Daily Snippets

Date: 27th December 2023 |

|

|

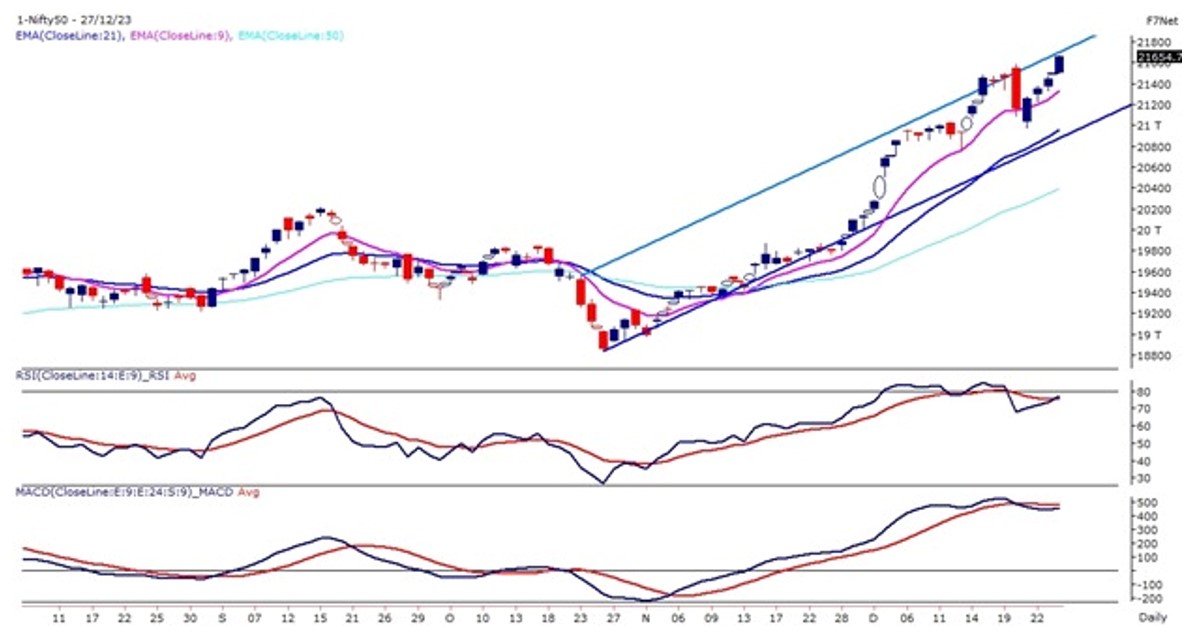

Technical Overview – Nifty 50 |

|

The Benchmark Index on 27th December witnessed a gap-up opening and the prices registered their lifetime high levels and marked 21,600 levels for the very first time. The Nifty50 on the daily chart is trading within the rising channel pattern and prices have presently reached near the upper band of the pattern.

The Index continues to trade in a higher high higher bottom formation and prices are trading above its 9 & 21 EMA. The momentum oscillator RSI (14) is reading near 80 levels and the momentum is strongly poised towards a bullish stance.

In the last 30 minutes, the prices witnessed a strong price surge and the index crossed near 21,650 levels and formed a tall bullish candle on the daily chart. The immediate support for the Index is placed at 21,500 – 21,400 levels and the upside is capped near 21,800 levels.

|

Technical Overview – Bank Nifty |

|

The Banking Index on 27th December witnessed a gap-up opening and the prices registered their lifetime high levels and marked 48,347 levels for the very first time. The Bank Nifty on the daily chart has given a rectangle pattern breakout and prices are trading above the upper band of the pattern.

The Banking Index continues to trade above the breakout levels and is trading above its 9 & 21 EMA. The momentum oscillator RSI (14) is reading near 70 levels and the momentum is strongly poised towards a bullish stance.

In the last 60 minutes, the prices witnessed a strong price surge and the index jumped 200 points and formed a tall bullish candle on the daily chart. The immediate support for the Index is placed at 47,800 – 47,500 levels and the upside are capped near 48,700 levels.

|

Indian markets:

- Wednesday saw the stock market closing with substantial gains, extending its growth streak for the fourth consecutive trading session.

- Analysts foresee a continuation of the bullish trend, often dubbed the “Santa Claus rally,” buoyed by India’s strong growth potential, institutional investments, and a shift towards large-cap stocks.

- Despite the overall positive outlook, caution is advised due to certain market areas causing concern, including oversubscribed IPOs and inflated valuations in mid and small-cap segments.

- Demand surged for PSU bank, autos, and metal shares, indicating investor interest in these sectors.

- Conversely, oil & gas, media, and FMCG shares experienced a lag in performance during this period.

|

Global Markets

- Markets in Europe and Asia advanced on Wednesday, tracking a rally from Wall Street as investors latched on to the year-end optimism driven by expectations that the Federal Reserve could begin cutting rates as early as next March.

- The summary of opinions of the Bank of Japans December meeting showing that members of the central bank saw monetary policy remaining ultra-loose for the time being.

|

Stocks in Spotlight

- L&T shares rose 1.5% after winning a major EPC order for the Amaala project in Saudi Arabia, pushing the stock to a record high of Rs 3,549. The order focuses on renewable energy and utility systems. Despite a Q2 dip in domestic orders, L&T’s overall order book for H1 FY24 reached Rs 4,50,700 crore, up 22% YoY, thanks to a surge in offshore contracts.

- UltraTech Cement saw a 4% jump on December 27 following Nomura’s upgrade of its rating from neutral to ‘buy.’ Nomura foresees strong sales volume growth, better pricing strategies, and improved valuations leading up to FY26. With a bullish stance, Nomura set a revised target price of Rs 11,500, up 15%. This optimism is fueled by expectations of India’s cement industry sustaining growth momentum in the latter half of FY24.

- Happy Forgings Ltd, a heavy forgings manufacturer, saw an 18% rise in its shares on debut after its IPO was oversubscribed 82 times. The Rs 1,009 crore IPO, open from December 19-21, had strong interest from retail investors (15.09 times), high net-worth individuals (62.17 times), and QIBs (220.48 times). Happy Forgings plans to use the funds for equipment acquisition (Rs 171.1 crore), debt repayment (Rs 152.76 crore), and general corporate purposes.

|

News from the IPO world🌐

- Azad Engineering shares to make D-Street debut on Thursday

- Ola Electric plans to deploy Rs 1,226.43 cr of IPO proceeds on cell production capacity expansion

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | ULTRACEMCO | ▲ 4.5 | | HINDALCO | ▲ 4.3 | | BAJAJ-AUTO | ▲ 3.9 | | JSWSTEEL | ▲ 3 | | TATAMOTORS | ▲ 2.9 |

| Nifty 50 Top Losers | Stock | Change (%) | | ONGC | ▼ -0.9 | | NTPC | ▼ -0.9 | | ADANIENT | ▼ -0.7 | | BRITANNIA | ▼ -0.7 | | UPL | ▼ -0.6 |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY PSU BANK | 2.06 | | NIFTY AUTO | 1.51 | | NIFTY METAL | 1.39 | | NIFTY BANK | 1.17 | | NIFTY PRIVATE BANK | 0.97 |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 1945 | | Declines | 1859 | | Unchanged | 110 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 37,545 | 0.4 % | 13.3 % | | 10 Year Gsec India | 7.2 | 0.20% | -0.20% | | WTI Crude (USD/bbl) | 76 | 2.3 % | (1.8) % | | Gold (INR/10g) | 62,982 | 0.40% | 13.40% | | USD/INR | 83.16 | (0.1) % | 0.6 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|