Technical Overview – Nifty 50

The Indian benchmark index reached a new all-time high at 22,297 and ended the week with a more than half percent gains. The Index opened with mild losses on Monday but the selling got extended and the prices broke 22,100 levels but witnessed a V shape reversal and partially covered the losses, which still ended in red.

Technically the Index is hovering near the breakout levels on the daily chart and the volatility factor is getting impacted. Overall, the index is trading above its 9, 21, and 50 EMA on the daily chart, adding a safety cushion for the prices. The momentum oscillator RSI (14) is hovering near 60 levels suggesting a bullish to sideways stand.

The India VIX rallied more than 4 percent in the day but has closed above 15 levels which will keep a volatility factor alive. The immediate support for the Nifty is placed at 22,000 and the immediate resistance is capped below 22,300 – 22,400 levels.

Technical Overview – Bank Nifty

The Banking Index on the daily chart has given a triangle pattern breakout and the prices closed above the upper band of the range after facing an above-average volatility. The Bank Nifty on the intraday chart continued to hover above the support levels.

The prices on the weekly time frame are trading above their 21 and 50 EMA and it is taking support near the lower band of the rising wedge pattern and moving higher. The momentum oscillator RSI (14) is hovering near 50 levels suggesting a bullish to sideways stand.

Technically speaking, Bank Nifty’s technical picture on the daily chart shifts to bullish from neutral amidst bullish breakout technical conditions on the daily charts. Immediate support for now is near 46,200 levels while resistance is near 47,200 levels.

Indian markets:

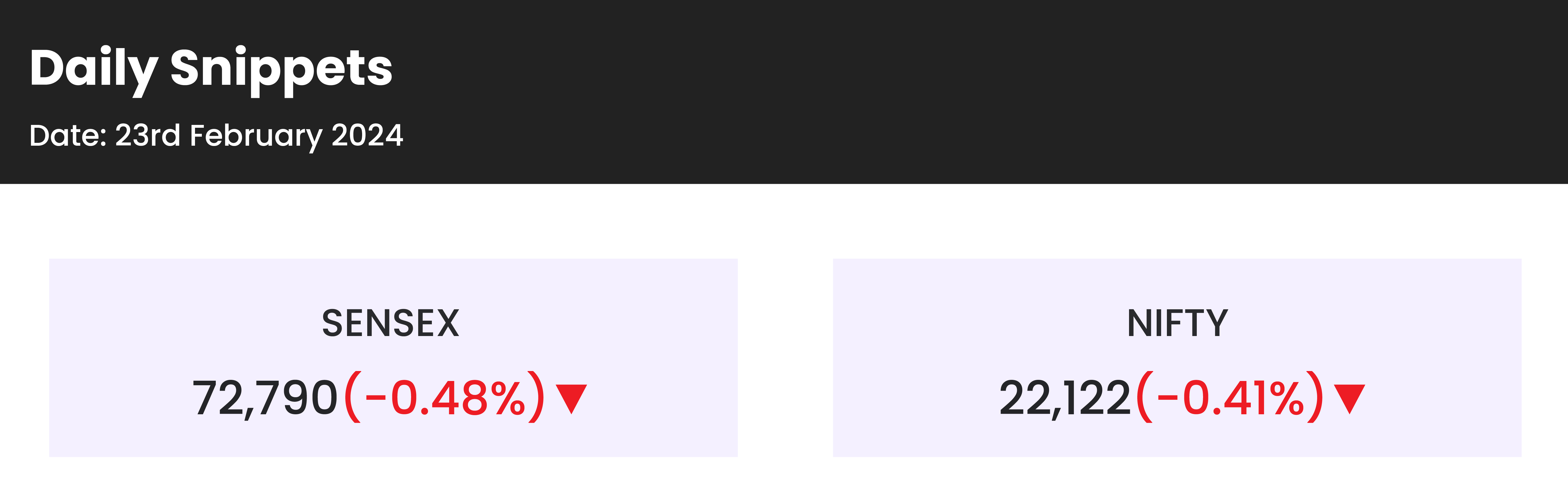

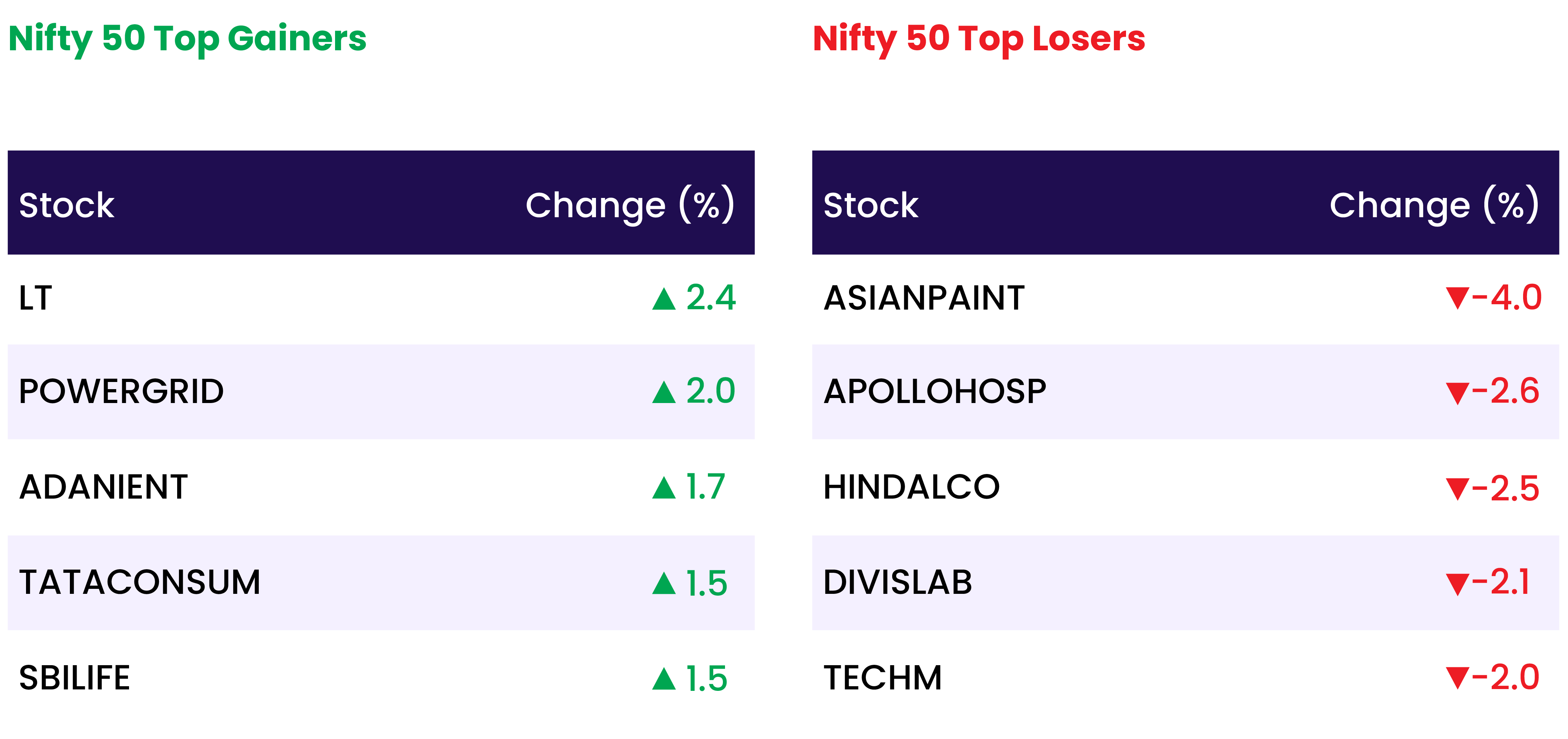

- The Sensex and the Nifty 50, India’s domestic benchmark equity indices, closed Monday’s session in negative territory, primarily influenced by declines in information technology (IT), metals, pharma, and bank stocks. This downward trend coincided with weak global indicators preceding crucial macroeconomic data releases.

- IT stocks experienced a 1.17% drop as investors braced for a substantial U.S. inflation report expected later in the week, which could potentially influence the Federal Reserve’s future interest rate decisions.

- Given that a significant portion of IT companies’ revenue originates from the U.S., this news weighed heavily on the sector. With anticipation building for significant inflation updates from Europe and Japan later in the week, Asian markets maintained a subdued stance.

Global Markets:

- Asian shares were taking a breather near seven-month highs on Monday as investors awaited inflation data from the United States, Japan and Europe that will help refine expectations for future rate moves.

- Early Monday, S&P 500 futures and Nasdaq futures were both trading 0.1% lower.

- MSCI’s broadest index of Asia-Pacific shares outside Japan was little changed, having climbed 1.7% last week to seven-month highs.

- The gains were thanks in large part to a rally in Chinese stocks, which have jumped almost 10% in as many sessions on hopes for more aggressive stimulus.

- Japan’s Nikkei rose 0.5%, having climbed 1.6% last week to clear its previous record high as bulls look to test the 40,000 barriers.

Stocks in Spotlight

- Oil India witnessed a significant surge of 12.4 percent driven by a bullish production outlook. According to brokerage house Motilal Oswal, Oil India’s production growth guidance remains strong, bolstered by increased drilling activity and development wells in existing areas. This positive assessment contributed to the notable uptick in Oil India’s stock price.Top of Form

- Paytm parent One 97 Communications Ltd gained 5 percent to be locked in the upper circuit again on February 26, the sixth time in the past seven sessions, continuing to recover from its all-time low of Rs 318.05 following RBI’s restrictions on its banking arm.

- RITES gained 2.42 percent after IIT Bhubaneswar appointed the company as project management to develop a permanent campus in Odisha. The estimated project cost, including the PMC fees, is estimated at Rs 414 crore, excluding GST.

- Olectra Greentech experienced a 2.76 percent decline as investors took profits, following the stock’s previous session gains driven by securing a Rs 4,000 crore contract from Brihanmumbai Electricity Supply and Transport Undertaking (BEST) for the provision, operation, and maintenance of 2,400 electric buses.Top of Form

- Skipper stock surged 3.62 percent after the company signed a Rs 737-crore contract with Power Grid Corporation of India. The power transmission & distribution structures manufacturer bagged the order for design, supply and construction of 765 kV transmission line project.

News from the IPO world 🌐

- Tata Group eyes mega $1-2 billion IPO for its EV business

- EV charger maker Exicom Tele systems IPO to open on Feb 27th

- Chinese companies axe IPO plans amid listing scrutiny

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY OIL & GAS | 0.1 |

| NIFTY AUTO | 0.1 |

| NIFTY REALTY | 0.1 |

| NIFTY FMCG | 0.0 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1665 |

| Decline | 2312 |

| Unchanged | 131 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,132 | 0.2 % | 3.8 % |

| 10 Year Gsec India | 7.1 | (0.2) % | (1.9) % |

| WTI Crude (USD/bbl) | 76 | (2.7) % | 8.7 % |

| Gold (INR/10g) | 61,800 | (0.2) % | (1.5) % |

| USD/INR | 82.89 | (0.0) % | (0.2) % |

Please visit www.fisdom.com for a standard disclaimer