Technical Overview – Nifty 50

Nifty continues to tumble as the carnage at Dalal Street knows no bounds. The Benchmark index has lost almost 600 points in the last three trading sessions indicating an intensity of sellers in the market.

NIFTY50 on the daily chart has reached near the lower band of the rising channel pattern and prices are trading above its trend line support. The index has also taken support near 61.80% Fibonacci retracement which adds additional confirmation to the support.

The bear grip tightened even more on Dalal Street as investors remained on the sidelines until they found some clarity regarding Middle-East tensions, sticky inflation, rising treasury yields, and rising US Dollar Index.

The immediate support for the Index is placed at 22,000 levels and resistance is capped at 22,350 levels. If the Index witnessed a breakdown below 22,000 levels, then the gate is open till 21,700 mark.

Technical Overview – Bank Nifty

The Bank Nifty witnessed a gap-down opening after a weekend and traded in a lower high lower low formation throughout the day and drifted below 47,700 levels. The Banking index has lost almost 1,700 points in the last three trading sessions indicating an intensity of sellers in the market.

The Bank Nifty on the daily chart has drifted below its 9 and 21 EMA and the momentum oscillator RSI (14) has drifted near 50 levels with a bearish crossover on the cards. The MACD indicator has given an early crossover signal above its line of polarity.

The Bank Nifty is trading in a rising channel pattern and presently it has taken resistance near the upper band of the pattern and drifted lower. Presently the market sentiments have shifted to sell-on-rise mode with immediate resistance placed at 48,000 levels and if prices drift below 47,100 levels then the gate is open till 46,500 levels.

Indian markets:

- Indian stock market benchmarks the Sensex and the Nifty 50 closed lower for the third consecutive session on Tuesday, April 16, following global market weakness exacerbated by tensions in West Asia. Investor sentiment was further dampened by a rise in U.S. treasury bond yields, reaching a five-month high.

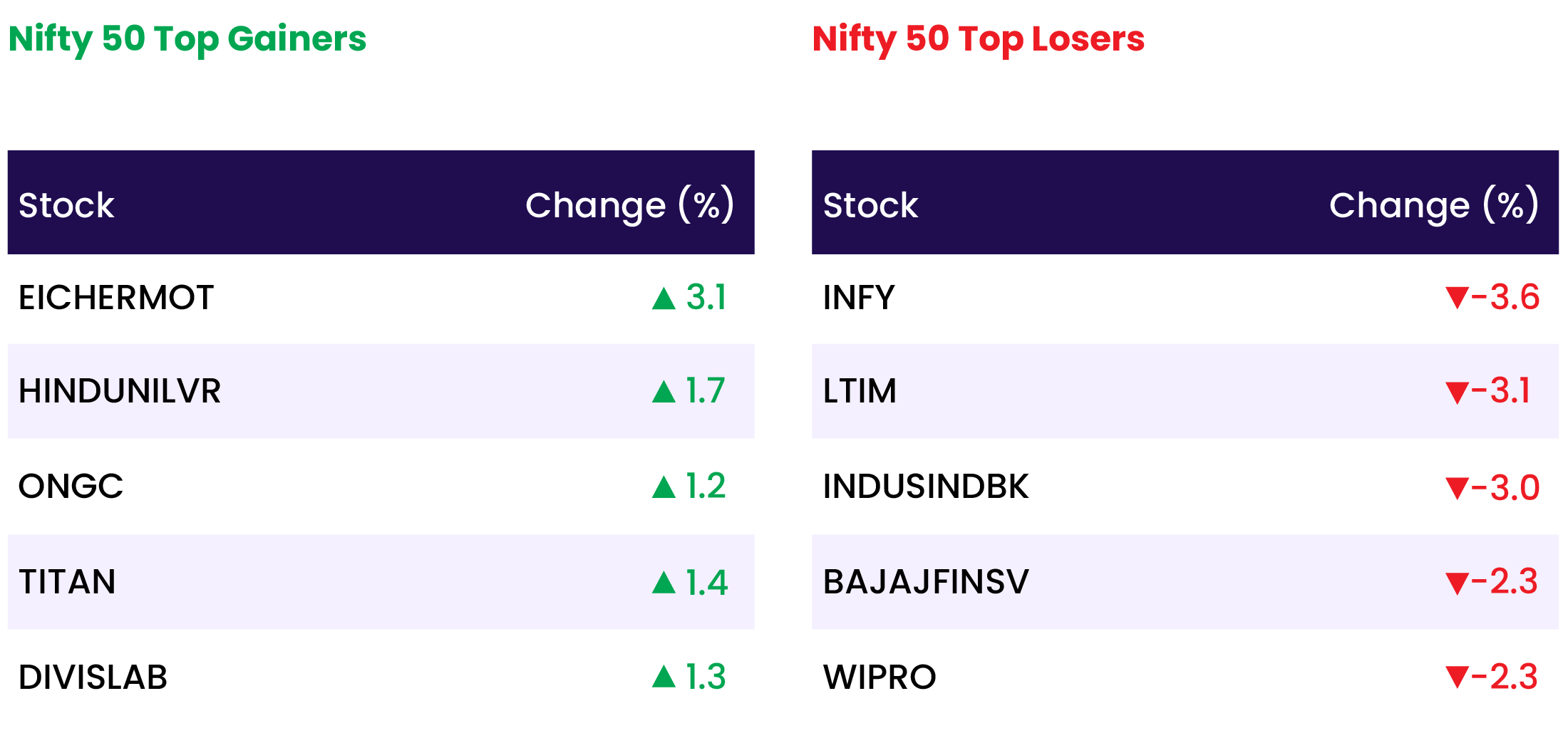

- Notably, prominent IT stocks such as Infosys, Tech Mahindra, Wipro, HCL Tech, and TCS were among the top losers, influenced by adverse global cues.

- Despite this, the broader market fared relatively better, with the BSE Smallcap index gaining 0.6 percent and the BSE Midcap index closing unchanged.

- Nifty IT and Nifty Financial Services were the most significant underperformers among sectoral indices, with Nifty IT declining by 2.6 percent and Nifty PSU Bank shedding 1.3 percent.

- Conversely, Nifty Pharma and Nifty FMCG emerged as the top gainers among sectoral indices, closing 0.4 percent higher.

Global Markets:

- Asia-Pacific markets experienced a sell-off amid anticipation of Israel’s response to Iran’s weekend air assault, leading to around a 2% decline in most major markets in the region.

- China’s economy surpassed expectations, growing at 5.3% in the first quarter compared to the anticipated 4.6% growth.

- South Korea’s Kospi suffered the most significant losses, plummeting 2.28%, with the Kosdaq also down by 2.3%.

- Japan’s Nikkei 225 hit its lowest level in nearly two months, dropping 1.94%, while the broader Topix fell 2.04%, reaching its lowest point in a month. Additionally, the yen weakened to 154 against the U.S. dollar, its lowest since June 1990.

- Australia’s S&P/ASX 200 declined by 1.81%, marking its fourth consecutive day of losses and reaching a two-month low.

- Hong Kong’s Hang Seng index decreased by 2.12%, while the CSI 300 was down by 1.07% following the GDP announcement.

Stocks in Spotlight

- Bharti Hexacom shares surged by 13 percent following brokerage Jefferies’ initiation of coverage on the stock with a ‘buy’ rating and a target price of Rs 1080, representing a 34 percent upside from the previous close. Jefferies views Bharti Hexacom as a compelling investment opportunity within the Indian telecom sector.

- LTI Mindtree shares declined by 3 percent on high trading volumes, with fourteen lakh shares traded compared to the monthly average of five lakh. The stock was also impacted by the resignation of Pankaj Chugh and Gregory Dietrich as executive vice-presidents of global sales, effective April 15.

- Infosys shares dropped over 3 percent amid significant trading volumes, extending losses for the third consecutive session. Trading activity saw 2 crore shares exchanged compared to the monthly average of 91 lakh.

News from the IPO world🌐

- Nephro Care India files DRHP to raise funds via IPO

- Vodafone Idea largest Rs 18,000 crore FPO will open on 18th April

- Deepak Builders & Engineers files draft papers with Sebi to raise funds via IPO

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY MEDIA | 1.6 |

| NIFTY OIL & GAS | 0.6 |

| NIFTY FMCG | 0.4 |

| NIFTY PHARMA | 0.4 |

| NIFTY CONSUMER DURABLES | 0.2 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2251 |

| Decline | 1567 |

| Unchanged | 115 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 37,735 | (0.7) % | 0.1 % |

| 10 Year Gsec India | 7.2 | (0.2) % | 1.0 % |

| WTI Crude (USD/bbl) | 85 | (0.3) % | 21.4 % |

| Gold (INR/10g) | 72,687 | 0.5 % | 7.7 % |

| USD/INR | 83.61 | 0.3 % | 0.7 % |

Please visit www.fisdom.com for a standard disclaimer