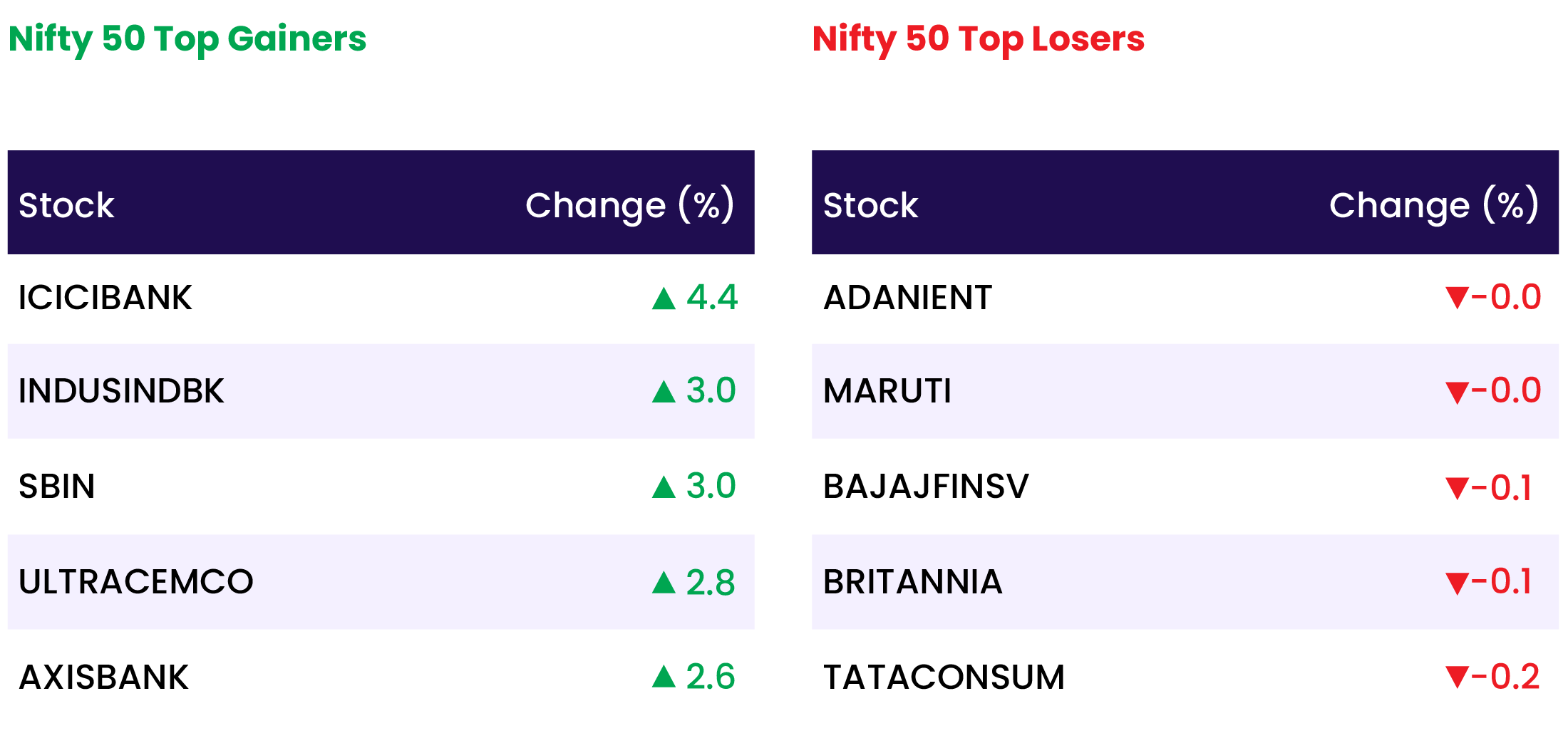

- The momentum continued throughout the day, fueled by gains in financial stocks, pushing the benchmarks to close near their highest points.

- With the exception of realty, all other sectoral indices finished in positive territory.

- Healthcare, metal, power, banking, and oil & gas sectors recorded gains ranging from 0.4 to 2 percent.

Global Markets:

- European markets showed gains on Monday, with investor attention focused on upcoming central bank decisions, earnings reports, and economic data releases scheduled for the week.

- The U.S. Federal Reserve is set to announce its latest interest rate decision on Wednesday, following a recent higher-than-expected U.S. inflation reading reported on Friday.

- While the central bank is expected to maintain the current borrowing cost, market participants will closely watch the post-announcement press conference led by Chair Jerome Powell.

- S&P 500 futures saw a slight increase on Sunday night, following a strong performance from the index during the previous week.

- In the Asian-Pacific region, stocks rose, leading to a weakening of the Japanese yen against the U.S. dollar, with the yen reaching 160 against the dollar

Stocks in Spotlight

- ICICI Bank’s stock surged by 4 percent following the announcement of strong Q4 earnings on April 27. With this increase, the bank achieved a significant milestone, becoming the fifth Indian company and the second bank to exceed a market capitalization of Rs 8 lakh crore. The impressive performance was fueled by a Q4 FY24 net profit of Rs 10,708 crore, marking a 20 percent rise from the same period in FY23. This growth was attributed to robust advances and lower credit costs, despite facing margin pressure.

- BSE witnessed a steep decline of 13 percent following Sebi’s directive for the exchange to pay regulatory fees based on the notional value, rather than the premium value, of its options contracts. This change is expected to significantly impact BSE’s financials, leading to a substantial increase in its regulatory fees.

- Ultratech Cement’s stock rose by 2 percent following a remarkable surge in net profit, which increased by 35.5 percent year-on-year to reach Rs 2,258 crore. This growth was fueled by strong demand for building materials and reduced operating costs. Additionally, the board declared a dividend of Rs 70 per equity share.

- IREDA saw a 6 percent surge in its stock price following the attainment of ‘Navratna’ status. The Department of Public Enterprises (DPE) granted this prestigious designation to the Indian Renewable Energy Development Agency in a letter dated April 26.

News from the IPO world🌐

- Swiggy secures shareholder nod for a potential $1.2 billion IPO

- Healthcare tech firm Indegene’s Rs. 1800 crore IPO to open on May 6th

- Staterun energy firms line up for green IPOs

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PSU BANK | 2.6 |

| NIFTY BANK | 2.5 |

| NIFTY PRIVATE BANK | 2.2 |

| NIFTY FINANCIAL SERVICES | 2.1 |

| NIFTY OIL & GAS | 1.0 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2015 |

| Decline | 1894 |

| Unchanged | 179 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,239 | 0.4 % | 1.4 % |

| 10 Year Gsec India | 7.2 | (0.1) % | 1.1 % |

| WTI Crude (USD/bbl) | 83 | (0.8) % | 16.7 % |

| Gold (INR/10g) | 72,130 | 0.6 % | 6.0 % |

| USD/INR | 83.40 | 0.0 % | 0.3 % |

Please visit www.fisdom.com for a standard disclaimer