Daily Snippets

Date: 25th September 2023 |

|

|

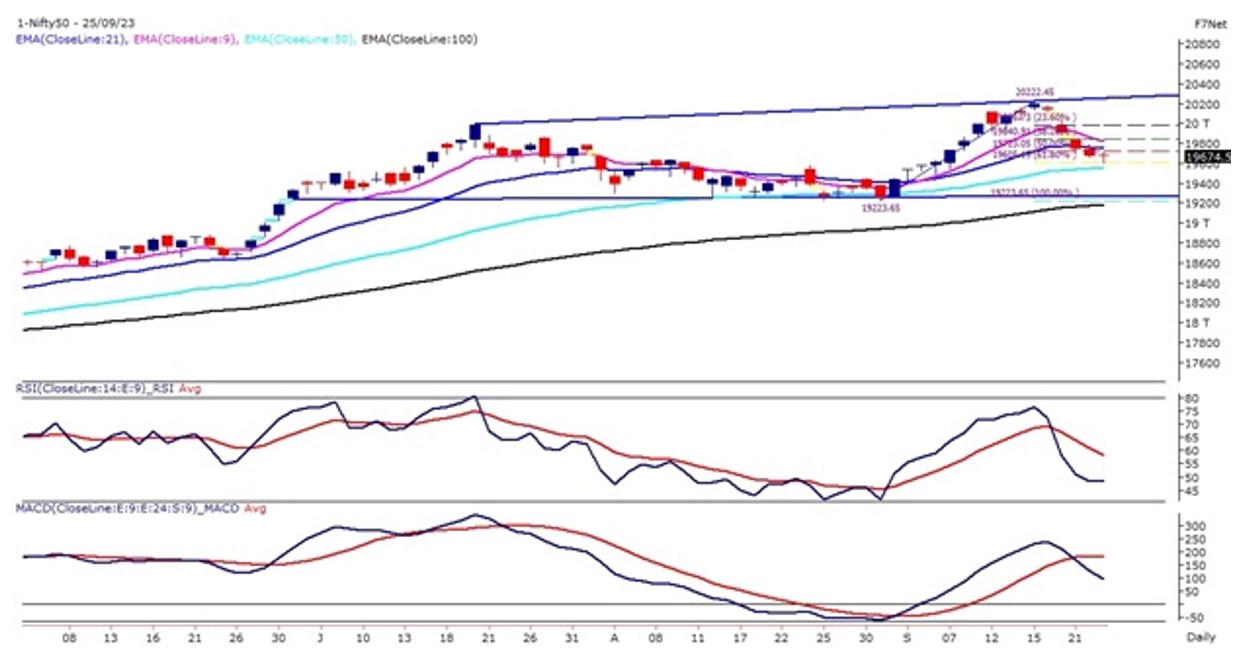

Technical Overview – Nifty 50 |

|

Nifty50 started its trade with volatility in the last week of the September month expiry and has formed a Doji candle stick pattern on the daily time frame. The index witnessed a flat opening but recorded day-lows and day-highs throughout the day suggesting a volatile trading session where traders keep guessing the trend for the day.

The index on the daily chart has taken support near 61.80% Fibonacci retracement which is placed at 19,600 levels. The index is trading below its short-term averages but taking firm support near its 50-day exponential moving average, which is at 19,550 levels.

The previous week’s tall bearish candle has paused the bullish trend and a breakout above 19,850 will be an again level to go long and close below 19,600 – 19,550 levels, which will open the downside till 19,300 levels.

|

Technical Overview – Bank Nifty |

|

The Bank Nifty witnessed a flat opening in the monthly expiry week but the volatility was on the mark throughout the day and prices closed above the 44,750 mark with a 150-point gain. The Banking index on the daily chart has formed a spinning top candle stick pattern which indicates a lack of clarity among the traders.

The Banking index is trading above the upper band of the horizontal channel pattern and sustaining above 100 days exponential moving average which is placed at 44,246 levels. The momentum oscillator RSI (14) is hovering just above 40 levels and this level is likely to act as an immediate support for an oscillator.

The previous week’s tall bearish candle has paused the bullish trend and a breakout above 45,100 will be an again level to go long and close below 44,400 – 44,300 levels, which will open the downside till 44,000 levels.

|

Indian markets:

- Domestic benchmark indices ended the day with minimal changes, breaking a four-day streak of losses.

- Initially starting on a lower note, there was a mild recovery during the afternoon session, with the Nifty 50 nearing 19,750.

- However, last-hour selling pressure wiped out the gains, resulting in a nearly flat closing.

- The performance of European and Asian indices remained lackluster, contributing to limited overall gains.

- Investor concerns escalated due to the increase in US treasury yields, while foreign institutional investors (FIIs) continued to sell shares in the Indian equity market.

- It’s worth noting that the Nifty 50 exhibited a Doji candlestick pattern, indicating uncertainty and indecision among market participants.

|

Global Markets

- Markets in Europe and Asia declined on Monday as investors look toward inflation data from across the region this week. Singapore and Australia are expected to report inflation figures for August this week, while Japan will release inflation data for the Tokyo region.

- US stocks ended lower on Friday as investors continued to grapple with signals from the Federal Reserve that it intended to keep interest rates higher for longer.

|

Stocks in Spotlight

- Delta Corp shares plummeted by 19 percent following the revelation that the casino operator is facing a colossal tax demand of Rs 16,822 crore. This tax claim from the authorities is a substantial 3.5 times Delta Corp’s recent market capitalization and more than double its total revenue over the past decade. In Q2, the company reported a robust YoY increase in net profit, surging by 18.86% to Rs 67.91 crore, with revenue from operations also growing by 10.74% to reach Rs 277.65 crore. However, total expenses also saw an increase, rising to Rs 195.01 crore from Rs 179 crore in the same quarter last year.

- Bajaj Finance witnessed a significant surge of over 4.5 percent in its stock price, citing sources, that the company was planning a substantial fund raise in the range of $800 million to $1 billion. This news also had a positive impact on shares of Bajaj Finserv, the holding company, which rose by 2.4 percent to reach Rs 1,581. In response to this development, foreign brokerage firm CLSA, known for its ‘buy’ rating on the stock, increased its price target for Bajaj Finance to Rs 9,500 per share, indicating a substantial upside potential of over 27 percent.

- Berger Paints slumped over 11 percent after turning ex-bonus. In the past month, the paint and coating manufacturer has surged 12 percent. Earlier this month, the company fixed September 23 as the record date to ascertain the eligibility of shareholders for the issue of bonus equity shares in the ratio 1:5, that is, one equity share of Re 1 for every five shares of Re 1 each

|

News from the IPO world🌐

- Rockingdeals Circular Economy files IPO papers

- JSW Infra IPO subscribed 43% on day 1; Retail portfolio oversubscribed

- Vaibhav Jewellers IPO sees 58% buying till day 2

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | BAJFINANCE | ▲ 4.50% | | TATACONSUM | ▲ 3.20% | | BAJAJFINSV | ▲ 2.00% | | APOLLOHOSP | ▲ 2.00% | | COALINDIA | ▲ 1.80% |

| Nifty 50 Top Losers | Stock | Change (%) | | HINDALCO | ▼ -2.10% | | SBILIFE | ▼ -1.80% | | HEROMOTOCO | ▼ -1.60% | | INFY | ▼ -1.40% | | M&M | ▼ -1.30% |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY REALTY | 1.52% | | NIFTY FINANCIAL SERVICES | 0.56% | | NIFTY CONSUMER DURABLES | 0.48% | | NIFTY PRIVATE BANK | 0.45% | | NIFTY BANK | 0.35% |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 1824 | | Declines | 1952 | | Unchanged | 170 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 34,964 | (0.3) % | 2.5 % | | 10 Year Gsec India | 7.2 | 0.10% | -1.70% | | WTI Crude (USD/bbl) | 90 | 0.4 % | 17.0 % | | Gold (INR/10g) | 58,896 | 0.10% | 7.60% | | USD/INR | 83.11 | 0.0 % | 0.5 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|