Technical Overview – Nifty 50

A sharp V shape recovery is being witnessed in the Benchmark Index where prices registered their day low at 22,224 levels and posted that reverse smartly and closed with 100 pints gains. The Index on the daily chart has taken support near 9 EMA and reverse post that.

The Nifty50 is trading in a higher high higher low formation with a bullish stance and presently reached the upper band of the rising wedge pattern. On the daily chart, the Nifty has again formed a bullish candle stick pattern with a long tail indicating a reversal from the lower levels.

On the weekly chart, the Index has given a bullish breakout of a consolidation pattern and prices are trading above the upper band of the range. It’s a buy-on-dips market presently and any dip towards 22,300 can be utilized as a fresh buying opportunity. The immediate resistance is likely to be capped near 22,600 levels.

Technical Overview – Bank Nifty

The Banking Index continues to outperform the Benchmark Index and trade above 47,500 levels on the daily time frame. Post-second-half prices suddenly spiked on the higher side and moved above 47,900 levels.

The Bank Nifty on the daily chart has given a cup and handle pattern breakout and the index is trading above the upper band of range. The Banking Index is trading above its 9, 21, and 50 EMA, and the slope of the average is moved higher indicating a bullish stance. The prices on the weekly chart are trading in a rising wedge pattern and prices have reversed from the lower levels of the pattern.

It’s a buy-on-dips on Bank Nifty presently and any dip towards 47,500 which be utilized as a fresh buying opportunity. The immediate resistance is likely to be capped near 48,500 levels.

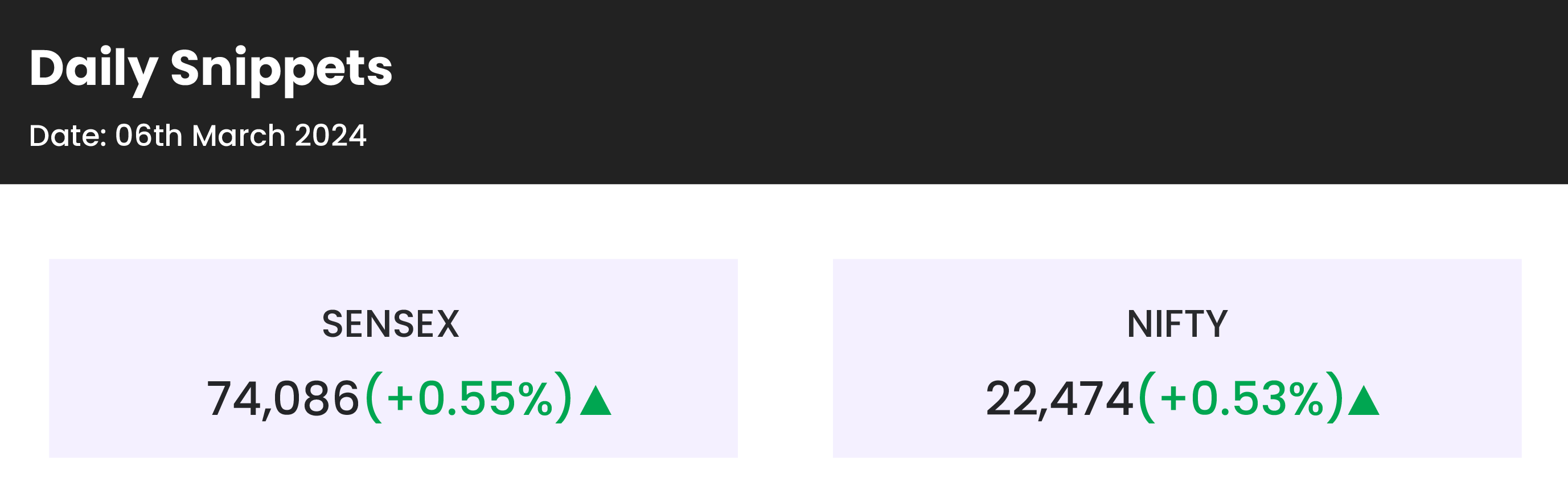

Indian markets:

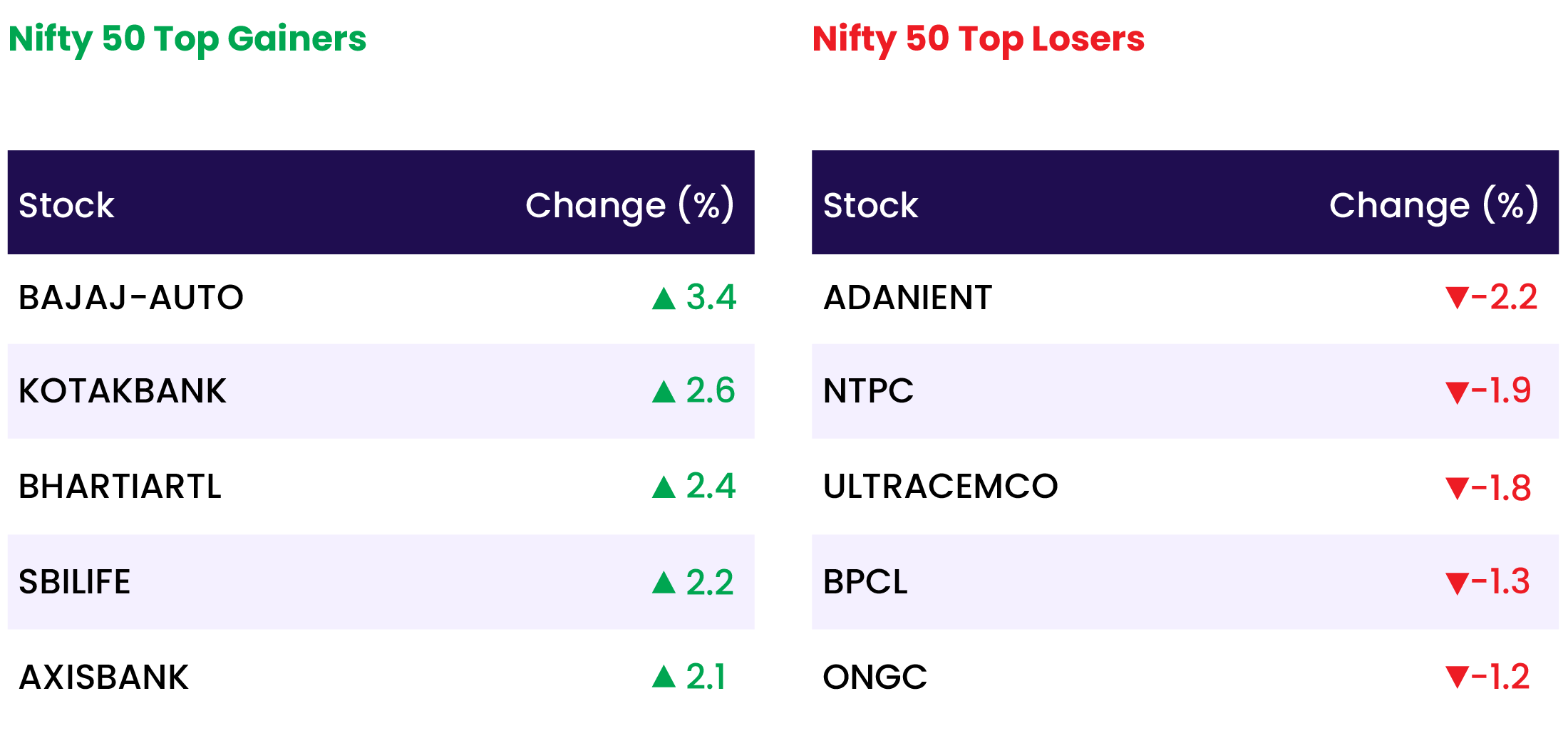

- The domestic market benchmark, the Sensex, hit a fresh record high, surpassing the coveted 74,000 mark for the first time, while the Nifty 50 also reached a new peak in intraday trading on Wednesday.

- After a weak start, market traded in the red for most of the session but final hour buying, especially in banking, IT and pharma names pushed them to new peaks.

- Among sectors, bank index was up 1 percent, while pharma and IT indices were up 0.7 percent each. On the other hand, oil & gas, power and realty were down a percent each.

Global Markets:

- Asia-Pacific markets were mixed Wednesday, with Hong Kong stocks leading gains in the region and up over 2%. Mainland Chinese stocks slid, sending the CSI 300 down 0.6%, after a tech slide on Wall Street led by Apple, following a report that iPhone sales dropped in China.

- MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.21% lower. Japan’s Nikkei fell 0.20% as investors took some profit after the index hit record peaks this week.

- European markets turned higher Wednesday as investors in the U.K. prepare for the 2024 budget statement.

Stocks in Spotlight

- Oil India witnessed a significant surge of 12.4 percent driven by a bullish production outlook. According to brokerage house Motilal Oswal, Oil India’s production growth guidance remains strong, bolstered by increased drilling activity and development wells in existing areas. This positive assessment contributed to the notable uptick in Oil India’s stock price.Top of Form

- IIFL Finance shares experienced a second consecutive lower circuit, plummeting by 20% following the RBI’s prohibition on the company issuing gold loans. Jefferies downgraded the stock to a ‘hold’ rating and reduced the target price from Rs 765 to Rs 435.

- Tata Chemicals observed a strong uptick of 11.39% in its stock, accompanied by substantial trading volumes. The total trading activity reached two crore shares, surpassing the monthly daily average of 15 lakh.

- KPI Green Energy’s stock saw an increase of 2.87% after the company announced securing four solar projects totaling 9.40 megawatts. The company will manage a 5 MW capacity, while the remaining 4.40 MW will be handled by its wholly-owned subsidiary, KPIG Energia.

- Sun Pharmaceuticals’ shares rose by 1.96% amid reports that the US Food and Drug Administration had granted approval to the company’s Ankleshwar API (Active Pharmaceutical Ingredients) unit for manufacturing and export.

News from the IPO world

- Shares worth $21 billion to enter market in 4 months as IPO lock-in period expires for 66 companies

- Gopal Snacks IPO subscribed 0.21 times so far on Day 1

- Popular Vehicles sets price band of Rs 280-295 for its Rs 602-crore IPO on March 12

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PRIVATE BANK | 0.9 |

| NIFTY HEALTHCARE INDEX | 0.8 |

| NIFTY BANK | 0.8 |

| NIFTY IT | 0.8 |

| NIFTY PHARMA | 0.6 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 904 |

| Decline | 2954 |

| Unchanged | 82 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,585 | (1.0) % | 2.3 % |

| 10 Year Gsec India | 7.1 | 0.0 % | (1.6) % |

| WTI Crude (USD/bbl) | 79 | (1.5) % | 11.9 % |

| Gold (INR/10g) | 64,629 | (0.1) % | 1.5 % |

| USD/INR | 82.90 | 0.1 % | (0.2) % |

Please visit www.fisdom.com for a standard disclaimer