Technical Overview – Nifty 50

It was an extremely volatile monthly expiry day where traders were always on their toes as prices kept floating in either direction without any specific direction bias. Despite the super volatile month, the Benchmark index closed one percent higher and formed a spinning top candle stick pattern on the monthly chart.

The Nifty50 on the daily chart is trading in a rising wedge pattern and presently the index is trading near the lower band of the pattern. The Index has closed below 21 EMA but manages to trade marginally above 50 EMA.

The momentum oscillator RSI (14) on the daily chart is reading within the rectangle pattern between 50- 65 levels. The MACD is reading above its line of polarity but has given a negative crossover.

The immediate support for the Nifty50 is placed at 21,800 levels near the lower band of the wedge pattern and a move above 22,050 levels will push the price higher towards 22,200 levels.

Technical Overview – Bank Nifty

The Bank Nifty continued to trade with super volatility and prices the prices have failed its triangle pattern breakout as prices have closed below the pattern indicating a whipsaw on the daily chart. Despite the super volatile month, the Bank Nifty index closed half a percent higher and formed a Doji stick pattern on the monthly chart.

The Bank Nifty on the weekly chart is trading in a rising wedge pattern and presently the index is trading near the lower band of the pattern. The Index has closed marginally above the 21 EMA. The momentum oscillator RSI (14) on the daily chart is reading near 50 levels suggesting a lack of momentum.

The View for the Banking Index remains as a sell on rise and an immediate resistance for the index is placed at 46,500 levels and a move below 45,800 will drag the index further lower to 45,300 levels.

Indian markets:

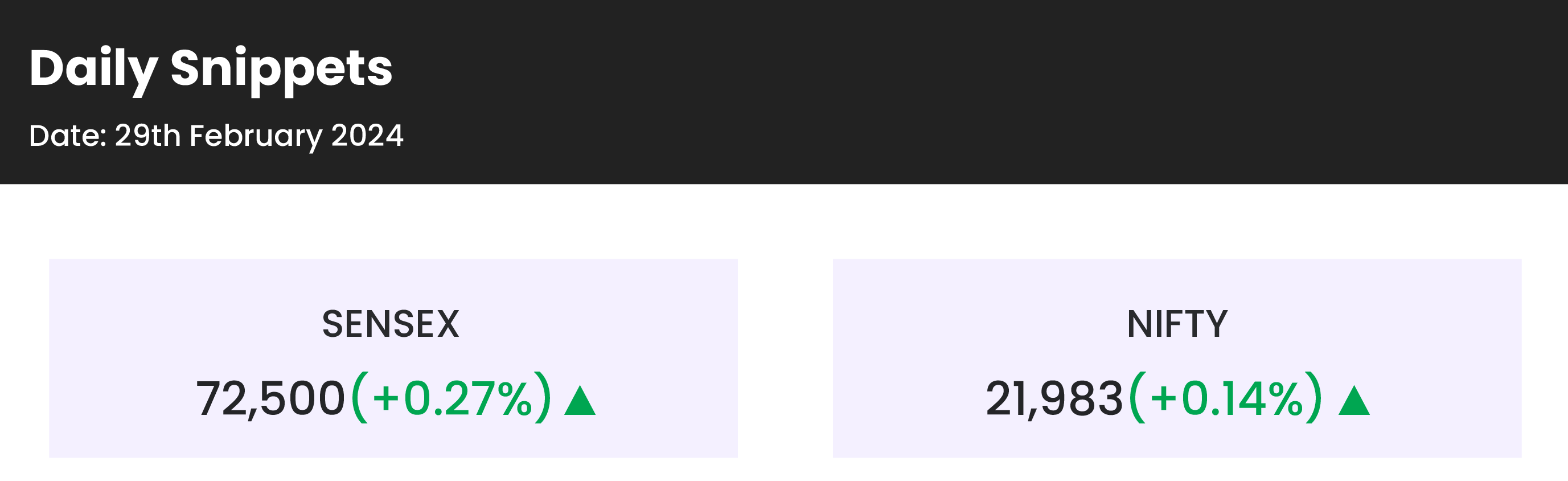

- Domestic equity benchmark indices, the Sensex and Nifty 50 closed positively in Thursday’s trading session despite significant volatility and a blend of diverse global signals.

- While the market started the day with a steady performance, it witnessed a recovery in the final hours. Given that it was the concluding day of the monthly expiry, trading remained characterized by notable fluctuations throughout the day.

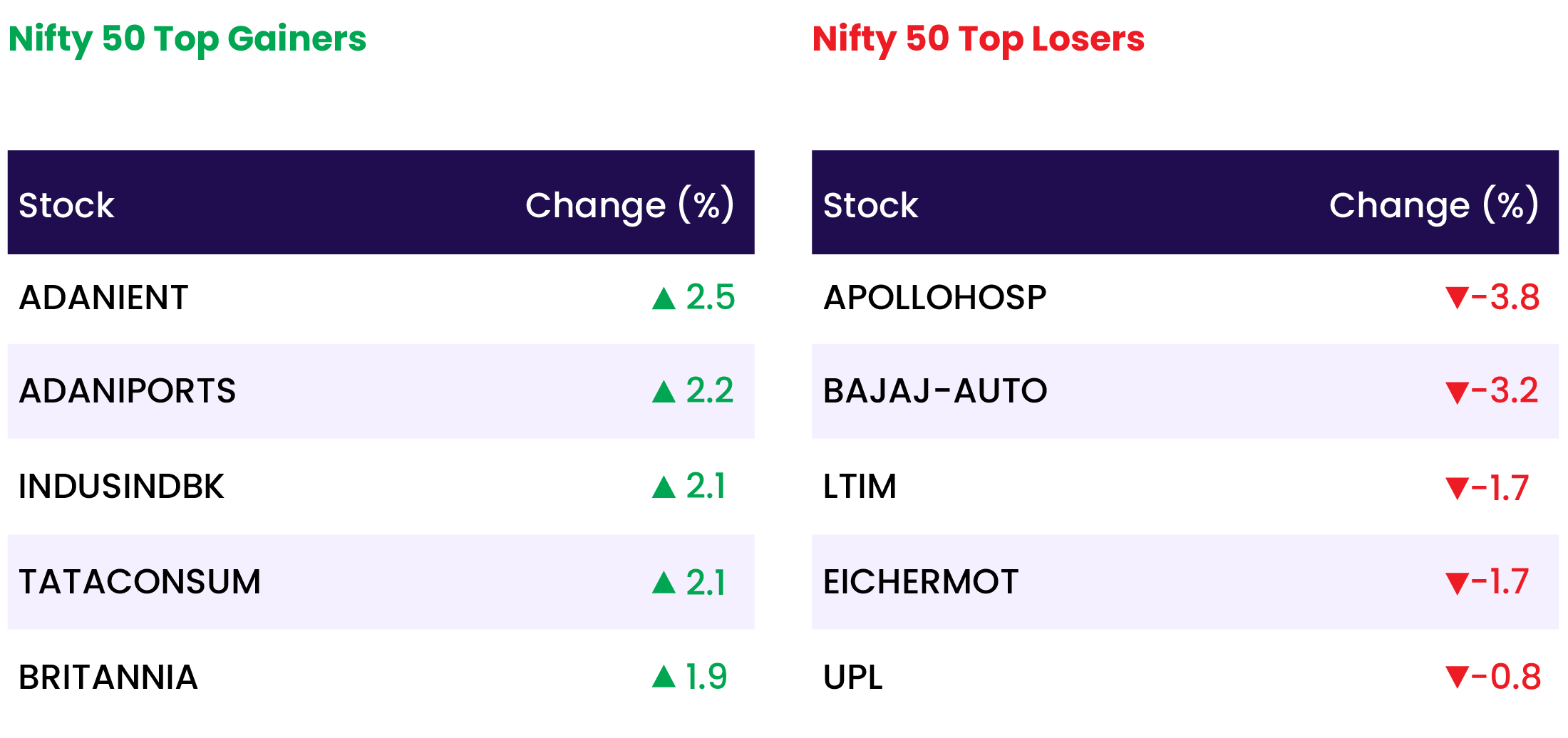

- Sector wise, Nifty PSU Bank led the gains, rising over one percent. It was followed by Nifty Metal, Pharma and Bank indices. Meanwhile, Nifty Media and Healthcare led the losses, falling up nearly 1 percent. Nifty IT also ended in the red.

Global Markets:

- Asian equities were mostly weaker on Thursday, while the dollar and U.S. Treasuries were largely steady ahead of crucial U.S. inflation data that could provide fresh clues on when the Federal Reserve will cut interest rates.

- South Korea’s Kospi declined 0.54%, while Taiwan and Australia benchmarks were flat.

- European markets were cautiously higher Thursday morning as investors look ahead to key inflation reports in both the U.S. and Europe.

- Wall Street futures pointed marginally lower, following declines for all three major indexes overnight. S&P 500 futures pointed down 0.04% and Nasdaq futures fell 0.06%.

Stocks in Spotlight

- Oil India witnessed a significant surge of 12.4 percent driven by a bullish production outlook. According to brokerage house Motilal Oswal, Oil India’s production growth guidance remains strong, bolstered by increased drilling activity and development wells in existing areas. This positive assessment contributed to the notable uptick in Oil India’s stock price.Top of Form

- Shares of BEML declined 3.7 percent even after the company won an order worth Rs 72.71 crore from Eastern Coalfields Limited for BH100 Rear dumper. This took the stock’s decline to two consecutive sessions after it gained 9 percent on February 27.

- Lumax Auto Technologies Share soared 6 percent after a deal worth Rs 134.50 crore took place on the exchanges. Around 30 lakh shares, representing a 4.4 percent stake in the company changed hands at an average price of Rs 455 per share. The floor price of the deal reflected a 1 percent discount to the stock’s previous closes

- Olectra Greentech experienced a 2.76 percent decline as investors took profits, following the stock’s previous session gains driven by securing a Rs 4,000 crore contract from Brihanmumbai Electricity Supply and Transport Undertaking (BEST) for the provision, operation, and maintenance of 2,400 electric buses.Top of Form

- Shares of Suzlon Energy gained 4.98 percent after the company won a 30-MW wind power project for EDF Renewables. The project is located in Gujarat and the company will install 10 wind turbine generators (WTGs) with a Hybrid Lattice Tubular (HLT) tower and a rated capacity of 3 MW each.

News from the IPO world 🌐

- JG Chemicals’ Rs 251-crore IPO to open on March 5

- Platinum Industries IPO picks up pace on Day 3

- Mukka Proteins IPO fully subscribed on strong retail interest

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PSU BANK | 1.3 |

| NIFTY METAL | 0.9 |

| NIFTY PRIVATE BANK | 0.4 |

| NIFTY FMCG | 0.4 |

| NIFTY BANK | 0.3 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1896 |

| Decline | 1893 |

| Unchanged | 120 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,949 | (0.1) % | 3.3 % |

| 10 Year Gsec India | 7.1 | 0.2 % | (1.4) % |

| WTI Crude (USD/bbl) | 79 | (0.4) % | 11.6 % |

| Gold (INR/10g) | 61,930 | 0.2 % | (1.4) % |

| USD/INR | 82.89 | 0.0 % | (0.2) % |

Please visit www.fisdom.com for a standard disclaimer