Technical Overview – Nifty 50

The Benchmark index started the fresh week with a bearish note where prices opened flat and continued to trade lower throughout the day and formed a bearish candle. In the previous week, the Index formed a spinning top candle stick pattern which indicates a sideways range for the index.

Strictly speaking, it has been an unusually narrow 7-trading week at Dalal Street as the great bulk of the market has been languishing and not participating in any euphoric action. The Nifty50 has presently given a diamond pattern breakdown and the index is trading below the convex point of the pattern.

The fear of missing out is itself missing, and chasing strength is not working. Nifty’s technical picture shifts from bearish to neutral amidst range-bound technical conditions on the daily charts with the biggest hurdles at the Nifty 22,000 – 21,500 mark.

Technical Overview – Bank Nifty

The Bank Nifty vanished all its previous day’s gain and formed a tall red candle indicating a bears are on the driving sheet. The Banking index started the fresh week with a bearish note where prices opened flat and continued to trade lower throughout the day and formed a bearish candle.

The Banking Index continued to trade below its 9, 21, and 50 EMA on the daily chart, and the shortest EMA slopped lower. Strictly speaking, volatility is the major concern for the traders which keeps traders on their toes. The Bank Nifty on the weekly chart is trading near the lower band of the rising wedge pattern which was acting as a crucial support for the index.

The immediate support for the Bank Nifty is placed near 44,400 levels a breakdown below these levels will drift prices to 44,000. The upper band is capped near 45,800 levels, a convincing move above the same will trigger more buying to 46,200 levels.

Indian markets:

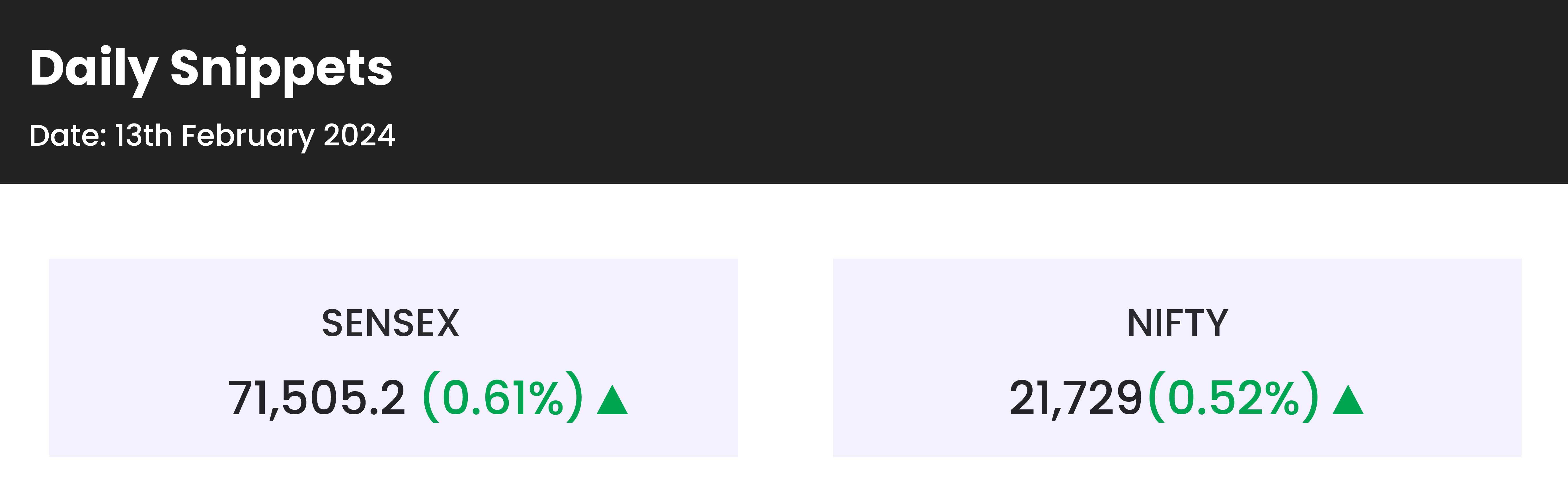

- Indian equity market rebounded strongly in the previous session, driven by favorable macroeconomic data, particularly in banking stocks, pushing Nifty above 21,700.

- Analysts foresee Nifty fluctuating between 21,100 and 22,000 in the short term as investors await the next market catalyst amid the final phase of corporate earnings season.

- Globally, investors are closely monitoring US inflation figures, expecting a rise to 2.9 percent in January from the previous month’s 3.4 percent, which will impact the interest rate cut trajectory.

- Strong job data has diminished the likelihood of a Federal Reserve rate cut in March, with May now being considered a more probable timing amidst expectations of central banks reducing rates due to falling inflation.

Global Markets:

- European markets experienced mostly lower trends on Tuesday morning as investors analyzed incoming corporate earnings and awaited the release of crucial U.S. inflation data.

- The focus of the day shifted towards the U.S. January consumer price index, scheduled for release at 1:30 p.m. London time, with the Federal Reserve closely observing it to determine the interest rate trajectory.

- Economists polled by Dow Jones anticipate headline inflation to be at 0.2% month-on-month and 2.9% annually, while core prices, excluding volatile food and energy components, are expected to rise by 0.3% in January and 3.7% from the previous year.

Stocks in Spotlight

- Bharat Forge shares continued their decline, dropping by 4 percent, following management’s announcement of an anticipated moderation in growth for the upcoming quarter and the financial year 2024-25. While the defense segment notably contributed to revenue growth, the oil & gas and agriculture sectors witnessed a decline compared to the previous year.

- Despite being included in the MSCI Global Standard Index, shares of NMDC, Union Bank, and BHEL, along with other public sector stocks, experienced a decline in morning trade. These stocks had rallied over the past three months, meeting the eligibility criteria for MSCI inclusion. However, following the announcement of the final results, profit-booking occurred, attributed mainly to subdued market sentiment in the last three sessions. The BSE PSU index reflected this trend, witnessing a loss of Rs 6.4 lakh crore in market capitalization over the last three days.

- Krsnaa Diagnostics saw a 4 percent decline in early trade following its Q3 financial report, which revealed a decrease in net profit and a contraction in margins. The company reported a 4.4 percent year-on-year decline in net profit to Rs 13 crore for the December quarter, attributed to expenses totaling Rs 6.1 crore incurred for the implementation of two projects across different geographies. This rise in expenses also led to a contraction in EBITDA margin, down to 24 percent from 25 percent a year ago. Despite this, the company recorded a 34 percent growth in revenue, reaching Rs 158.3 crore compared to the same period last year.

News from the IPO world🌐

- Aplex Solar IPO closes with over 320 times subscription

- Apeejay Surrendra Park Hotel stock lists at nearly 21% premium

Exicom Tele Systems may launch IPO by Feb end

Daily Leader board :

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PRIVATE BANK | 1.48 |

| NIFTY BANK | 1.38 |

| NIFTY FINANCIAL SERVICES | 1.37 |

| NIFTY PSU BANK | 1.2 |

| NIFTY HEALTHCARE INDEX | 0.85 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1716 |

| Decline | 2136 |

| Unchanged | 90 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,797 | 0.3 % | 2.9 % |

| 10 Year Gsec India | 7.1 | (0.0) % | (1.1) % |

| WTI Crude (USD/bbl) | 78 | 1.1 % | 8.5 % |

| Gold (INR/10g) | 61,856 | (0.4) % | (1.7) % |

| USD/INR | 83.00 | (0.0) % | (0.3) % |

Please visit www.fisdom.com for a standard disclaimer