Daily Snippets

Date: 12th January 2024 |

|

|

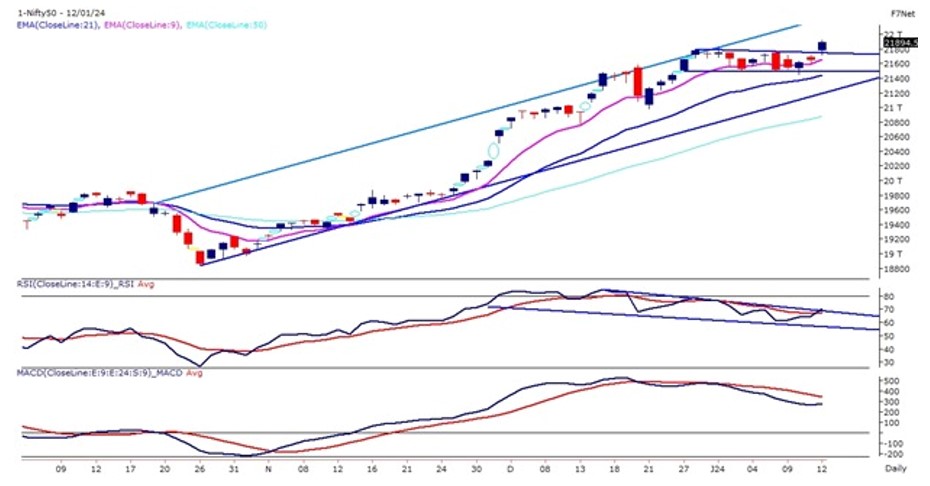

Technical Overview – Nifty 50 |

|

The Benchmark index on 12th January finally witnessed a breakout of a rectangle pattern on the daily chart above 21,800 levels. The Index was consolidating within the rectangle pattern from the past 12 trading sessions and prices finally gave the breakout above the horizontal trend line.

The Index on the daily chart trades in a higher, higher, and lower formation, and prices are trading above all the major averages. The momentum oscillator RSI (14) has finally moved above the 60 level and given a falling channel pattern.

The Nifty50 on the weekly chart has given a return of close to 1 percent and has formed a green candle with a long wick on the lower end. As the Index has given a bullish breakout the support for the index has shifted higher near the 21,650 level and the resistance is likely to face near the 22,100 level.

|

Technical Overview – Bank Nifty |

|

The Banking Index witnessed a bullish momentum on 12th January but underperformed the Benchmark index. The Bank Nifty closed above its 9 & 21 EMA on the daily chart which adds bullish bias for the index.

The Banking index on the weekly chart also underperformed against the Nifty50 where the index closed almost 1 % lower and formed a bearish candle. The positive takeaway from today’s trading session was that bulls regrouped at lower levels and moved higher above their short-term averages.

The Bank Nifty on the daily chart has taken support near the lower band of the rectangle pattern which was acting as a crucial support for the index. The momentum oscillator RSI (14) is reading in a lower low lower high formation and the oscillator is reading near 50 levels with a bearish crossover. The immediate support for the Banking index is placed near 47,000 and below that bearish breakdown and resistance is placed near 48,200 levels and above 48,500 are likely to be achievable.

|

Indian markets:

- Domestic equity indices closed higher for the third consecutive day, with the Nifty nearing the 21,650 level.

- Market witnessed volatility related to the expiry of weekly index options on the NSE.

- Investor caution prevailed amid marginal gains in choppy trade, anticipating December quarter earnings and US inflation data.

- Energy and auto stocks performed well, while the IT index corrected ahead of Q3 results from Infy and TCS.

- Notably, market attention shifted to broader markets, with mid and smallcaps outperforming the frontline indices.

|

Global Markets

- Most shares in Europe and Asia advanced on Thursday as investors looked forward to key US inflation data.

- The Bank of Korea left its main lending rate unchanged at 3.50% for the eighth time in a row.

- US stocks ended higher on Wednesday led by communications stocks and mega caps. Investors are awaiting the U.S. consumer price index report slated for release Thursday. The producer price index reading is due on Friday.

|

Stocks in Spotlight

- On January 12, Wipro, an IT services company, disclosed a 12 percent decline in net profit year-on-year (YoY) for the third quarter of the current financial year, amounting to Rs 2,694 crore. This marks the fourth consecutive quarter of YoY profit decreases for the company.

- Infosys experienced a session where its shares surged by over 7 percent, driven by brokerages suggesting that the company had overcome its challenges. This positive outlook was fueled by the company’s strong new deal wins in Q3. However, it’s noteworthy that the firm revealed a 1.7 percent sequential decline in profits for December, significantly below the estimates of the Street.

- TCS, India’s premier IT company, witnessed a 4 percent surge in its shares due to its performance in the December quarter, which met expectations in terms of revenue and exceeded them in margins. The company also showcased a robust deal pipeline. Reporting an 8.2 percent year-on-year growth, TCS achieved a net profit of Rs 11,735 crore, accompanied by a 4 percent increase in revenue, reaching Rs 60,583 crore.

|

News from the IPO world🌐

- IPOs to wathcout in 2024: Swiggy, firstcry, Ola Electric, Oyo, Portea Medical

- Firstcry CEO Supam Maheshwari offloaded shares worth Rs. 300 crores before IPO filing

- Medi Assist’s Rs 1,172-cr IPO to open on January 15

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | INFY | ▲ 8.1 | | ONGC | ▲ 5.7 | | TECHM | ▲ 4.7 | | HCLTECH | ▲ 4.7 | | LTIM | ▲ 4.6 |

| Nifty 50 Top Losers | Stock | Change (%) | | CIPLA | ▼ -1.2 | | APOLLOHOSP | ▼ -1.1 | | BAJAJFINSV | ▼ -1 | | ULTRACEMCO | ▼ -1 | | POWERGRID | ▼ -1 |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY IT | 5.14 | | NIFTY PSU BANK | 2.75 | | NIFTY REALTY | 1.8 | | NIFTY OIL & GAS | 1.47 | | NIFTY CONSUMER DURABLES | 0.67 |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 2112 | | Declines | 1742 | | Unchanged | 88 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 37,711 | 0.0 % | (0.0) % | | 10 Year Gsec India | 7.2 | -0.20% | 0.00% | | WTI Crude (USD/bbl) | 72 | (0.3) % | 2.3 % | | Gold (INR/10g) | 62,363 | 0.90% | 0.20% | | USD/INR | 83.06 | (0.1) % | 0.0 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|