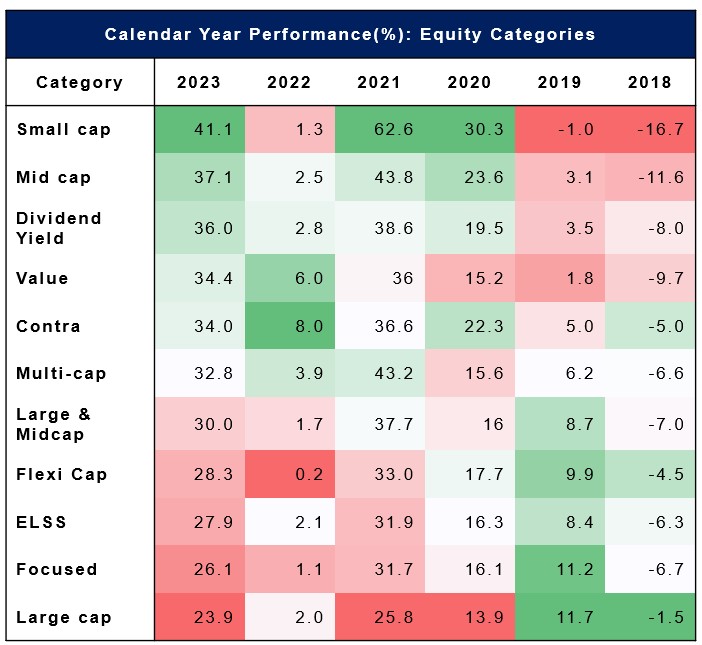

Midcap & Smallcap Outshines

2024 Outlook: Large-cap-oriented categories may make a comeback.

Source: ACE MF, Fisdom Research

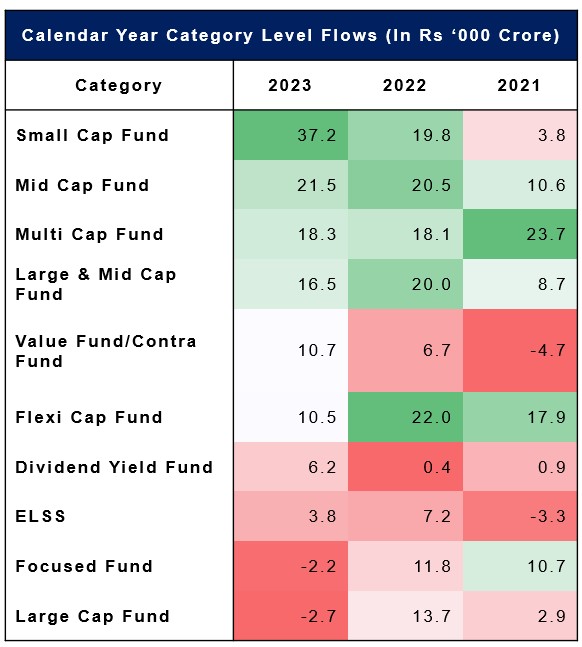

Key Factors Behind Outperformance

2024 Outlook: Keep orientation towards large but don’t avoid investing in mid- and Smallcap as certain opportunities are present only in these segments. In CY2024, adopting a multicap approach stands out as the most effective strategy.

Source: ACE MF, DSP Mutual Fund Presentation, ICICI AMC, Fisdom Research

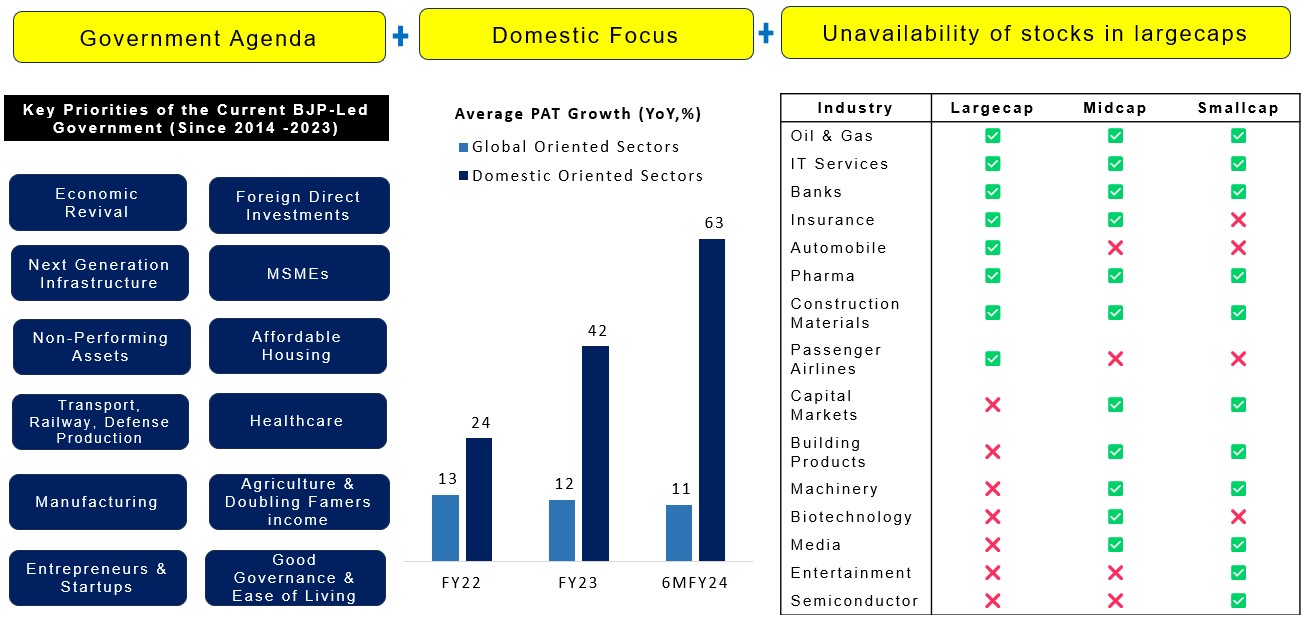

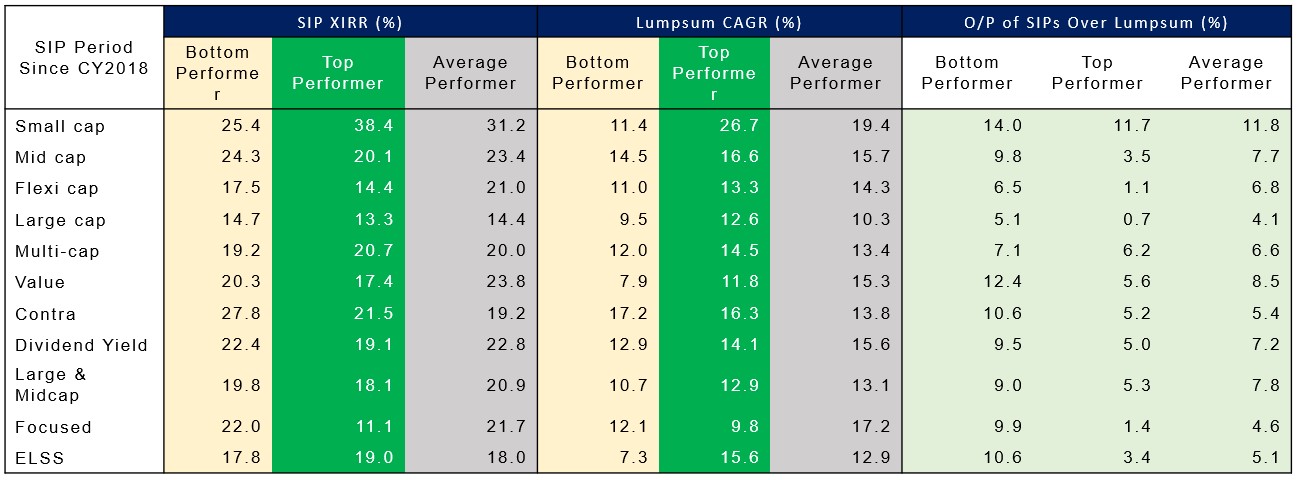

Winner in 2023: SIP or Lumpsum?

2024 Outlook: The SIP investor emerged as the clear winner in 2023. Choose SIP for investments, and for those with lump sums, consider STP.

- The SIP investor emerged triumphant in 2023 across all three categories such as top, bottom & and average. Notably, when compared to lump sum investments in the same fund, SIP performance demonstrated a significant outperformance, exceeding 100 basis points or even more.

- The 2023 market favoured stock pickers, with significant divergence between top and bottom performers in various categories. This trend is uncommon in categories with a limited investible universe in the long term.

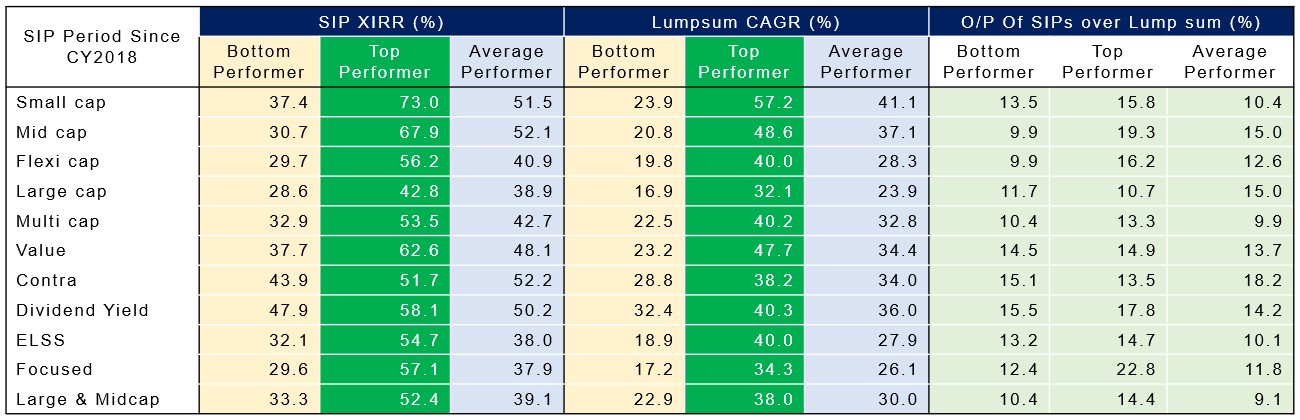

But then, Is it advisable to sell investments solely because they are at the bottom for one calendar year? Can underperformers transform into top performers?

Source: ACE MF, Fisdom Research

Bottom Performer Surpasses Top?

2024 Outlook: Even bottom performing funds in CY2018 have outperformed the best-performing funds within five years

- Over the long run, even the bottom-performing funds in CY2018 have outperformed the best-performing funds within five years. This reveals that too much portfolio rebalancing can hinder long-term performance.

- Divergence of returns between bread-based category funds like small cap, and focused, value is much higher as compared to restricted mandate categories like large cap, and mid-cap multi-cap where the universe is limited or flexible mandate categories where most of the funds from the category have large-cap orientation. Case in point: Flexicap Category

- Please note that not every bottom performer becomes a winner. choosing quality schemes and utilizing Fisdom ratings can guide you in identifying funds with the potential to rebound even if they are currently underperforming. The performance of these funds is influenced by market conditions, company fundamentals, and various factors. A thorough analysis of specific investments, market trends, and economic conditions is crucial before making any investment decisions.