Daily Snippets

Date: 28th December 2023 |

|

|

Technical Overview – Nifty 50 |

|

Nifty scales fresh all-time-high as large-cap stocks are hot amidst year-end window dressing. It’s now time for bulls to do a victory lap as Nifty (21,801.45) and Sensex (72,484) scale fresh new all-time highs.

It’s ‘Santa Claus Rally’ time at Dalal Street as investors anticipate interest rate cuts from the Federal Reserve and other central banks. The Auto and Metal Indices led the benchmarks to fresh highs in today’s session.

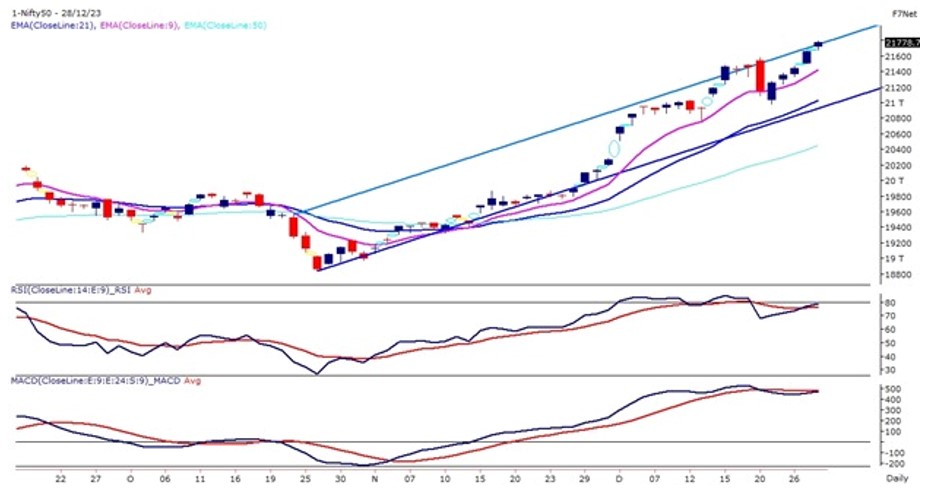

The Nifty50 on the daily chart is trading within the rising channel pattern and prices have presently reached near the upper band of the pattern. The Index continues to trade in a higher high higher bottom formation and prices are trading above its 9 & 21 EMA. The momentum oscillator RSI (14) is reading near 80 levels and the momentum is strongly poised towards a bullish stance.

The positive takeaway from today’s trading session was that the benchmark Nifty still appears to be the only bullish deal in the town. The immediate support for the Index is placed at 21,600 – 21,550 levels and the upside is capped near 21,900 levels.

|

Technical Overview – Bank Nifty |

|

The Banking Index on 28th December witnessed a gap-up opening and the prices registered their lifetime high levels and marked 48,636 levels for the very first time. The Bank Nifty on the daily chart has given a horizontal channel pattern breakout and prices are trading above the upper band of the pattern.

The Banking Index continues to trade above the breakout levels and is trading above its 9 & 21 EMA. The momentum oscillator RSI (14) is reading near 70 levels and the momentum is strongly poised towards a bullish stance.

The positive takeaway from today’s trading session was that the Bank Nifty still appears to be the only bullish deal in the town. The immediate support for the Index is placed at 48,100 – 48,000 levels and the upside is capped near 49,000 levels.

|

Indian markets:

- Thursday witnessed significant gains in the domestic stock market, marked by new all-time highs for both NSE Nifty and BSE Sensex.

- Volatility characterized trading due to the December F&O series expiry, despite concerns over soaring valuations.

- The market’s overall mood remained optimistic, driven by enthusiastic retail participation, but caution is advised amidst the jubilation.

- Potential risks, including China’s economic resurgence and possible disruptions in Red Sea shipping lines, pose concerns for market flows and oil prices.

- The Nifty closed above the 21,750 mark, with expectations of immediate resistance within the 21,800-21,900 range for investors.

- Energy, FMCG, and healthcare sectors experienced increased demand, while IT and consumer durables stocks lagged behind in performance.

|

Global Markets

- Asian shares advanced while European stock markets retreated Thursday, with investors taking some of the recent profits off the table as the trading year nears the end.

- On Wednesday, US stocks closed higher, with the S&P 500 inching up to 4,781.58 and the Nasdaq Composite adding to 15,099.18. The Dow Jones Industrial Average also rose by 111.19 points to close at 37,656.52.

|

Stocks in Spotlight

- On December 28, Hudco shares surged 12% on signing a Rs 14,500 crore MoU with the Gujarat State Government for urban projects. The stock hit a record high of Rs 136.80, marking a 144% YTD increase, outperforming the Nifty 50 benchmark’s 19% rise.

- Man Industries‘ shares surged 5% as they successfully tested pipes for safe hydrogen transport, a milestone in advancing hydrogen-based systems. Their net profit spiked by 867% to Rs 39 crore in Q3 2023, and they secured Rs 400 crore in orders for various pipes in October.

- Sula Vineyards Limited’s shares rose by nearly 5% on December 28 following news of their wine tourism business hitting a record high with 5,000+ visitors on Christmas Eve. The festive weekend from December 23 to 25 saw unprecedented attendance, setting new single-day, two-day, and three-day records. Over 12,000 people visited Sula’s Nashik and Bengaluru facilities during this period, contributing to the stock’s 45% gain since the year began.

|

News from the IPO world🌐

- FirstCry files IPO papers to raise Rs 1,816 crore

- Ratan Tata to sell all his 77,900 shares in FirstCry IPO

- Canara Bank gives in-principal approval to float Canara Robeco AMC IPO

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | COALINDIA | ▲ 4.2 | | NTPC | ▲ 3.1 | | M&M | ▲ 2.8 | | HEROMOTOCO | ▲ 2.6 | | BPCL | ▲ 2.5 |

| Nifty 50 Top Losers | Stock | Change (%) | | ADANIENT | ▼ -0.9 | | EICHERMOT | ▼ -0.6 | | LT | ▼ -0.6 | | LTIM | ▼ -0.5 | | ADANIPORTS | ▼ -0.4 |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY OIL & GAS | 2.01 | | NIFTY FMCG | 1.35 | | NIFTY HEALTHCARE INDEX | 1.24 | | NIFTY PHARMA | 1.23 | | NIFTY PSU BANK | 1.03 |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 1746 | | Declines | 2050 | | Unchanged | 124 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 37,657 | 0.3 % | 13.6 % | | 10 Year Gsec India | 7.2 | 0.10% | -0.10% | | WTI Crude (USD/bbl) | 76 | 2.3 % | (1.8) % | | Gold (INR/10g) | 63,164 | -0.20% | 13.20% | | USD/INR | 83.17 | 0.0 % | 0.6 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|