Technical Overview – Nifty 50

It was a dramatic turnaround from the Benchmark Index after witnessing a gap-down opening of more than 150 points and eventually reversed 300 points from the low and formed a tall green candle on the daily chart.

The Nifty50 has engulfed its previous three days’ candles and formed a tall bullish candle near the support levels. Currently, the Nifty has taken support near the upward-slanting trend line and has closed higher even after opening below the trend line.

The momentum oscillator and the MACD indicator stand still at neutral levels but the prices have crossed above its 9 & 21 EMA which was acting as a hurdle for the past few days.

The bias has turned to a buy on dips immediate support is placed at 21,600 levels and resistance is capped below 22,100 levels.

Technical Overview – Bank Nifty

The Banking Index witnessed a more than 500 points gap down opening but the bears short leaved as the index started to trade in a higher high formation and witnessed an V shape reversal from the lower levels. The Bank Nifty formed a bullish candle on the daily chart but lost 200 points from the top due to volatility.

The Bank Nifty has moved above its 9 & 21 EMA but closed below its 50 EMA which is placed at 46,050 levels. The momentum oscillator and the MACD indicator stand still at neutral levels but indicate a strength from the lower levels.

On the weekly chart, the Banking index is forming a hammer candle formation and if the index sustains this pattern then we may see a reversal from the lower levels. The bias has turned to a buy on dips immediate support is placed at 45,500 levels and resistance is capped below 46,400 levels.

Indian markets:

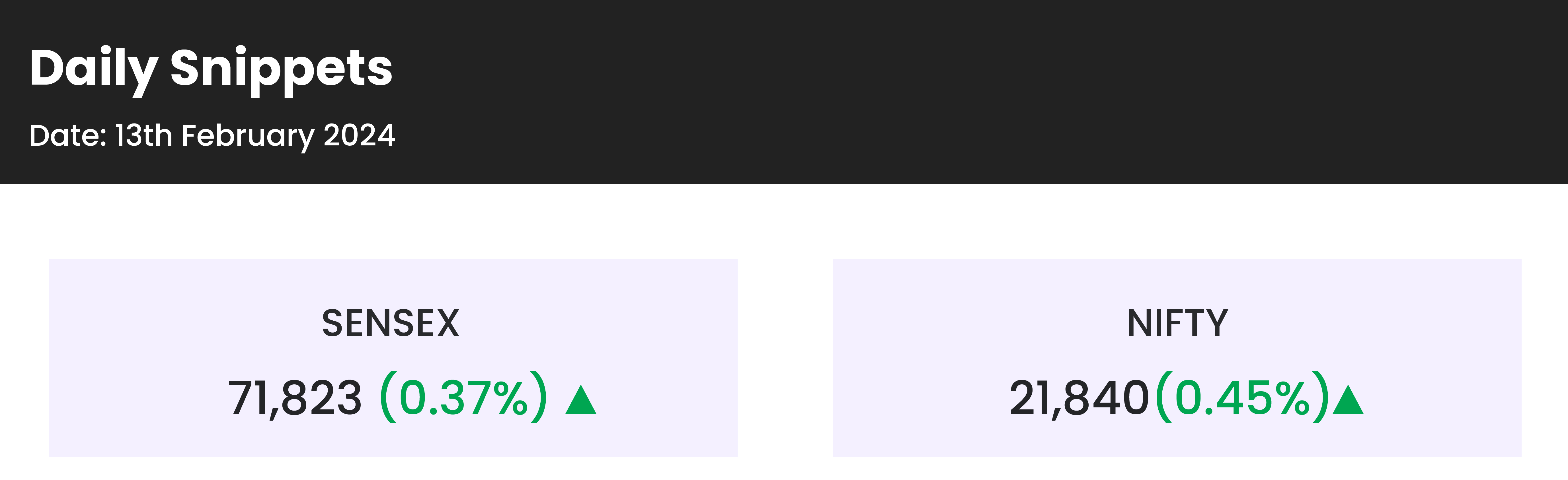

- The market displayed a notable recovery on February 14, ending higher driven by gains in SBI and other PSU banks despite a highly volatile session.

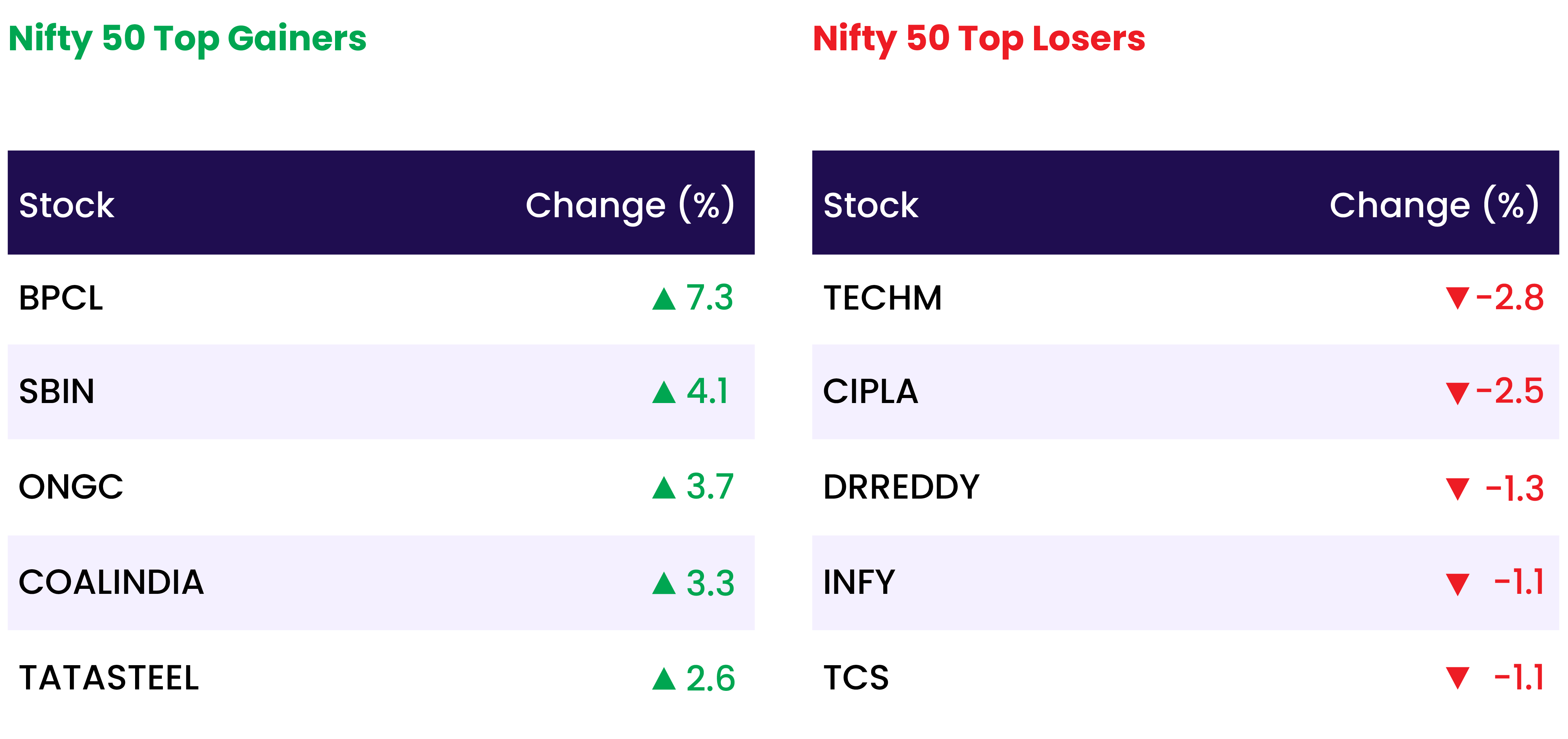

- Across sectors, PSU bank and oil & gas indices surged by 3 percent each, while auto, bank, FMCG, capital goods, metal, power, and realty sectors all witnessed gains of 1.2 percent each.

- Despite weak global cues, the markets exhibited significant resilience, with a nearly half-percent gain.

- Although Nifty initially opened gap-down, tracking weak US markets, a strong recovery in select heavyweights not only offset losses but also facilitated the index to close near the day’s high.

Global Markets:

- European markets concluded lower on Tuesday, with investors analyzing incoming corporate earnings reports and monitoring a key U.S. inflation release.

- Losses intensified following the announcement of new U.S. inflation figures for January, which exceeded expectations. Stubbornly high shelter prices exerted pressure on consumers.

- The unexpected rise in inflation suggests that the U.S. Federal Reserve might adopt a more cautious approach regarding interest rate cuts, diverging from the market’s expectations of swift and substantial cuts.

Stocks in Spotlight

- Reliance Industries Ltd (RIL) has achieved a historic milestone by becoming the first Indian company to reach a market value of Rs 20 lakh crore. This achievement marks a significant journey for RIL, which took 12 years to escalate from Rs 1 lakh crore in 2005 to Rs 10 lakh crore in 2017, and an additional five years to double to Rs 20 lakh crore. Along the way, RIL demonstrated remarkable growth, doubling its market capitalization to Rs 2 lakh crore within 418 days from August 2005, and then doubling again to Rs 4 lakh crore within approximately six months by October 2007. Another milestone was attained a decade later in July 2017 when its market cap reached Rs 5 lakh crore.

- Top of Form

- Garden Reach Shipbuilders and Engineers saw a 2.5 percent increase at the opening following the announcement of its financial results. The shipbuilding and repairing company reported a substantial 38 percent year-on-year rise in net profit, reaching Rs 88.3 crore, while revenue surged by 32.1 percent to Rs 923.1 crore. EBITDA also showed improvement, rising by 3.8 percent to Rs 48.7 crore compared to the last fiscal year. However, the margin for the same period declined to 5.3 percent from 6.7 percent in the year-ago period.

- Indian Renewable Energy Development Agency (IREDA) rebounded from early losses, hitting a 5 percent upper circuit at Rs 170.25 after a significant deal in the counter. Approximately 2 crore shares of IREDA, equivalent to a 0.9 percent stake in the company, were traded in a deal valued at Rs 389.80 crore. The transaction occurred at a floor price of Rs 160 per share, representing a slight discount of just over 1 percent compared to the previous close.

News from the IPO world 🌐

- Travel portal Ixigo files draft papers for IPO

- Hyundai seeks expansion higher valuation with India IPO

- Exicom Tele Systems may launch IPO by Feb end

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PSU BANK | 3.24 |

| NIFTY OIL & GAS | 3.10 |

| NIFTY MEDIA | 2.51 |

| NIFTY METAL | 1.77 |

| NIFTY AUTO | 1.46 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1716 |

| Decline | 2136 |

| Unchanged | 90 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,272 | (1.4) % | 1.5 % |

| 10 Year Gsec India | 7.1 | 0.2 % | (0.9) % |

| WTI Crude (USD/bbl) | 78 | 1.2 % | 9.7 % |

| Gold (INR/10g) | 61,267 | (1.0) % | (2.7) % |

| USD/INR | 83.1 | 0.2 % | (0.1) % |

Please visit www.fisdom.com for a standard disclaimer