Daily Snippets

Date: 27th September 2023 |

|

|

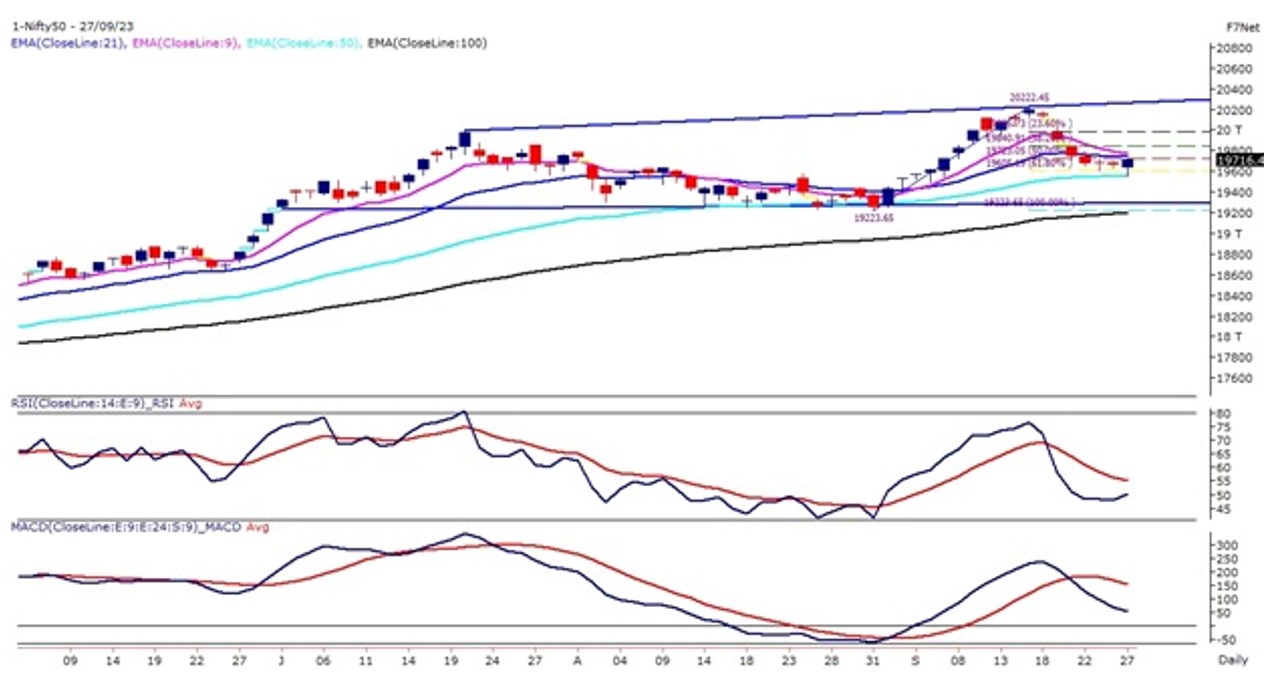

Technical Overview – Nifty 50 |

|

The Benchmark index on 27th Sept witnessed a negative gap down opening taking the clues from its global peers. The prices traded lower in the first hour of the trade and recorded a day low at 19,554 levels post the smart recovery was witnessed which forced the index to move higher above 19,700 levels.

Today’s low is near the crucial support of 50 days EMA in the Nifty. In terms of candle stick prices have formed a bullish hammer pattern which is signified as a bullish reversal pattern. The RSI (14) is finding support near 50 levels and is forming a rounding structure on the daily chart.

We continue to believe that Nifty has got strong support in the zone of 19,550-19,600. Nifty has bounced from the very strong support and therefore traders are advised to reduce shorts and go long with support at 19,550 levels and resistance at 19,900 levels.

|

Technical Overview – Bank Nifty |

|

The Bank Nifty on 27th Sept showed a smart recovery from the lower levels and recovered more than 400 points from the day’s low. The prices traded lower in the first hour of the trade and recorded a day low at 44,182.50 levels post the smart recovery was witnessed which forced the index to move higher above 44,550 levels.

Today’s low is near the crucial support of 100 days EMA in the Bank Nifty. In terms of candle stick prices have formed a bullish hammer pattern which is signified as a bullish reversal pattern. The RSI (14) is finding support near 40 levels and is forming a rounding structure on the daily chart.

We continue to believe that Bank Nifty has got strong support in the zone of 44,300 – 44,200. Bank Nifty has bounced from the very strong support and therefore traders are advised to reduce shorts and go long with support at 44,200 levels and resistance at 45,100 levels.

|

Indian markets:

- Equity markets recorded modest gains on Wednesday.

- Nifty closed above the 19,700 mark.

- Initially, Nifty 50 started with a gap down and went through a notable correction.

- However, a recovery occurred and continued throughout the trading day.

- Pharma, healthcare, and PSU banks stocks saw increased demand.

- In contrast, financial services, private bank, and consumer durables stocks faced downward pressure.

- Market movements were influenced by mixed cues from Asian markets.

|

Global Markets

- Dow Jones index futures were up 108 points, indicating a positive opening in the US stocks today.

- Most European shares declined while most Asian stocks ended higher ahead of Chinas industrial data and Australias August inflation figures due on Wednesday.

- Japans central bank board was split over when should the Bank of Japan should start to raise interest rates, according to minutes from its monetary policy meeting in July.

- US stocks saw a sell off on Tuesday after the latest home sales and consumer confidence reports stoked concern over the state of the U.S. economy,

- August new home sales were down 8.7% from July, according to the Commerce Department. The Conference Boards consumer confidence index fell to 103 in September from 108.7 in August

|

Stocks in Spotlight

- Adani Enterprises exhibited positive trading performance, driven by expectations of substantial passive inflows due to imminent alterations in NSE indices such as Nifty Bank, Nifty, Nifty Next 50, and CPSE. At the market close, the stock stood at Rs 2,484, reflecting a 1 percent increase over the previous NSE close.

- Coal India reached its 52-week high following a statement by coal secretary Amrit Lal Meena, who affirmed that the company was executing its coal production plans as intended. Additionally, he dispelled rumors suggesting the possibility of a public sector undertaking OFS (Offer for Sale).

- Investors displayed a lack of enthusiasm for Tata Consumer Products‘ entry into the energy drink sector with Say Never Energy Drink, featuring caffeine-based beverages in red (berries) and blue (tropical flavors) variants. The company’s shares witnessed a marginal decline of 0.5 percent, closing at Rs 890.

|

News from the IPO world🌐

- Rockingdeals Circular Economy files IPO papers

- TATA gears up for India’s largest ever public offering with upcoming IPO

- Fincare Small Finance Bank IPO gets SEBI approval

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | LT | ▲ 2.00% | | COALINDIA | ▲ 1.80% | | ITC | ▲ 1.60% | | CIPLA | ▲ 1.40% | | LTIM | ▲ 1.30% |

| Nifty 50 Top Losers | Stock | Change (%) | | TITAN | ▼ -1.40% | | GRASIM | ▼ -1.30% | | HEROMOTOCO | ▼ -0.90% | | SBIN | ▼ -0.70% | | ICICIBANK | ▼ -0.70% |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY PHARMA | 1.19% | | NIFTY HEALTHCARE INDEX | 1.19% | | NIFTY PSU BANK | 0.83% | | NIFTY FMCG | 0.80% | | NIFTY REALTY | 0.73% |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 1956 | | Declines | 1703 | | Unchanged | 139 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 33,619 | (1.1) % | 1.5 % | | 10 Year Gsec India | 7.2 | 0.00% | -1.70% | | WTI Crude (USD/bbl) | 90 | 0.4 % | 17.5 % | | Gold (INR/10g) | 58,478 | -0.40% | 6.90% | | USD/INR | 83.1 | 0.0 % | 0.5 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|