Daily Snippets

Date: 09th January 2024 |

|

|

Technical Overview – Nifty 50 |

|

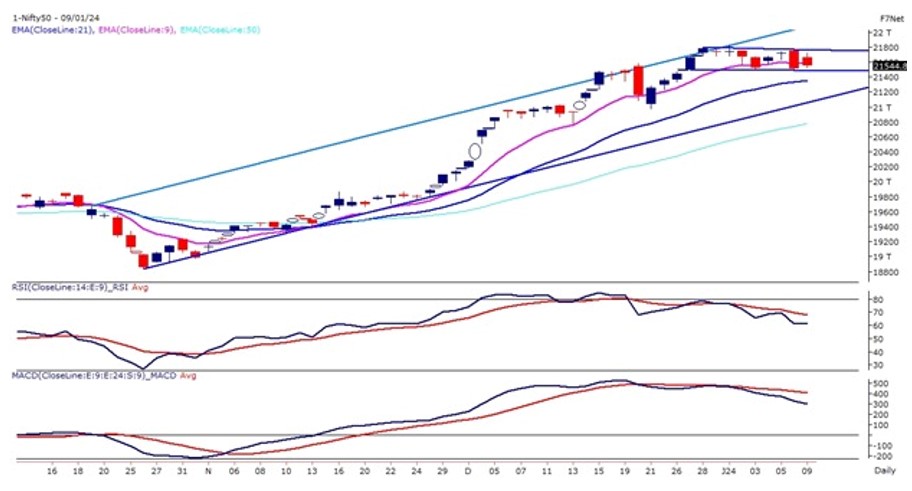

It was again a super volatile day for the Indian Bourses where prices witnessed a gap opening above 21650 levels and traded with bullish bias in the first half of the sessions. A strong sell-off was witnessed from the day’s high in the last hour of the trade and the index lost almost 150 points from the day’s high.

The Nifty50 from the past ten trading sessions is trading within the 300-point range and has formed a narrow rectangle pattern on the daily time frame. The prices are hovering around its 9 EMA and suggesting a sideways trend for the Index.

The momentum oscillator RSI (14) is reading in a lower low lower high formation and the oscillator is reading near 60 levels with bearish crossover. The Nifty50 on the daily chart is trading within the rising channel pattern and prices have presently reached near the middle of the pattern and have breached its short-term moving average support. The immediate support for the index is placed near 21,400 and below that near 21,250 levels and resistance is placed near 21,700 levels.

|

Technical Overview – Bank Nifty |

|

The Bank Nifty on 9th Jan witnessed a gap-up opening but couldn’t hold on to its gains and went through a critical selling in the final hour of the trading session. The Banking index drifted almost 700 points from the day-high and breached its crucial support levels.

The Banking index on the daily chart has closed below its 9 & 21 EMA which was acting as a crucial support for the index. The Bank Nifty on the daily chart has given a breakdown of a rising channel pattern and has closed below its lower band of the pattern.

The momentum oscillator RSI (14) is reading in a lower low lower high formation and the oscillator is reading below 50 levels with a bearish crossover. The last hour of selling has triggered a bearish breakdown and sell-on rallies will be a short-term strategy for the index. The immediate support for the Banking index is placed near 46,800 and below that near 46,500 levels and resistance is placed near 47,800 levels.

|

Indian markets:

- Domestic markets ended the day with a neutral stance, opening at 21,653.60 and reaching a high of 21,724.45 before retracing below 21,550 by the session’s close.

- Realty and auto sectors contributed to market breadth, while banking and media stocks faced selling pressure, impacting the overall index.

- Profit-taking at higher levels resulted in a reversal of gains, sparking concerns over elevated valuations and signaling a bout of profit-booking in the market.

- Traders anticipate potential volatility, particularly in light of upcoming elections, and speculate on a possible further decline should the Nifty breach the 21,500 mark.

- Despite these concerns, a healthy market consolidation within the range of 21,800 to 21,300 is forecasted during the Q3 earnings season, indicating the potential for a subsequent market rally.

|

Global Markets

- European stocks declined while Asian stocks ended mixed on Tuesday. Risk appetite was subdued as investors awaited key inflation data releases from the U.S., Japan, and China.

- Expectations of early interest rate cuts by the U.S. Federal Reserve, the European Central Bank, and the Bank of England were tempered. This shift in outlook was influenced by a surprising increase in U.S. nonfarm payrolls and a rise in eurozone inflation to 2.9% in December from 2.4% in November, supporting the case for the European Central Bank to maintain record high interest rates.

- U.S. stocks ended higher on Monday boosted by tech shares. Global investors will be looking ahead to US inflation data and big bank earnings in the week ahead for further clues on the state of the economy and the path of rate cuts from the Federal Reserve.

|

Stocks in Spotlight

- Tata Motors stock rose by 1.5% following an impressive performance by its Jaguar Land Rover (JLR) division, marking its highest wholesale figures in 11 quarters during the October-December period. JLR experienced a substantial 27% year-over-year increase in sales for the December quarter.

- IRB Infrastructure Developers’ shares surged by 8%, reaching a 52-week high following the company’s announcement of a 26% year-on-year growth in toll collection, reaching Rs 488 crore in the December quarter.

- Larsen and Toubro’s stock rose by 1.68% following the company’s successful bid to develop AIIMS in Haryana. The buildings and factories division of Larsen & Toubro Construction secured a significant order from HITES, a mini-Ratna PSE under the health and family welfare ministry. The project’s value, however, was not disclosed.

|

News from the IPO world🌐

- MobiKwik files draft papers for Rs 700 crore IPO

- IPOs to wathcout in 2024: Swiggy, firstcry, Ola Electric, Oyo, Portea Medical.

- Jyoti CNC Automation IPO subscribed 2.51 times on Day 1. Retail portion booked 8.25 times

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | HEROMOTOCO | ▲ 2.9 | | ADANIPORTS | ▲ 2.8 | | SBILIFE | ▲ 2.2 | | APOLLOHOSP | ▲ 2.1 | | ADANIENT | ▲ 2.1 |

| Nifty 50 Top Losers | Stock | Change (%) | | BRITANNIA | ▼ -1.2 | | BAJAJFINSV | ▼ -1 | | NESTLEIND | ▼ -0.9 | | HDFCLIFE | ▼ -0.9 | | ASIANPAINT | ▼ -0.8 |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY REALTY | 2.52 | | NIFTY HEALTHCARE INDEX | 1.07 | | NIFTY AUTO | 0.92 | | NIFTY PHARMA | 0.87 | | NIFTY METAL | 0.79 |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 2207 | | Declines | 1637 | | Unchanged | 100 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 37,683 | 0.6 % | (0.1) % | | 10 Year Gsec India | 7.2 | -0.20% | 0.20% | | WTI Crude (USD/bbl) | 71 | (2.0) % | 0.6 % | | Gold (INR/10g) | 62,355 | 0.30% | -1.00% | | USD/INR | 83.13 | (0.2) % | 0.1 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|