Daily Snippets

Date: 15th January 2024 |

|

|

Technical Overview – Nifty 50 |

|

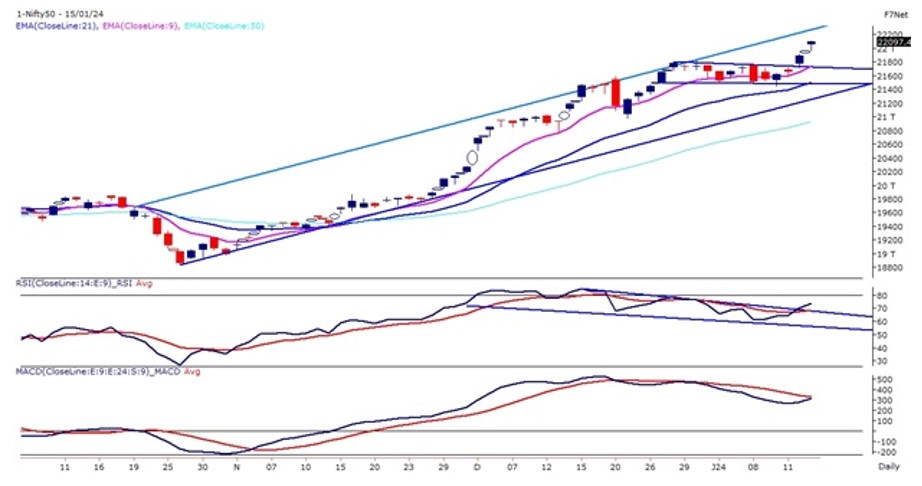

It’s time for bulls to do a victory lap as the Benchmark Index has crossed its important psychological levels of 22,000 and registered the life high. The dramatic rally at Dalal Street was on the backdrop of robust gains witnessed in IT stocks as the majority of IT stocks have given hefty returns in the last few trading sessions.

The Benchmark index finally witnessed a breakout of a rectangle pattern on the daily chart above 21,800 levels and continued to move above 22,000 levels with a strong bullish bias. The momentum oscillator RSI (14) has finally moved above the 60 level and given a falling channel pattern.

The positive takeaway from today’s trading session was that bulls were in control. From a technical perspective, Nifty’s aggressive upside targets are still at 22,200, and support is marked at 21,950 levels.

|

Technical Overview – Bank Nifty |

|

By taking the positive clues from the Nifty50 the Banking Index also witnessed a gap up opening and sustained above the 48,000 mark for the majority of time. The Index has closed above its 9 & 21 EMA which suggests the prices are done with its immediate bottom near 47,000 levels.

The Bank Nifty is trading within the rectangle pattern and prices have taken support from the lower levels and moved higher above the polarity line. The momentum oscillator RSI (14) has formed a bottom near 50 levels and again moved higher with a bullish crossover on the cards.

The positive takeaway from today’s trading session was that bulls were in control. From a technical perspective, Bank Nifty’s aggressive upside targets are still at 48,500, and above that bullish breakout and support are marked at 47,700 levels.

|

Indian markets:

- The Bank Nifty displayed signs of a positive momentum reversal, indicating optimism in the banking sector.

- Traders are closely watching for the upcoming results of HDFC Bank, anticipating its potential impact on the future trajectory of the market.

- India’s wholesale price inflation for December 2023 was reported at 0.73%, driven by price increases in various sectors such as food articles, machinery & equipment, and electronics.

- Consumer price inflation increased to 5.69% in December, up from 5.55% in November, primarily due to higher food prices.

- The Index for Industrial Production (IIP) growth declined to 2.4% in November from the high of 11.7% in October.

- India’s forex reserves experienced a decrease of $5.89 billion, reaching $617.3 billion in the week ending January 5th. Despite the decline, there was an overall increase of $55.72 billion in the fiscal year.

- Gold reserves decreased to $47.48 billion, and both the special drawing rights (SDRs) and the reserve position with the IMF also saw declines during the reporting week.

|

Global Markets

- European shares declined across the board on Monday as government bond yield climbed in response to the European Central Banks warnings of premature rate reduction.

- The German economy contracted 0.3% in 2023, data published by the national statistics agency.

- Most of the Asian stocks advanced, Chinese shares under pressure after the Peoples Bank unexpectedly kept lending rates on hold, while outperformance in Japanese markets continued.

- Investors will be closely watching China’s fourth-quarter gross domestic numbers due on Wednesday, while Japan will release inflation figures for December on Friday.

- U.S. stock and bond markets will be closed on Monday for Martin Luther King Day. On Friday in the U.S., all three major indexes ended mixed as the fourth-quarter earnings season got under way, with four Big Banks posting downbeat results.

|

Stocks in Spotlight

- IRFC shares surged by 16 percent, reaching a record high due to the government’s emphasis on the sector, recent capital infusion, and anticipated strong performance in the December quarter, as stated by analysts. The stock has witnessed an impressive nearly 300 percent increase in the past year.

- On January 15, Jio Financial Services, a newly listed subsidiary of Reliance Industries, disclosed a net profit of Rs 293 crore for the December quarter in the current financial year. This marked a decline from the previous quarter’s net profit of Rs 668 crore. The non-banking financial company (NBFC) reported a net interest income of Rs 269 crore for the quarter. Additionally, its total interest income amounted to Rs 414 crore, with a total revenue of Rs 413 crore. These figures were presented in the company’s second quarterly earnings report since its listing on bourses in August 2023.

- The Ultracab stock experienced its third consecutive session with a 5 percent lower circuit lock. This followed a reduction in the promoters’ shareholding from 59.69 percent during the August-September period to 27.89 percent in the October-December quarter.

|

News from the IPO world🌐

- Nova AgriTech IPO to open on January 22

- Epack Durable IPO will open for subscription on January 19

- IPOs to wathcout in 2024: Swiggy, firstcry, Ola Electric, Oyo, Portea Medical

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | WIPRO | ▲ 6.4 | | ONGC | ▲ 4.3 | | HCLTECH | ▲ 3.1 | | INFY | ▲ 2.4 | | HDFCBANK | ▲ 2.4 |

| Nifty 50 Top Losers | Stock | Change (%) | | HDFCLIFE | ▼ -3.6 | | BAJFINANCE | ▼ -2.4 | | BAJAJFINSV | ▼ -1.2 | | HINDALCO | ▼ -1.2 | | EICHERMOT | ▼ -1.2 |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY IT | 1.86 | | NIFTY OIL & GAS | 1.73 | | NIFTY PHARMA | 1 | | NIFTY PSU BANK | 0.98 | | NIFTY HEALTHCARE INDEX | 0.98 |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 2061 | | Declines | 1893 | | Unchanged | 107 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 37,593 | (0.3) % | (0.3) % | | 10 Year Gsec India | 7.2 | -0.40% | -0.40% | | WTI Crude (USD/bbl) | 72 | (0.3) % | 2.3 % | | Gold (INR/10g) | 62,542 | 0.30% | 0.50% | | USD/INR | 83.04 | (0.0) % | 0.0 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|