Technical Overview – Nifty 50

The Benchmark Index witnessed a gap-down opening but the bears didn’t stay for long and the market started to recover within a few ticks. A stronger recovery was witnessed in the Indian bourses from the lower levels and the index formed a tall green candle that engulfed the previous three days’ candles.

The prices have taken support near its 9 & 21 EMA and reversed sharply from there. Interestingly, the broader markets underperformed the benchmarks in today’s trade.

India VIX ended a bit higher after falling for the last few sessions but net the market mood seemed positive. Tomorrow all eyes will be on US GDP data. The US economy is expected to grow 2.1% in Q1, a slowdown from a 3.4% rate in Q4.

The immediate support for the Index is placed at 22,300 levels and resistance is capped at 22,750 levels. If the Index witnessed a breakdown below 22,300 levels, then the gate is open till 22,100 mark. Similarly, a close above 22,750 will trigger more upside till the 23,000 level.

Technical Overview – Bank Nifty

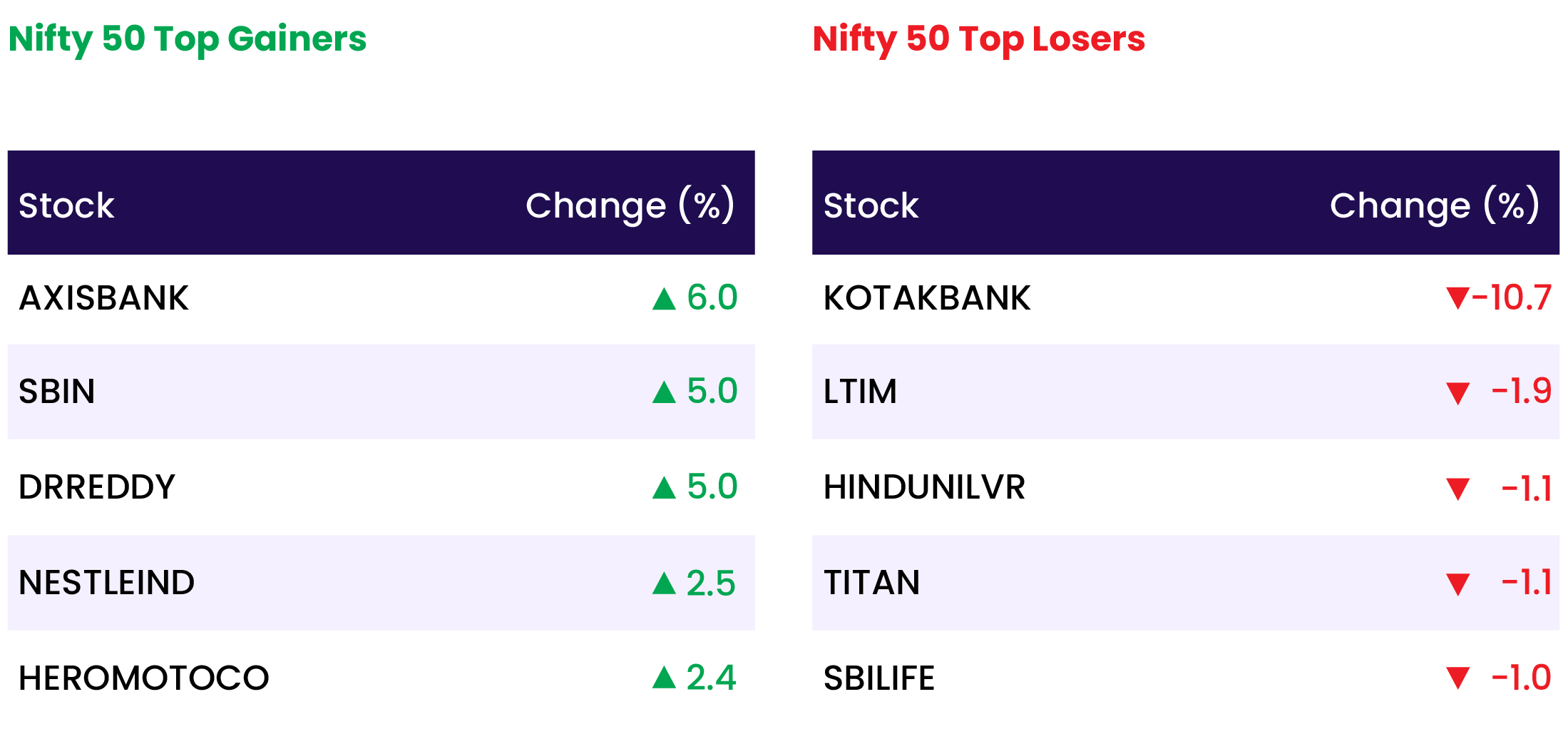

The Bank Nifty Index witnessed a gap-down opening due to a 10% fall in Kotak Bank but the bears didn’t stay for long and the prices started to recover within a few ticks. A stronger recovery was witnessed in the Overall broader market from the lower levels and the index formed a tall green candle that engulfed the previous three days’ candles.

The prices have taken support near its 9 & 21 EMA and reversed sharply from there. The momentum oscillator RSI (14) is reading in a higher low formation above the upward-rising trend line on the daily chart. The oscillator presently has taken support of a trend line and has moved above 50 levels with a bullish crossover.

The immediate support for the Banking Index is placed at 47,800 levels and resistance is capped at 49,000 levels. If the Index witnessed a breakdown below 47,800 levels, then the gate is open till the 47,000 mark. Similarly, a close above 49,000 will trigger more upside till 50,000 levels.

Indian markets:

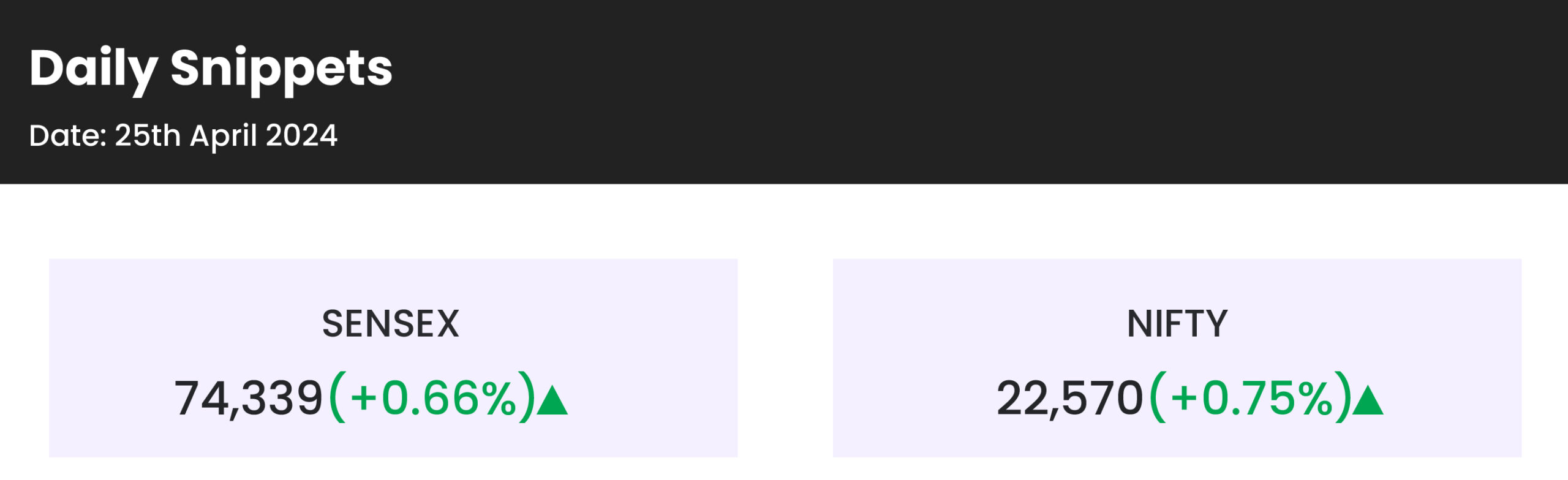

- Despite weak global cues ahead of the release of the first quarter (Q1) US GDP data, the Indian stock market benchmarks, the Sensex and the Nifty 50, ended higher for the fifth consecutive session on Thursday, April 25. The Indian market made a smart recovery from the day’s low to extend the winning streak to a fifth straight session on April 25, but last-hour profit booking capped the gains.

- Among sectors, except realty, all indices ended in the green, with the PSU Bank index rising nearly 4 percent to hit a record high of 7,421.20.

- BSE midcap and the smallcap indices gained 0.5 percent each.

Global Markets:

- Asia-Pacific markets paused following two consecutive days of gains, echoing movements on Wall Street ahead of the release of first-quarter gross domestic product figures from the U.S. scheduled for Thursday.

- Japan’s Nikkei 225 initially dropped by 2.16%, leading losses in the region before recovering slightly, while the Topix declined by 1.74%.

- South Korea’s Kospi also experienced a decline of 1.76%, while the small-cap Kosdaq fell by 1.04%.

- However, Chinese indexes diverged from the downtrend, as Hong Kong’s Hang Seng index rose by 0.39%, and China’s CSI 300 gained 0.25%.

- Markets in Australia and New Zealand were closed due to a public holiday.

Stocks in Spotlight

- Nestle India saw a surge of over 2 percent following the FMCG giant’s better-than-expected earnings report for the March quarter. The company’s standalone net profit rose by 27 percent to Rs 934 crore compared to the year-ago quarter, while its revenue increased by nine percent to Rs 5,268 crore.

- Shares of Axis Bank climbed 6 percent after the private lender announced strong fiscal fourth-quarter earnings, leading brokerages to maintain their bullish outlook. Jefferies issued a “buy” rating on the stock, setting a target price of Rs 1,380 per share. The fourth quarter performance exceeded expectations by 13 percent in terms of profit, according to the brokerage.

- IndusInd Bank, a private sector lender, posted a net profit of Rs 2,349 crore for the January-March quarter of the financial year 2023-24, marking a 15% increase from the year-ago period’s Rs 2,043 crore. The reported net profit of Rs 2,349 crore surpassed market estimates of Rs 2,261 crore. The bank noted an 18% growth in net loans, outpacing a 14% growth in deposits, according to its quarterly update earlier this month.

- Tech Mahindra, a leading IT services company, reported a 40.9 percent decrease in net profit to Rs 661 crores year-on-year for the fourth quarter ending on March 31, driven by a continued slowdown in key verticals including telecom, communications, media, and entertainment. However, sequentially, the net profit increased by 29.5 percent.

News from the IPO world🌐

- Swiggy secures shareholder nod for a potential $1.2 billion IPO

- RCRS Innovations files draft papers with NSE Emerge to raise funds via IPO

- On the second day, the JNK India IPO sails through smoothly.

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PSU BANK | 3.8 |

| NIFTY PHARMA | 1.6 |

| NIFTY HEALTHCARE INDEX | 1.4 |

| NIFTY AUTO | 1.3 |

| NIFTY METAL | 1.1 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2076 |

| Decline | 1718 |

| Unchanged | 140 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,461 | (0.1) % | 2.0 % |

| 10 Year Gsec India | 7.2 | 0.3 % | 1.4 % |

| WTI Crude (USD/bbl) | 83 | (3.1) % | 17.5 % |

| Gold (INR/10g) | 71,656 | (0.1) % | 4.8 % |

| USD/INR | 83.31 | (0.1) % | 0.3 % |

Please visit www.fisdom.com for a standard disclaimer