Technical Overview – Nifty 50

It was carnage selling in the Indian bourses where prices witnessed one side selling and breaching the majority of its short-term supports on the daily chart. The Benchmark index on the daily chart has witnessed an ending diagonal pattern breakdown and the prices have formed a tall red candle on the daily time frame.

The Nifty50 on the daily chart has drifted below its 9 & 21 EMA and the momentum oscillator RSI (14) has given a consolidation breakdown below 50 levels with a bearish crossover. The MACD indicator has witnessed a bearish crossover above its line of polarity signals early signs of trend deterioration.

The market context has changed for now as sellers use every smaller rally as a selling opportunity. The Index has faced the worst advance-decline ratio in the past 1 year indicating a weakness.

The immediate support for the Nifty50 is placed at 21,800 levels near its 50 EMA and 22,250 will act as an immediate resistance for the index.

Technical Overview – Bank Nifty

The Bank Nifty continued to trade lower for the fourth straight day and prices have drifted near 47,000 levels and formed a bearish candle on the daily time frame. Technically both the indices witnessed a carnage selling but the Bank Index outperformed the Benchmark index in relative terms.

The Index has drifted below its 9 EMA and it is hovering near its 21 EMA on the daily time frame. The momentum oscillator RSI (14) has formed a rounding top near 65 levels and drifted lower near 50 levels with a bearish crossover on the cards.

The market context has changed for now as sellers use every smaller rally as a selling opportunity. The immediate support for the Bank Nifty is placed at 46,500 levels near its 50 EMA and 47,500 will act as an immediate resistance for the Banking index.

Indian markets:

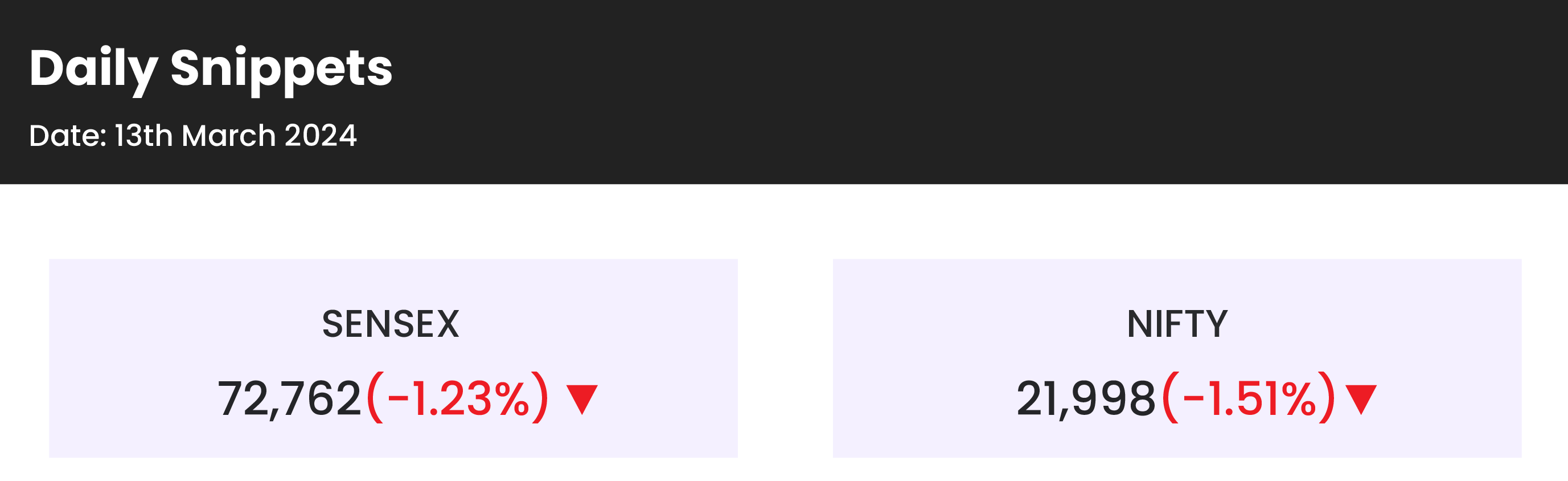

- On Wednesday, the Indian stock market witnessed a decrease of more than 1 percent, a reaction that ensued a day after the publication of US inflation data for February, indicating a marginal uptick.

- Despite the initial positive start facilitated by moderate CPI data and consistent industrial production growth, Indian benchmarks couldn’t sustain the gains. As selling pressure intensified in the latter half, the Nifty slipped below the 22,000 mark.

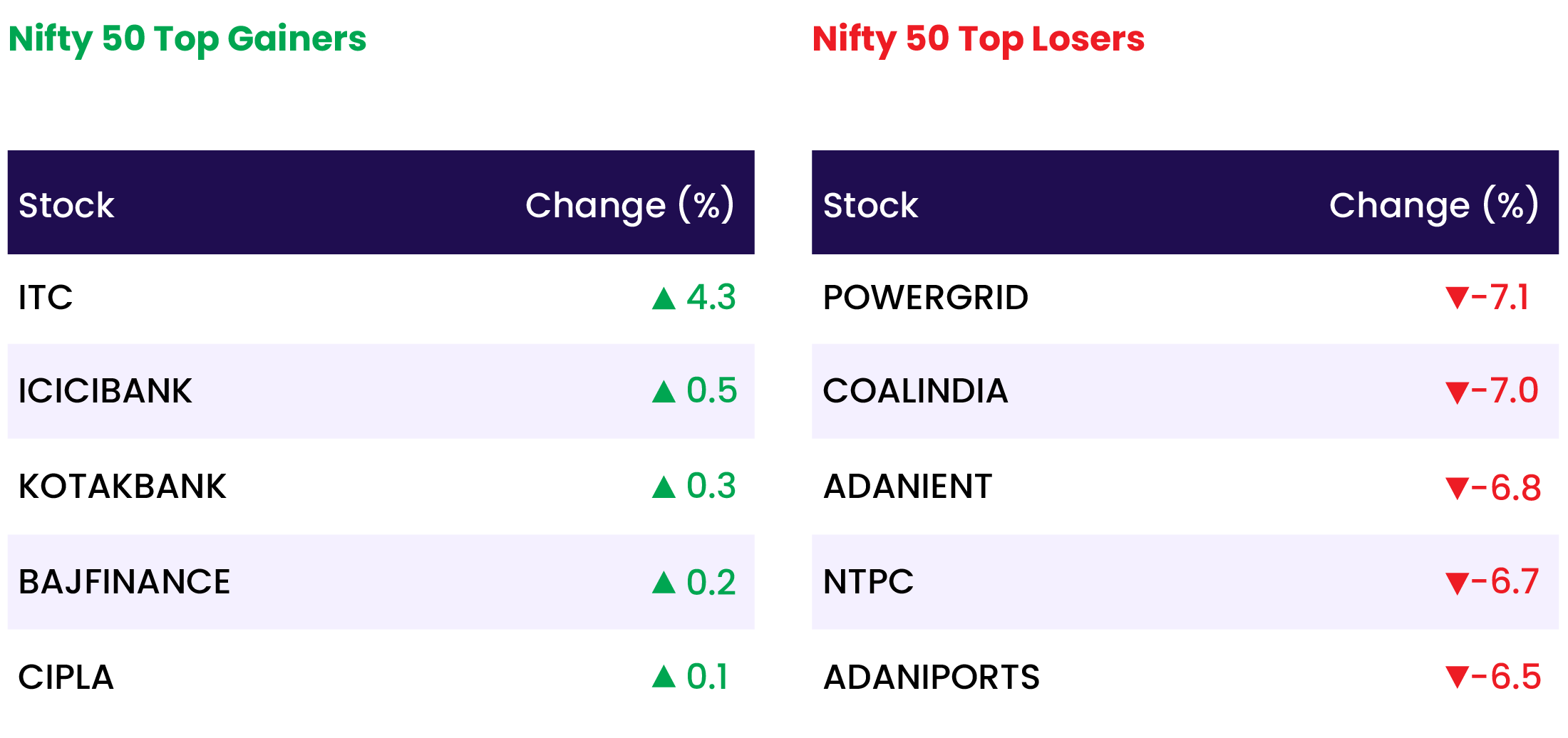

- With the exception of the IT sector, all sectoral indices concluded in negative territory. Realty, media, PSU bank, telecom, power, oil & gas, and metals sectors experienced declines ranging from 4% to 6%.

Global Markets:

- Asia-Pacific markets displayed mixed performance following a surge in Wall Street spurred by U.S. inflation data meeting expectations.

- The S&P/ASX 200 in Australia closed the day with a 0.22% gain, building on Tuesday’s positive momentum.

- Japan’s Nikkei 225, on the other hand, retreated by 0.26%, extending its three-day losing streak, while the Topix index also declined by 0.33% after an initial session of gains.

- South Korea’s Kospi rose by 0.44% as the February unemployment rate dropped to 2.6%, down from January’s 3%. The Kosdaq, a small-cap index, ended slightly higher at 889.93, breaking a three-day upward trend.

- Hong Kong’s Hang Seng index remained flat after a 3% surge on Tuesday, while the mainland CSI 300 concluded with a 0.7% decline.

- European markets started lower on Wednesday morning as investors processed the recent U.S. inflation report and U.K. gross domestic product figures.

Stocks in Spotlight

- Oil India witnessed a significant surge of 12.4 percent driven by a bullish production outlook. According to brokerage house Motilal Oswal, Oil India’s production growth guidance remains strong, bolstered by increased drilling activity and development wells in existing areas. This positive assessment contributed to the notable uptick in Oil India’s stock price.Top of Form

- ITC stock witnessed a growth of over 4 percent subsequent to British American Tobacco’s divestment of a 3.5 percent stake in the company. Analysts suggest that the stock, which had previously declined by 20 percent following BAT’s stake sale news, is now trading at appealing valuations.

- Jubilant FoodWorks shares experienced a 3 percent decrease as brokerages had varying opinions on the company’s recent acquisition of Turkey (DP Eurasia) and Bangladesh businesses. Analysts expressed concern about the company’s increasing debt-book, particularly in light of their plans to expand Domino’s and Popeyes outlets in India.

- Macrotech Developers’ shares took a hit with a 10 percent decline, a day after promoter Sambhavnath Infrabuild and Farms sold 49.7 lakh shares, equivalent to a 0.5 percent stake, in the developer at an average price of Rs 1,180.02 per share. The total transaction was valued at Rs 586.72 crore.

News from the IPO world 🌐

- Shares worth $21 billion to enter market in 4 months as IPO lock-in period expires for 66 companies

- Vishal Mega Mart planning $1 billion IPO

- Kolkata-based Rungta Greentech files DRHP with NSE Emerge for IPO

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY FMCG | 0.1 |

| NIFTY BANK | -0.6 |

| NIFTY FINANCIAL SERVICES | -0.7 |

| NIFTY PRIVATE BANK | -0.7 |

| NIFTY IT | -0.8 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 400 |

| Decline | 3516 |

| Unchanged | 60 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,005 | 0.6 % | 3.4 % |

| 10 Year Gsec India | 7.0 | 0.2 % | (1.7) % |

| WTI Crude (USD/bbl) | 78 | (0.6) % | 10.2 % |

| Gold (INR/10g) | 65,420 | 0.1 % | 1.8 % |

| USD/INR | 82.75 | 0.0 % | (0.4) % |

Please visit www.fisdom.com for a standard disclaimer