Daily Snippets

Date: 18th September 2023 |

|

|

Technical Overview – Nifty 50 |

|

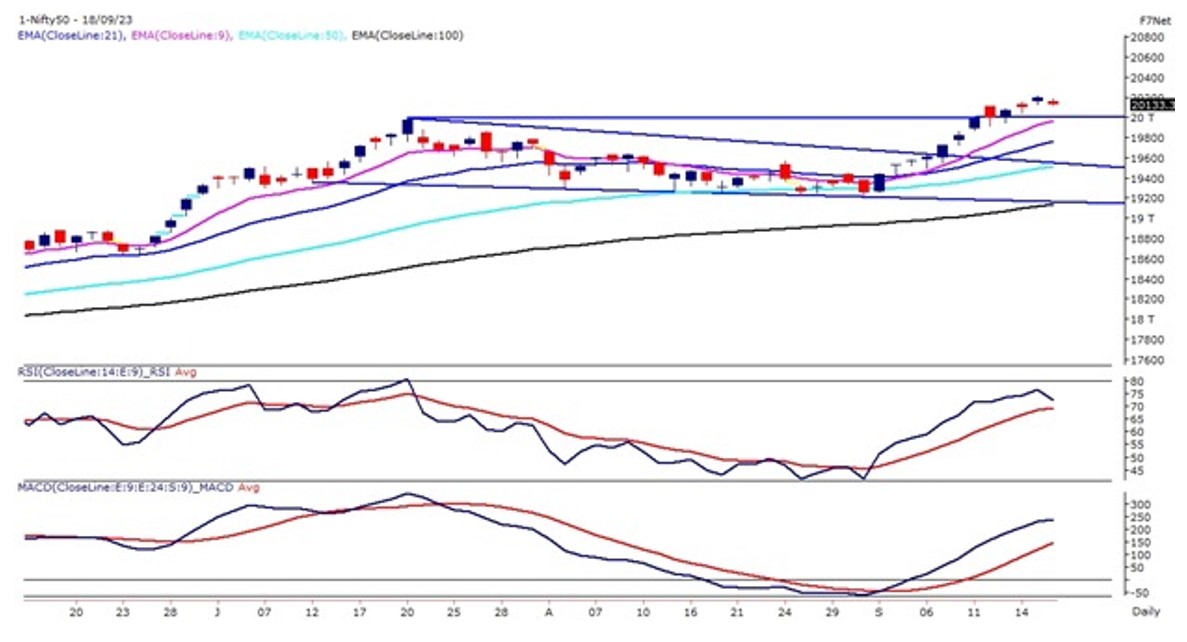

Nifty50 witnessed a narrow-range trading session on the first day of a truncated week and prices traded within the range of 35 – 50 points throughout the day and formed a tiny candle on the daily chart. The positive takeaway from today’s trading session was that Nifty closed well above the dotted lines of 20,100 levels.

On the weekly time frame index has closed in green for the consecutive third week and the prices have completed their throwback of the triangle pattern breakout. The Index on the broader time frame indicates a fresh start of an uptrend and the momentum oscillator RSI (14) has witnessed a cup and handle pattern breakout above 65 levels with a bullish crossover on the cards. The MACD indicator suggests positive momentum ahead as reading above its line of polarity.

The view continues to remain bullish with BUY on dips as a strategy to be used. Technically 20,000 – 19,9000 will act as immediate support for the index and the upper band is capped near 20,250 – 20,325 Levels for the time being.

|

Technical Overview – Bank Nifty |

|

The Bank Nifty on its first day of the truncated week witnessed selling pressure from the large-cap banks and in opposite to that PSU banks were showing strong bullish strength. The Banking index on the daily chart formed a red tiny candle with a wick on the higher end indicating selling pressure from the higher levels.

On the broader time frame, the index is trading within a rising wedge pattern and presently has taken support near the lower band of the pattern and moved higher post that. The momentum oscillator RSI (14) has formed a bullish cup and handle formation and the breakout is expected above 70 levels.

Looking ahead the Bank Nifty may witness a minor throwback but the structural trend remains buy on dips. Technically 45,600 – 45,400 will act as immediate support for the index and the upper band is capped near 46,300 – 46,500 Levels for the time being.

|

Indian markets:

- Domestic equity benchmark indices closed lower on Monday, influenced by negative global trends.

- The market opened with a gap-down and stayed in negative territory throughout the session, ultimately ending close to the day’s lowest point.

- However, there was some buying activity in PSU banks, auto, and power sectors, which helped limit the overall losses.

- Globally, equities encountered difficulties due to worries about economic growth, leading investors to adopt a cautious stance.

- Market participants exercised caution ahead of central bank meetings scheduled in various countries.

- There was additional apprehension related to the outcome of the US Federal Reserve meeting, contributing to the cautious sentiment among investors.

|

Global Markets

- Markets in Europe and Asia declined on Monday as investors look ahead to a week of central bank decisions.

- The U.S. Federal Reserves decision is expected early Thursday in Asia, while Australias central bank will release its minutes for its 5 September 2023 policy meeting on Tuesday.

- On Friday, the Bank of Japan will conclude its monetary policy meeting and traders will be looking for clarity on when the BOJ will start to shift its ultra-easy monetary policy. Elsewhere, the Peoples Bank of China is also expected to release its loan prime rate decisions on Friday.

- US stocks fell Friday as investors wrapped up a volatile week ahead of the Federal Reserves policy meeting.

- On the economic front, the University of Michigans consumer sentiment survey showed one-year inflation expectations dropped to 3.1% in September, tied for the lowest since January 2021. Also, the five-year outlook fell to 2.7%, matching its lowest since December 2020.

|

Stocks in Spotlight

- Shares of the company surged by 1 percent following an announcement by Managing Director Rajiv Bajaj regarding a significant upgrade to their popular Pulsar motorcycle range. In the past three days, Bajaj Auto’s stock has climbed more than 7 percent. Bajaj revealed plans to enhance the Pulsar lineup with six upgrades or entirely new Pulsar models, with the most noteworthy being the introduction of the “biggest ever Pulsar” in the current financial year.

- Bharat Electronics has secured substantial orders totaling Rs 3,000 crore. Cochin Shipyard Limited, on the other hand, has granted a contract worth Rs 2,118.57 crore to supply a range of equipment, including sensors, weapon systems, fire control systems, and communication equipment, for six next-generation missile vessels (NGMV). These vessels belong to the anti-surface warfare corvette class and are intended for the Indian Navy.

- Five Star Business saw an increase in its stake as SmallCap World Fund raised its holdings in the company. Foreign entity SCHF PV Mauritius sold 30.19 lakh shares, equivalent to a 1.03 percent stake in the non-banking finance firm, at an average price of Rs 700.15 per share, totaling Rs 211.35 crore. As of June 2023, it held 1.2 percent of the company’s shares. The entire stake sold was acquired by foreign portfolio investor Smallcap World Fund Inc, which now holds 1.64 percent or 47.78 lakh shares in Five Star Business, as of June 2023.

|

News from the IPO world🌐

- JSW Infra IPO: Price band fixed at Rs 113-119

- SAMHI Hotels, Zaggle Prepaid sail through on last day

- Yatra Online issue subscribed just 22% on Day 2

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | POWERGRID | ▲ 3.10% | | TITAN | ▲ 2.70% | | HDFCLIFE | ▲ 2.40% | | M&M | ▲ 2.30% | | BPCL | ▲ 2.30% |

| Nifty 50 Top Losers | Stock | Change (%) | | HINDALCO | ▼ -2.20% | | HDFCBANK | ▼ -1.90% | | ADANIPORTS | ▼ -1.80% | | DRREDDY | ▼ -1.70% | | BHARTIARTL | ▼ -1.50% |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY PSU BANK | 3.39% | | NIFTY AUTO | 0.84% | | NIFTY CONSUMER DURABLES | 0.61% | | NIFTY FMCG | 0.58% | | NIFTY OIL & GAS | 0.04% |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 1642 | | Declines | 2143 | | Unchanged | 162 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 34,618 | (0.8) % | 4.5 % | | 10 Year Gsec India | 7.2 | 0.00% | 4.90% | | WTI Crude (USD/bbl) | 91 | 0.7 % | 18.0 % | | Gold (INR/10g) | 59,125 | 0.20% | 8.60% | | USD/INR | 83.02 | 0.1 % | 0.4 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|