Technical Overview – Nifty 50

The bears charged with super speed post-lunch trading session and drifted more than 150 points from the high and have formed a bearish engulfing candle stick pattern after registering lifetime high levels.

The prices have drifted below the breakout levels and again entered the pattern. The RSI has formed a high near 65 levels and hooked lower. The bearish candle has engulfed its previous two days’ candle suggest and intensified selling in the index.

The Index still holds above its 9 EMA which is placed at 22,000 levels. The support for the Nifty50 stands at 21,900 levels and resistance is capped below 22,200 levels and the view remains sideways.

Technical Overview – Bank Nifty

The Bank Nifty continued to trade with volatility and prices were facing resistance at higher levels. The Banking index has too formed a bearish candle but has outperformed the Nifty50.

The Bank Nifty on the daily chart has witnessed a bullish golden crossover where 9 EMA and crossed above 21 EMA indicating a bullish momentum in the index.

As The index has sustained above its psychological resistance of 47,000 levels the trend looks more convincing at present levels. The next resistance for the Bank Nifty is placed at 48,000 levels and support is placed near 46,200 levels.

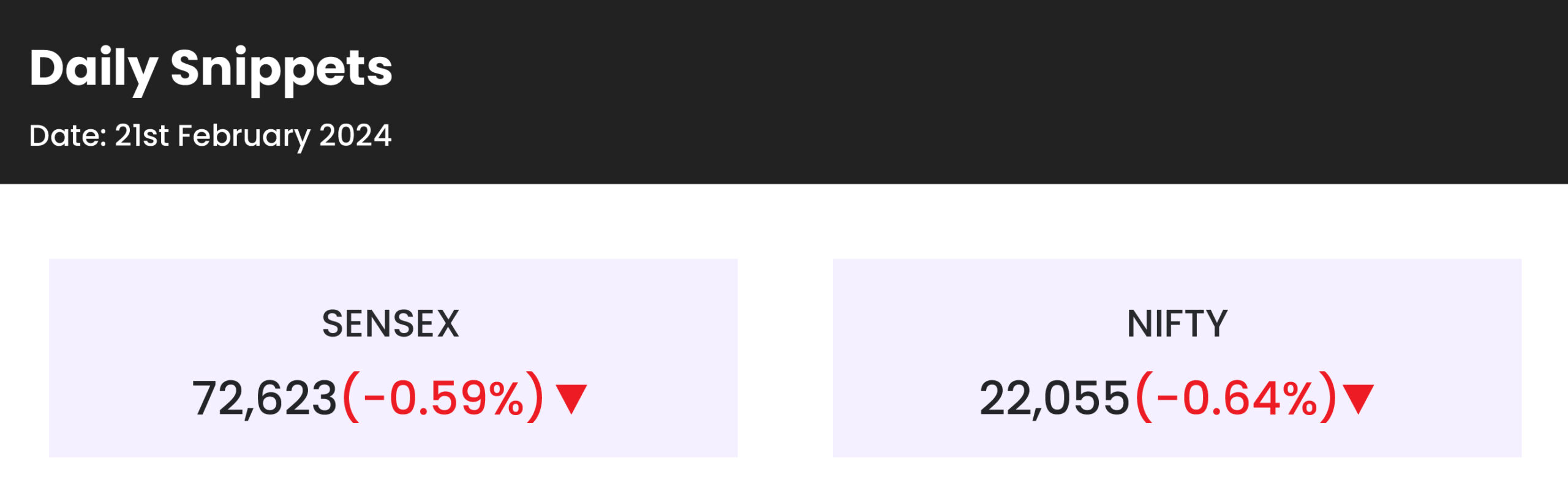

Indian markets:

- Domestic benchmark indices halted their six-day winning streak on February 21 due to profit booking by traders.

- IT and oil & gas sectors exerted significant downward pressure on the indices.

- Investor sentiment turned cautious in anticipation of the US Fed’s last meeting minutes.

- Profit-taking was observed in IT, oil & gas, power, and metals sectors.

- The market’s winning streak of six sessions came to an end.

- There’s anticipation that the US Fed may maintain its hawkish stance on interest rates until inflation moderates further, as indicated in the meeting minutes.

Global Markets:

- European stocks displayed a mixed performance on Wednesday, indicating a struggle to gather positive momentum in regional markets.

- Hong Kong stocks surged over 3%, contrasting with mixed trading in wider Asia-Pacific markets overnight, which followed losses on Wall Street on Wednesday.

- Investors analyzed Japan’s trade data and noted a downturn in business sentiment among large manufacturers.

- U.S. stock futures dipped on Tuesday night following a second consecutive day of losses, driven by a decline in Nvidia.

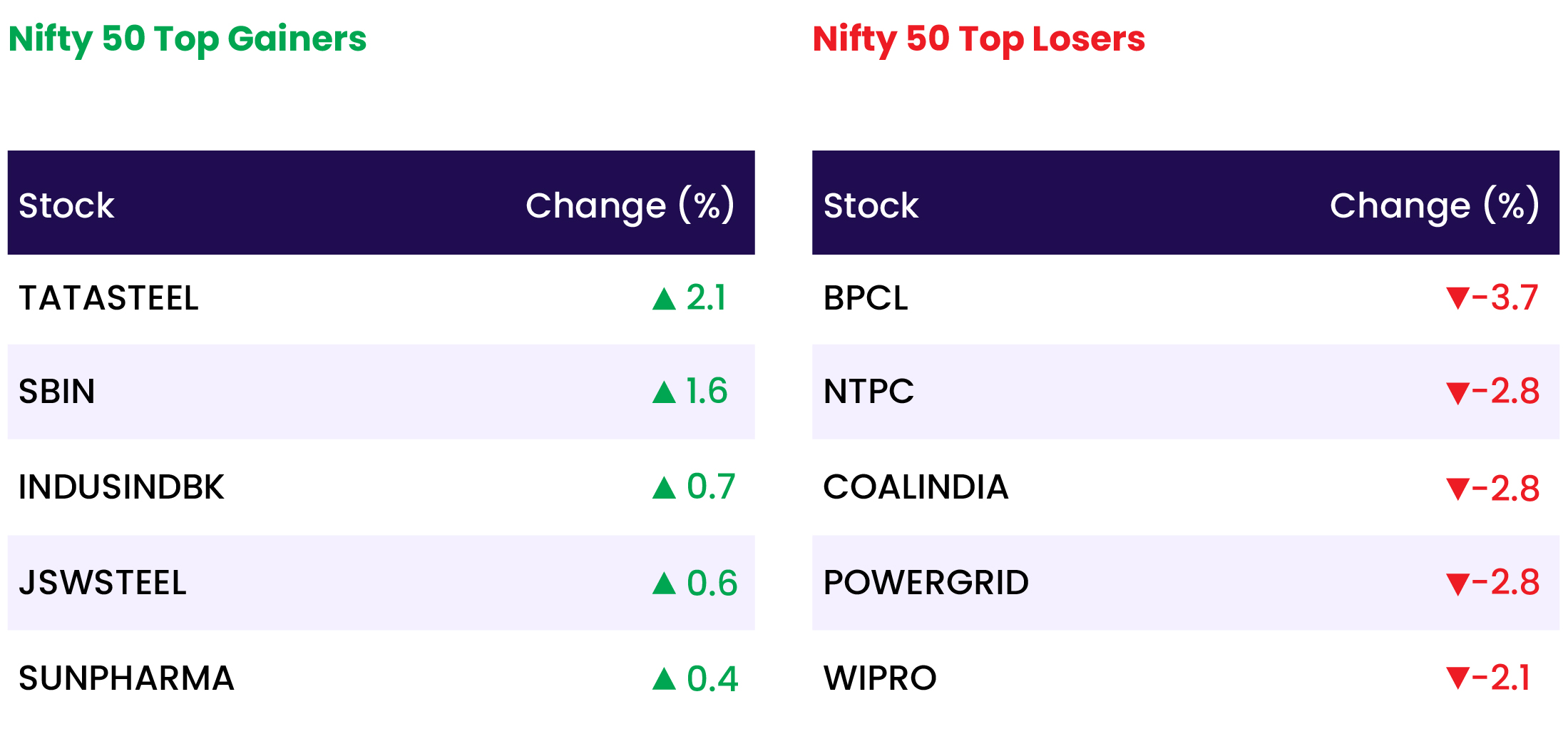

Stocks in Spotlight

- Oil India witnessed a significant surge of 12.4 percent driven by a bullish production outlook. According to brokerage house Motilal Oswal, Oil India’s production growth guidance remains strong, bolstered by increased drilling activity and development wells in existing areas. This positive assessment contributed to the notable uptick in Oil India’s stock price.Top of Form

- Tata Steel and other steel companies experienced gains attributed to the surge in coking coal prices, a crucial raw material utilized in steel production via the blast furnace route. Industry executive Bimlendra Jha highlighted in September 2023 that steel prices in India were on the rise due to the rapid escalation of coking coal rates.

- DLF witnessed a 2.73 percent rally following the announcement that its wholly-owned subsidiary, DLF Home Developers, had entered into a private agreement with Axis Trustee Services and IREO Private. The agreement entails the acquisition of a land parcel in Gurugram for Rs 1,241 crore.

- Zee Entertainment witnessed a significant plunge of 14.02 percent following a report by Bloomberg revealing that the Securities and Exchange Board of India (Sebi) had uncovered potential diversion of about $241 million from the company. The report indicated ongoing discussions between Sebi and senior officials at Zee, including its founders Subhash Chandra and his son Punit Goenka, along with certain board members, aimed at clarifying their position on the matter.

News from the IPO world🌐

- IPO bound Ola Electric slashes prices of e-scooters by up to Rs. 25000

- Hyundai seeks expansion higher valuation with India IPO

- Platinum Industries IPO opens on Feb 27th

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY REALTY | 2.0 |

| NIFTY PSU BANK | 0.6 |

| NIFTY METAL | 0.3 |

| NIFTY FMCG | 0.0 |

| NIFTY BANK | -0.2 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1467 |

| Decline | 2374 |

| Unchanged | 101 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,564 | (0.2) % | 1.8 % |

| 10 Year Gsec India | 7.1 | (0.5) % | (1.6) % |

| WTI Crude (USD/bbl) | 78 | 0.1 % | 8.6 % |

| Gold (INR/10g) | 61,780 | 0.2 % | (1.5) % |

| USD/INR | 82.8 | (0.2) % | (0.4) % |

Please visit www.fisdom.com for a standard disclaimer