The Festival of Lights, Diwali, has dawned upon us, casting a warm glow of optimism over the Indian markets. Following a volatile pre-Diwali month that saw a decline of 2.5 percent, the arrival of this joyous occasion seems to have infused a renewed sense of positivity. As we step into November 2023, the Nifty 50 has already embarked on a promising trajectory, bouncing back by 1.7 percent until the first day of Diwali celebrations on November 9th.

Along with some global challenges the Diwali has brought in several other positive factors that have impacted the market mood recently. Below are some of the positive factors that might impact markets:

|

Realty Sector Buoyancy

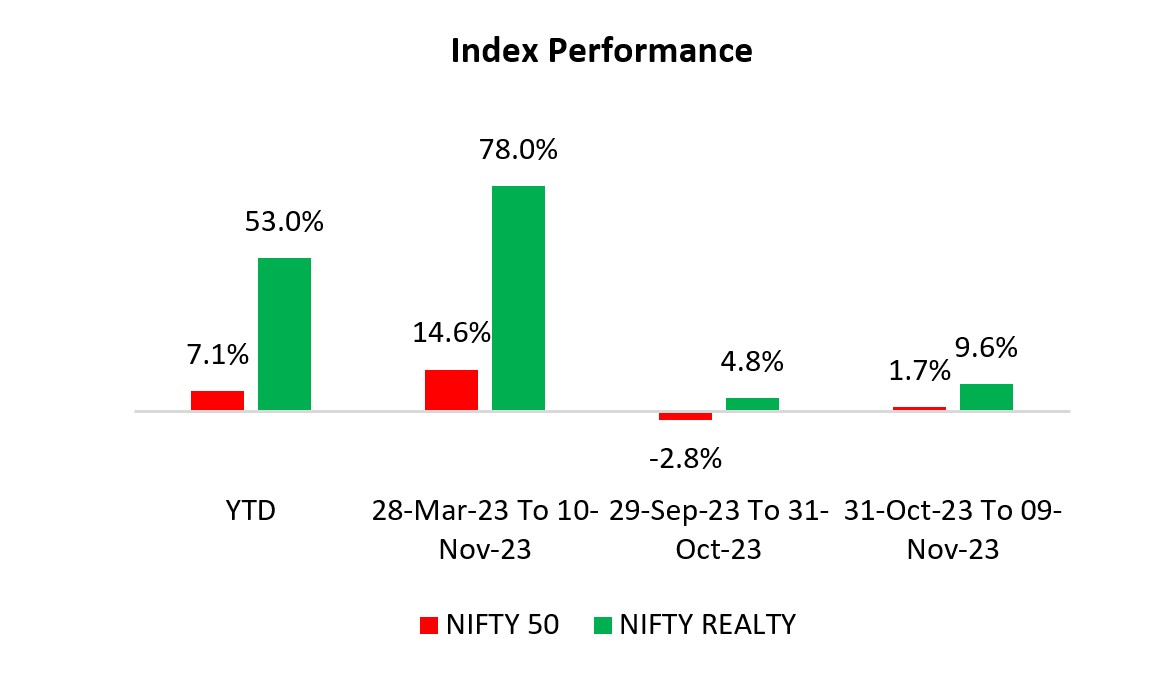

In the fiscal year 2024, the Indian realty sector has emerged as one of the top-performing segments, showcasing remarkable resilience and growth. Demonstrating a robust return of 78% since the conclusion of March 2023, the Nifty Realty Index has notably surpassed the broader Nifty 50 Index, which recorded a comparatively modest 15% during the same timeframe. This surge in the realty sector’s performance is not a recent phenomenon in FY24. Following the global response to the pandemic, where central banks worldwide implemented accommodating monetary policies, the Nifty Realty Index witnessed an impressive rally, soaring by an astounding 125%. Importantly, this liquidity-driven surge was not exclusive to the realty sector alone; the broader Nifty 50 also experienced a substantial uptick, registering a noteworthy 115% increase from the pandemic lows leading up to FY24.

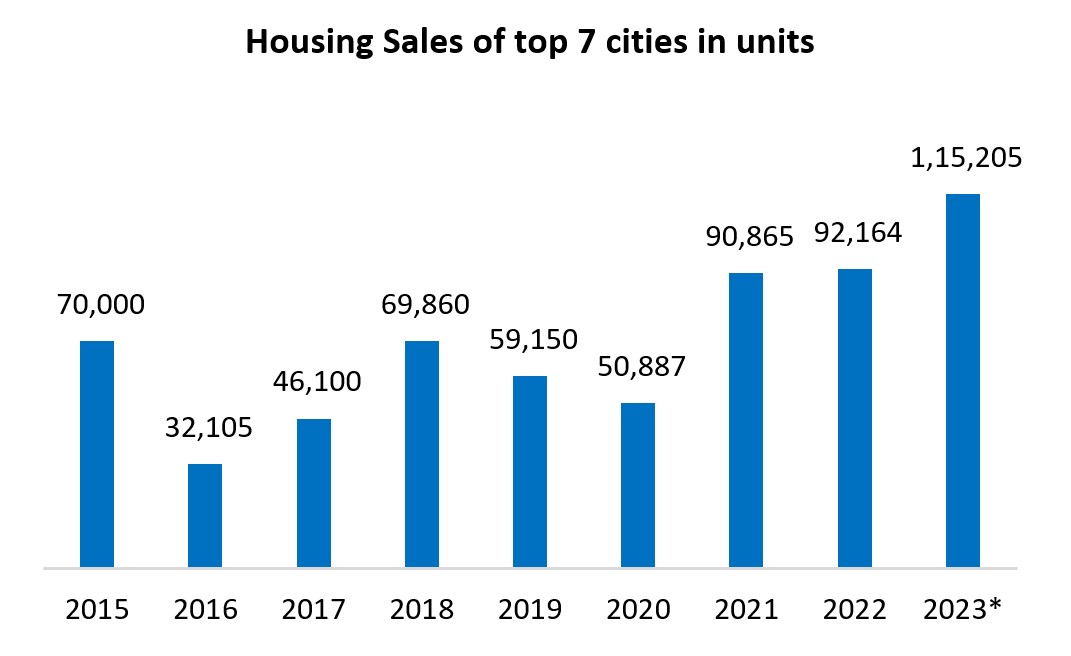

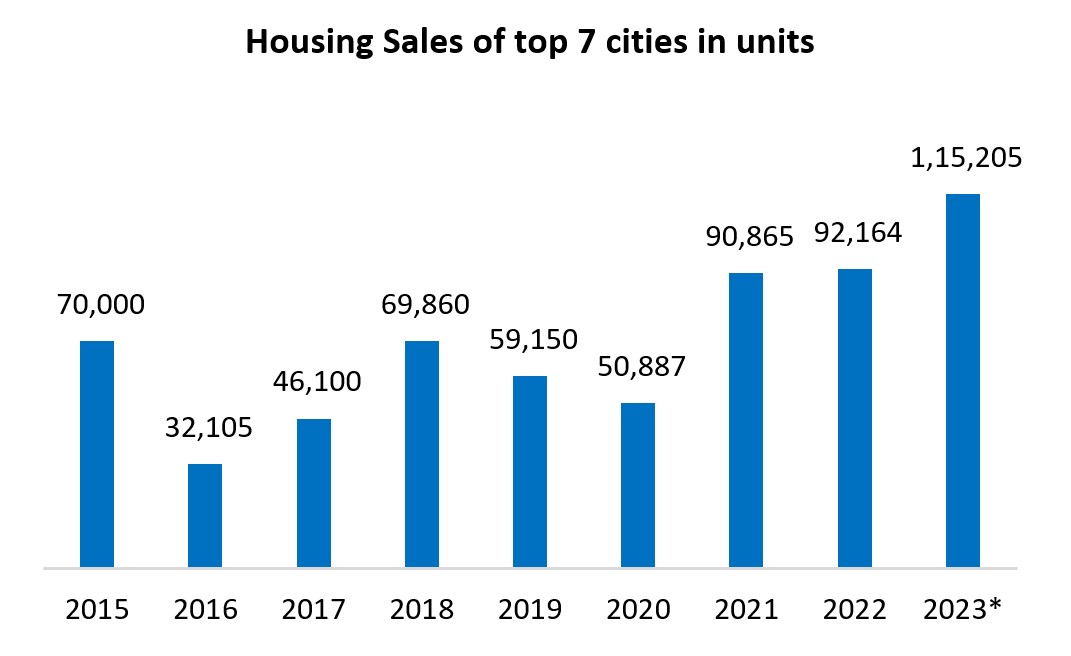

Throughout FY24, while the broader market has experienced a subdued trend, the realty sector has sustained its upward journey. Particularly what is noteworthy is the surge in demand for residential real estate, reaching at fresh high levels. Notably, during the ongoing festive season spanning from October to December 2023, the realty sector anticipates a remarkable 25% growth in home sales. This surge is remarkable, especially in the face of escalating property prices and record-high interest rates. Mirroring the trajectory observed in other consumer discretionary segments, the heightened demand for residential homes is predominantly emanating from the premium segment. This trend underscores the resilience and continued appeal of the realty sector despite the challenges posed by market conditions. |

|

Source: NSE India, fisdom research. Data as on 10th Nov 2023 |

|

Source: Livemint, Anarock, Fisdom research *Estimates

Anticipated to undergo significant expansion, the Indian real estate sector is poised to transform from its current valuation of less than $500 billion to a substantial $1 trillion by the year 2030. Looking further ahead, the sector is projected to reach an impressive $5.8 trillion by the year 2047. This trajectory reflects a robust annual growth rate of 10.5% over the next 25 years, showcasing the immense potential for development within the industry.

|

Festive Buying Gains Traction

India’s festive season has ignited a surge in consumer spending, particularly on big-ticket items such as cars, smartphones, and TVs, contributing to the growth of one of the world’s rapidly expanding economies. Online platforms like Amazon and Flipkart witnessed a substantial uptick in sales, rising nearly a fifth in the first week of festive sales compared to the previous year. Digital transactions through Unified Payments Interface also saw a notable 40% increase in October year-on-year. These sales figures serve as vital indicators of consumption health, constituting about 60% of India’s GDP. The boost in spending is attributed to factors such as easing inflation, rising wages, particularly in rural areas, and a surge in consumer confidence, reaching a four-year high in September.

Despite interest rate hikes this year, demand for bank loans remains near a 12-year high. In preparation for upcoming elections, Prime Minister Narendra Modi’s government is focusing on farmers by offering higher guaranteed crop prices and reduced cooking gas costs, and emphasis on capex led growth. This has fuelled fresh optimism in rural as well as urban recovery.

The ongoing cricket tournament hosted across Indian cities is also expected to contribute significantly to the economy, with estimates suggesting a potential addition of US$2.6 billion. Further, the upcoming wedding season, spanning from Nov 23 to Dec 15, is anticipated to spur a considerable spending of US$50 billion on items like gold jewellery, clothing, and other consumer goods, as predicted by the Confederation of All India Traders.

|

Oil Prices decline

Oil prices experienced a significant decline, dropping approximately 3% to their lowest levels since late August. The downturn was attributed to rising concerns about demand, stemming from mixed data from China and a diminishing investor enthusiasm for interest rate cuts. Notably, China’s crude oil imports exhibited robust year-on-year and month-on-month growth in October, although the total exports contracted more rapidly than anticipated.

|

Rating agencies firm up GDP growth estimates for FY24

The Reserve Bank of India (RBI) has projected a GDP growth estimate of 6.5% for FY23-24. This estimate aligns with the momentum of economic activities and positive early indicators in the country. The central bank’s assessment takes into account factors such as the sustained momentum in economic activities, as evidenced by several positive indicators. Additionally, the robust Goods and Services Tax (GST) collections in October, amounting to ₹1.72 lakh crore, mark the second-highest monthly collection since the implementation of the new indirect tax regime in July 2017. The strong GST collections suggest buoyancy in economic activities, supporting the RBI’s optimistic outlook for India’s GDP growth in the fiscal year 2023-24.

Below are some of the estimates by marque institutions

|

| Institution |

GDP Growth Estimate for FY23-24 |

| OECD |

6.30% |

| Fitch Ratings |

6.30% |

| S&P Global Market Intelligence (Raised estimates) |

6.60% |

| Moody’s (Raised estimates) |

6.70% |

| RBI |

6.50% |

Source: TOI, Fisdom Research |

The current positive outlook for India’s growth prospects in the second quarter of the fiscal year 2023-24 is grounded in the encouraging performance of buoyant high-frequency indicators observed in recent months.

What should investors do till next Diwali?

Investors, amid the positive sentiments and economic developments highlighted, may consider maintaining an aggressive stance on equities, with a staggered investment approach until the next Diwali. Small and mid-cap segments are anticipated to perform well, although caution is advised as valuations may undergo adjustments. In the face of global uncertainties, including the Israel-Hamas conflict, the inflation battle in the US and Europe, and indications of slowing global growth, volatility might persist. Consequently, investors may find favorable opportunities in large-cap investments, balancing risk and potential returns. While Diwali might be good occasion to create great moments with family and friends, a re-look at your exiting portfolio might be a even more fruitful for many Diwali’s to come! |

Market this week

| | 06th Nov 2023 (Open) | 10th Nov 2023 (Close) | %Change | | Nifty 50 | ₹ 19,346 | ₹ 19,425 | 0.40% | | Sensex | ₹ 64,848 | ₹ 64,905 | 0.10% |

|

Source: BSE and NSE

- Indian equity indices concluded the final week of Samvat 2079 on a positive trajectory, marking the second consecutive week of gains until November 10.

- The market witnessed volatility attributed to factors such as the easing of US treasury yields, a decline in crude oil prices, and statements from the Federal Reserve chair regarding potential rate hikes in the future.

- Foreign institutional investors (FIIs) continued their trend of selling, offloading equities amounting to Rs 3,105.27 crore during this period.

- In contrast, domestic institutional investors (DIIs) exhibited a buying trend, acquiring equities worth Rs 4,155.23 crore.

|

|

Weekly Leader Board

NSE Top Gainers | Stock | Change (%) | | BPCL | ▲ 6.24% | | Divis Lab | ▲ 4.25 % | | L&T | ▲ 4.19 % | | Axis Bank | ▲ 4.08% | | Bajaj Finserv | ▲ 3.90% |

| NSE Top Losers | Stock | Change % | | Infosys | ▼ (1.45) % | | Wipro | ▼ (1.11) % | | Adani Enterprises | ▼ (1.11) % | | HUL | ▼ (0.90) % | | HCL Tech | ▼ (0.85) % |

|

Source: BSE |

Stocks that made the news this week:

- Eicher Motors, the Indian automaker known for its Royal Enfield motorcycles, announced a robust second-quarter profit, surpassing expectations on Friday. The consolidated net profit surged by 54.7%, reaching 10.16 billion rupees ($122 million) in the three months ending Sept. 30, compared to the same period the previous year. This stellar performance was attributed to strong sales, particularly in response to the growing demand for premium motorcycles. Analysts had anticipated a lower profit of 9.29 billion rupees on average. The results underscore Eicher Motors’ resilience and success in meeting the heightened market demand for its premium motorcycle offerings.

- Force Motors witnessed a 5 percent upper circuit lock after reporting a substantial surge in revenue for the September-ended quarter. The company’s revenue soared by 42.5 percent year-on-year, reaching Rs 1,802 crore. Concurrently, the profit experienced an impressive nearly five-fold increase, reaching Rs 94 crore. This strong financial performance contributed to the positive investor sentiment, leading to the upper circuit lock on Force Motors’ shares.

- Lupin’s shares climbed 2 percent to reach a 52-week high after the pharmaceutical company reported a significant increase in net profit, soaring from Rs 129.73 crore in the previous year to Rs 489.67 crore. This surge in profit was attributed to robust revenue growth of over 20 percent, amounting to Rs 4,939.20 crore. Despite the initial positive momentum, the stock later surrendered its gains, closing 0.59 percent lower.

|

|

Please visit www.fisdom.com for a standard disclaimer.

|