Daily Snippets

Date: 16th January 2024 |

|

|

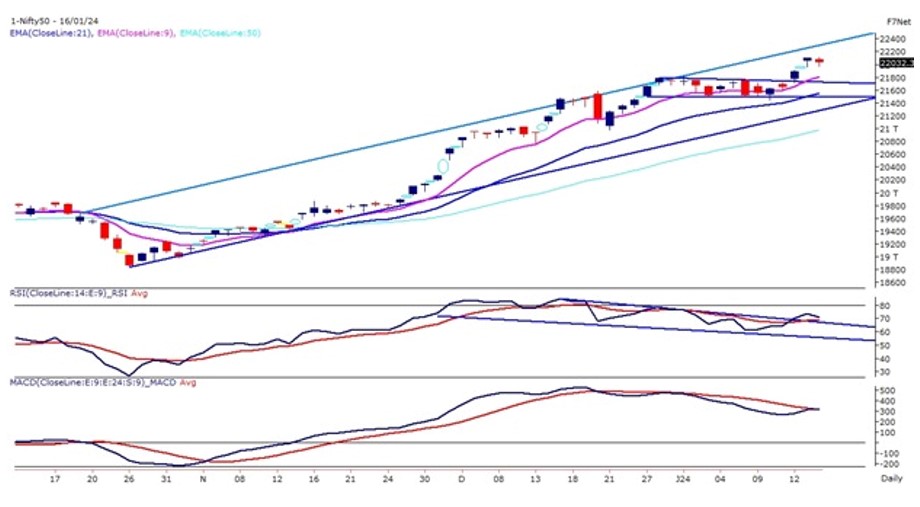

Technical Overview – Nifty 50 |

|

The Nifty50 witnessed a flat opening on the 16th of January after a Steller rally in the previous trading sessions and traded within the defined trading range in the day. Technically the Index traded within its previous day’s candle range for the entire day and formed a spinning top-like candle stick pattern.

The Nifty PCR Ratio closed at 1.51 levels on 15th January which hinted at an overbought scenario and VWAP suggested a sideways trading range for Index. Nifty notches fresh record high supported by macroeconomic and geopolitical tailwinds.

The momentum oscillator RSI (14) has finally moved above the 60 level and given a falling channel pattern. The positive takeaway from today’s trading session was that Nifty was trading above its previous day’s low. From a technical perspective, Nifty’s aggressive upside targets are still at 22,200, and support is marked at 21,900 levels.

|

Technical Overview – Bank Nifty |

|

The Bank Nifty witnessed a flat opening on the 16th of January after a Steller rally in the previous trading sessions and traded within the defined trading range in the day. Technically the banking Index traded within its previous day’s candle range for the entire day and formed a Doji candle stick pattern.

The Bank Nifty is trading within the rectangle pattern and prices have taken support from the lower levels and moved higher above the polarity line. The momentum oscillator RSI (14) has formed a bottom near 50 levels and again moved higher with a bullish crossover on the cards.

The Bank Nifty PCR Ratio closed at 1.25 levels on 15th January which hinted at a bullish to sideways scenario and VWAP suggested the same view for the index. The positive takeaway from today’s trading session was that bulls were in control. From a technical perspective, Bank Nifty’s aggressive upside targets are still at 48,500, and above that bullish breakout and support are marked at 47,700 levels.

|

Indian markets:

- Domestic equity benchmarks concluded the day on a downward trend, marking the end of a five-day winning streak. The Nifty50 closed below 22,050.

- The day’s trading session saw profit booking in IT, pharma, realty, and power stocks. This downturn was influenced by weak global cues.

- Traders are closely observing Foreign Institutional Investor (FII) flows, which are currently mixed. The market lacks fresh triggers, contributing to the uncertainty.

- Additionally, oil prices remained firm amidst ongoing geopolitical tensions.

|

Global Markets

- Markets in Europe and Asia declined on Tuesday, as markets continue to focus on news and comments from the World Economic Forum in Davos, Switzerland.

- U.S. markets were closed Monday due to the Martin Luther King holiday. Investors are looking ahead to U.S. December retail sales data out Wednesday.

|

Stocks in Spotlight

- Polycab shares experienced a 3.5% surge following Goldman Sachs’ decision to uphold its “buy” recommendation for the stock, setting a target price of Rs 5,750. This target suggests a potential 33% increase from the current market price. Goldman Sachs clarified that it refrains from expressing any opinion on the allegations, emphasizing that the stock, despite recent corrections, is presently trading at appealing valuations.

- HDFC Bank reported a Q3 net profit of Rs 16,372 crore, up 33.5% from a year ago and in line with market estimates. The net interest income (NII) increased to Rs 28,470 crore, a 23.9% rise from the previous fiscal’s corresponding quarter but slightly below market expectations of Rs 29,554 crore.

- In the quarter ending December 2023, L&T Technology Services posted a consolidated net profit of Rs 336.2 crore, this net profit reflects a 13% increase compared to the Rs 303 crore reported in the same period last year. Q3FY24 consolidated revenue reached Rs 2,422 crore, marking a 12% rise from the Rs 2,049 crore recorded in the corresponding quarter of the previous fiscal.

|

News from the IPO world🌐

- Nova AgriTech IPO price band fixed at Rs 39-41 per share

- Epack Durable IPO price band set at Rs 218-230/share

- IPOs to wathcout in 2024: Swiggy, firstcry, Ola Electric, Oyo, Portea Medical

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | BPCL | ▲ 2.7 | | TATASTEEL | ▲ 1.7 | | TITAN | ▲ 1.6 | | ITC | ▲ 1.6 | | MARUTI | ▲ 1.1 |

| Nifty 50 Top Losers | Stock | Change (%) | | DIVISLAB | ▼ -2.1 | | HCLTECH | ▼ -2.1 | | NTPC | ▼ -1.8 | | WIPRO | ▼ -1.8 | | INFY | ▼ -1.6 |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY METAL | 0.99 | | NIFTY OIL & GAS | 0.37 | | NIFTY MEDIA | 0.34 | | NIFTY PSU BANK | 0.26 | | NIFTY CONSUMER DURABLES | 0.26 |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 1287 | | Declines | 2570 | | Unchanged | 72 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 37,593 | (0.3) % | (0.3) % | | 10 Year Gsec India | 7.1 | 0.00% | -0.40% | | WTI Crude (USD/bbl) | 73 | 0.9 % | 3.3 % | | Gold (INR/10g) | 62,372 | -0.30% | 0.20% | | USD/INR | 82.84 | (0.2) % | (0.2) % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|