Technical Overview – Nifty 50

Post the US FED commentary the global market spiked higher with more than 1 percent gains and henceforth the Gift Nifty indicated a gap-up opening of more than 140 levels. The Nifty50 witnessed a gap up opening near 22,000 levels and continued to hover at the same levels with a bullish bias for the majority of the day.

The Index opened near its 21 EMA but was not able to cross above the same and it will continue to act as an immediate resistance for the Index. The momentum oscillator RSI (14) has taken a hook turn near 40 levels but has closed below 50 only with a negative crossover.

The volatility index drifted lower by more than 6% and has closed below 13 levels. The Index has formed a back-to-back Doji candle stick pattern on the daily chart suggesting an above-average volatility. The immediate resistance is capped below 22,100 levels and the support is at 21,800 levels.

Technical Overview – Bank Nifty

The Bank Nifty has finally closed in the green after 9 days of consecutive falls. The Banking Index has gained more than 0.70% gains and formed a Doji candle stick pattern. The Banking Index may see some pullback rally but the sustainability of the same is the key to watch as overall sentiments.

The Bank Nifty has recorded a day’s high near 47,000 levels witnessed a profit booking from the higher levels and drifted lower below its 9 and 21 EMA on the daily time frame. The momentum oscillator RSI (14) has taken a hook turn near 40 levels but has closed below 50 only with a negative crossover.

The Banking Index has formed a back-to-back Doji candle stick pattern on the daily chart suggesting an above-average volatility. The immediate resistance is capped below 47,000 levels and the support is at 46,300 levels.

Indian markets:

- On March 21, the Sensex and Nifty 50 closed higher, buoyed by a surge in global markets driven by the US Federal Reserve’s commitment to maintaining its projection of three rate cuts this year, which bolstered investor confidence.

- Following the Fed’s announcement, all three major Wall Street indices reached new peaks. Meanwhile, in the Asia-Pacific region, Japan’s Nikkei surged to a fresh all-time high.

- In the broader market, both the BSE Midcap and BSE Smallcap indices recorded gains of over 2 percent.

- Across sectors, there was a broad-based rally, with Nifty Realty and Nifty PSU Bank witnessing the most significant gains, while Nifty Bank and Nifty FMCG saw comparatively modest increases.

Global Markets:

- On Thursday, Japan’s stock market reached new historic highs as Asian markets surged following the Federal Reserve’s decision to maintain its projection for three rate cuts this year, keeping rates steady at 5.25%-5.5% in its latest meeting.

- The Nikkei 225 in Japan closed 2.03% higher at 40,815.66, marking a fresh all-time high, while the Topix also scaled new heights, ending up 1.64% at 2,796.21.

- South Korea’s Kospi closed 2.41% higher at 2,754.86, reaching its highest level since April 2022, while the small-cap Kosdaq rose 1.44% to 904.29.

- Hong Kong’s Hang Seng index concluded 1.93% higher at 16,863.10, whereas mainland China’s CSI 300 edged down 0.12% to 3,581.09.

- In Australia, the S&P/ASX 200 gained 1.16%, closing at 7,784.9, boosted by flash data from Judo Bank indicating faster business activity expansion in March compared to the previous month.

Stocks in Spotlight

- Muthoot Finance shares surged by 6 percent following a significant rise in gold prices, spurred by dovish remarks from the US Federal Reserve. Gold prices soared to a new high of Rs 66,778 on the MCX. In the global market, spot gold experienced a robust surge as investors breathed a sigh of relief, with the Fed maintaining its projection for three rate cuts this year.

- The BSE stock witnessed a 10 percent rally after Investec revised its rating for the company to “buy”. Additionally, the brokerage set a price target of Rs 2,800, indicating an upside potential of approximately 38 percent from the previous close. Investec cited strong traction in equity derivatives volumes, anticipation of market share expansion, and stabilization in metrics as key factors propelling the upgrade.

- IRB Infra shares surged by 9 percent subsequent to Kotak Institutional Equities upgrading the stock and revising the fair value (FV) upwards. This adjustment was driven by revisions to traffic estimates for private InvIT assets.

News from the IPO world🌐

- Airtel’s unit Bharti Hexacom gets Sebi nod to raise funds through an IPO

- Sebi proposes audiovisual details of IPO disclosures

- Trust Fintech sets IPO price band at Rs 95-101; issue to open on March 26

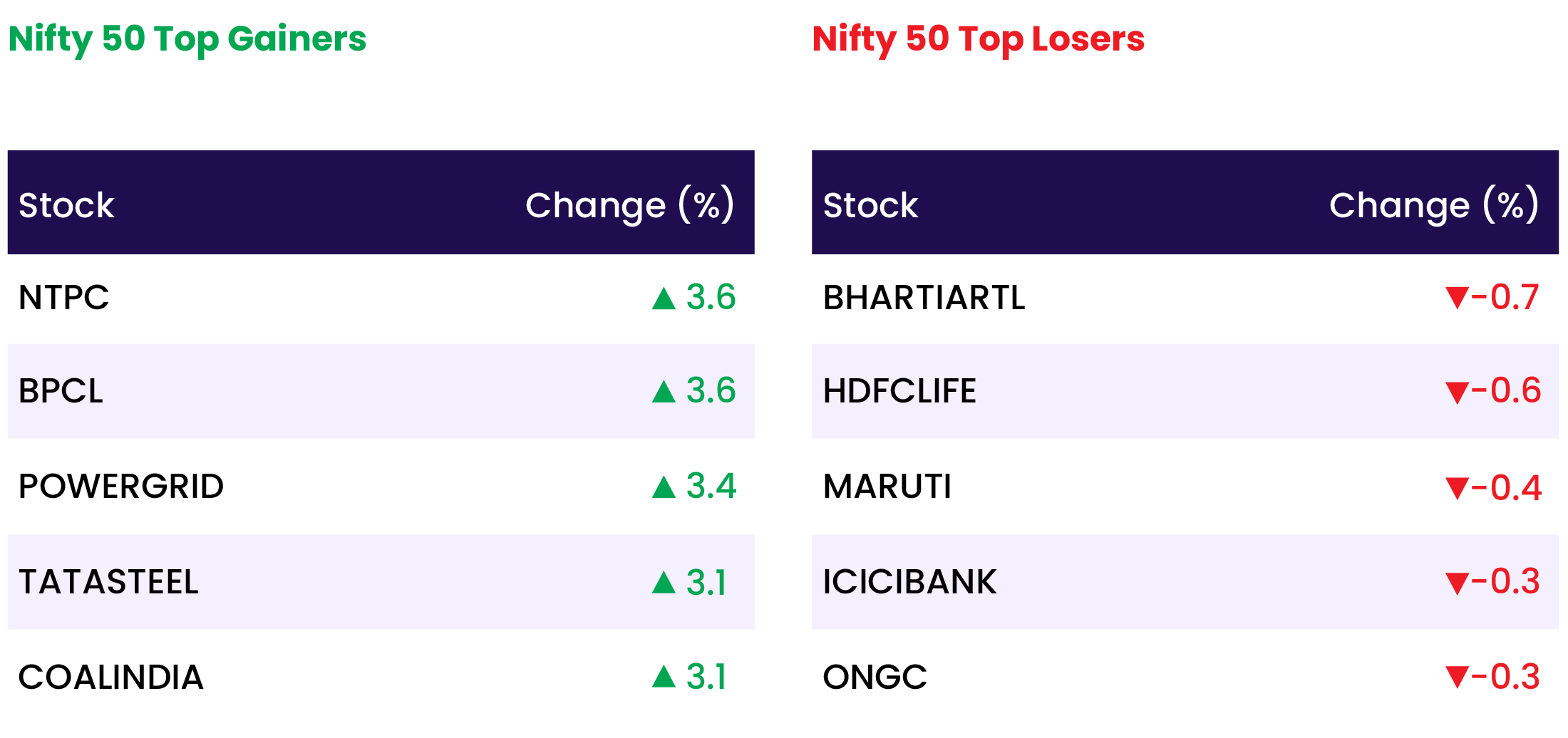

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY REALTY | 3.0 |

| NIFTY METAL | 2.4 |

| NIFTY PSU BANK | 2.1 |

| NIFTY MEDIA | 1.8 |

| NIFTY CONSUMER DURABLES | 1.5 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2758 |

| Decline | 1061 |

| Unchanged | 107 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,512 | 1.0 % | 4.8 % |

| 10 Year Gsec India | 7.1 | (0.0) % | (1.1) % |

| WTI Crude (USD/bbl) | 81 | (2.6) % | 15.5 % |

| Gold (INR/10g) | 66,503 | 1.4 % | 2.7 % |

| USD/INR | 83.00 | 0.1 % | (0.1) % |

Please visit www.fisdom.com for a standard disclaimer